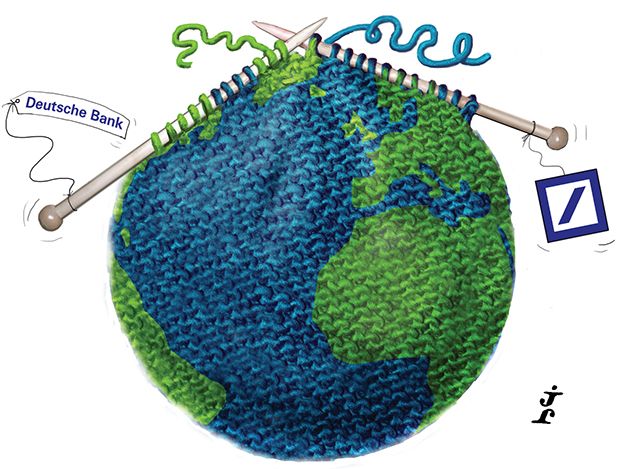

Deutsche Bank’s commitment to its home market remains undiminished, but in 2014 the firm leveraged its global reach to introduce a number of fresh faces that might not have considered issuing to the euro market. It is IFR’s Euro Bond House of the Year.

Deutsche Bank’s proposition is a simple one to articulate but a more difficult one to execute.

“We pride ourselves on stand-out breadth, depth and diversity. Our franchise is built on impartial advice and best execution. This makes for eye-catching deals comprising size and complexity.”

So said Miles Millard, global head of capital markets and treasury solutions and co-head of corporate finance for the EMEA region – and few could disagree that the sentiment is borne out by the results.

The overall proposition is one of excellent credentials across all aspects of the market, from high-grade to high-yield, from SSA, through FIG to corporates.

Deutsche’s success with eurozone borrowers is unquestionable. The bank boasts the usual raft of issuance from home-grown credits, both from core and resurgent peripheral jurisdictions (where two lead-left roles for Wind neatly encapsulate its high-yield and peripheral strengths).

But it is its global reach that helped set it apart from the crowd. “What we were able to do was hit all the relevant spots in an evolving year,” said Hakan Wohlin, global head of debt origination.

The US proved a particularly rich feeding ground in 2014. Apple entrusted the bank with its dual-tranche eight and 12-year deal in early November. That followed a slew of trades from issuers treading the multi-pronged path, such as Pepsi, Coca-Cola and Verizon. Such deals proved the euro bond market “could now deliver decent size at a good price”, Millard said.

And with US issuers finding that they could issue in Europe at virtually no premium to what they could achieve domestically, online travel company Priceline marked a particularly noteworthy moment in September – the first time a US corporate had debuted solely in a European currency.

Deutsche also looked to the other side of the world to offer corporate euro solutions, with deals for Australia’s Scentre and SGSP Assets (the latter adding a bit of Singapore and China flavour into the mix for good measure).

From Green bonds to FRNs, jumbo deals to long-end offerings (naturally including a strong showing in the vibrant hybrid market), Deutsche demonstrated leadership, leveraging relationships but also trading on its wits.

“A great measure of how you’re viewed is who’s on trades with issuers who don’t rely on lending relationships,” said Millard.

“The march goes on,” he added, and indeed it did, especially in the financials space, where Deutsche also claimed the crown as EMEA Financial Bond House.

“We’re at the forefront, driving the agenda,” said Chris Whitman, head of global risk syndicate.

This was amply demonstrated in the SSA sector, where Deutsche ensured access for peripheral sovereigns such as Ireland, Portugal, Greece, Cyprus and Iceland in conventional format, as well as Italy and Spain in index-linked. It also arranged euro issues for unlikely candidates Indonesia, South Korea and Mexico.

“We were on the deals that simply couldn’t be allowed to go wrong,” said Nigel Cree, head of SSA origination.

Supranationals were not ignored, as evidenced by ADB’s debut euro benchmark and the year’s only euro transaction from the Council of Europe. There was also the usual top-level showing for other more regular European supras and agencies, with hardly a name missing from an impressive deal roster from both within and outside the eurozone.

“The supras in particular are the most overbroked borrowers out there. It’s a very competitive business but our market share is up there and consistent,” said Cree.

That consistency was evident across all asset classes, with Deutsche’s global capabilities meaning it could offer truly impartial advice.

It was not so much a case of “the answer’s euro; what was the question?” rather that if the euro was the best option, Deutsche was a bank that could be relied on – as it was by a great number of issuers from around the world.

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.