Europe’s corporate treasurers are studying trends from Japan as they seek attractive entry points to rebalance their fixed and floating liability mix in response to concerns that Europe could be heading into a Japan-style deflationary spiral.

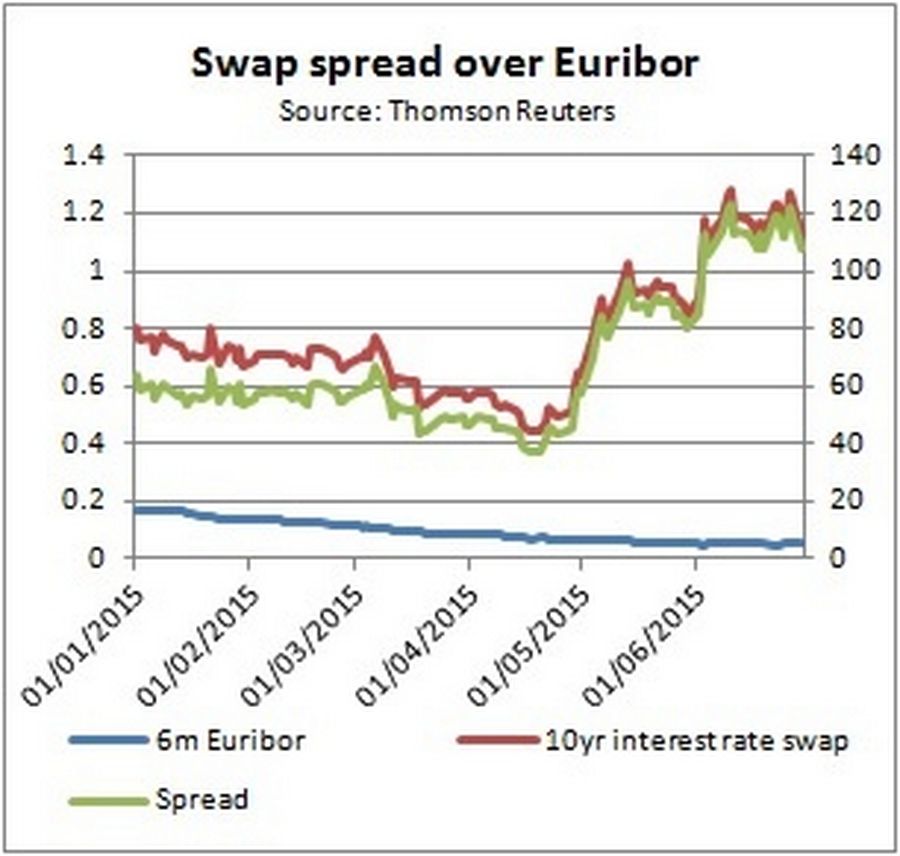

Despite persistent low rates – six-month Euribor has been stuck below 0.1% for more than three months – many are finding that current levels offer an attractive entry point for switching into floating exposures as volatile 10-year swap rates edge close to year-high spreads over the funding benchmark.

“There’s a lot of debate over whether Europe is going to be the next Japan, but the big question is what that means for corporate treasurers,” said Antoine Jacquemin, global head of market risk advisory group at Societe Generale.

“Most treasurers share the view that Euribor won’t go anywhere any time soon, but they are asking what represents low and high in this low rate environment,” said Jacquemin.

He believes asset and liability management trends seen over the last 20 years in Japan could provide a blueprint for European firms as they navigate a low interest rate environment that could last for years to come. Japan has endured 25 years of low rates and 15 years with Libor at zero.

SG analysis showed that while the fix/floating mix for Japanese corporates was largely determined by company policy and positioning, there was a trend for cyclical industries to rebalance towards floating format over the debt cycle. Meanwhile defensive industries tended to rebalance towards fixed liabilities over that period.

The analysis showed that cyclical firms such as chemical and consumer goods companies, kept around 60% of their liabilities in fixed format 15 years ago. But through the deflationary spiral they added more floating exposure, ultimately leading to a reversal in that mix, with 60% in floating format today and just 40% in fixed.

More defensive, low-beta industries that are typically more capital intensive and require higher levels of debt to finance their activities, rebalanced their liabilities further towards fixed format, increasing that level from 60% to around 70% over the last 15 years.

“It’s an important discussion for corporates today. First, they take an holistic view on the best mix for their business model and rating without expressing a view on rates, then they look at the market to see if the time is right to do the rebalancing today,” said Jacquemin.

Volatile carry

Analysis of the yen curve over the last two decades is providing some clues. While yen Libor has been stuck at zero for many years, 10-year yen swap rates have been more volatile – sometimes showing sizeable carry opportunities with spreads as high as 200bp, and sometimes falling as low as 50bp.

“Even if the short end isn’t moving, there has been significant volatility at the long end of the yen curve,” said Jacquemin. “Over the last 15 years the carry has moved from 50bp to 200bp and it can make that shift in just a couple of months. Every time it moved to the highs, it has always come back.”

Those levels have provided a useful barometer for European corporate treasurers. SG notes that a spread of 110bp should be considered as a signal for those looking to swap into floating rate to spring into action. Similarly, a spread below 70bp is viewed as a signal for those looking to add fixed rate exposure.

The euro carry level is currently close to 120bp, triggering a flurry of demand for fixed-to-floating swaps from European corporates. SG notes a proliferation of large multi-billion rebalancing transactions in recent weeks.

It is a big turnaround from two or three months ago when defensive sectors were busy rebalancing towards fixed rates and pre-hedging future bond issuance with forward-starting swaps – some have done so out to four years.

“Many clients spend a lot of time considering the balance as they typically take a buy-and hold approach and only rebalance once every few years,” said Jacquemin. ”Corporates aren’t like financials, which can focus on rates all day long, but some are becoming more dynamic and coming into the market a few times a year.”