Anatomy of a giant: Verizon’s US$49bn bond. This is a behind-the-scenes look at the trials and tribulations of creating the biggest bond deal ever. It was a transaction many years in the making, but when it came together, it did so very quickly indeed.

Just how do you price a bond that’s nearly three times larger than anything ever seen in the history of the capital markets? That was the puzzler facing Bank of America Merrill Lynch, Barclays, JP Morgan and Morgan Stanley as they were attempting to put together a deal to take out much of Verizon’s record US$61bn bridge loan used to buy out rival Vodafone from their US joint venture.

The risks were high: the four active managers had more than US$15bn of balance sheet on the line in the trade. They also had to figure out how to grapple with the world’s biggest money managers – the most voracious investors of all – who were demanding that their orders be filled, while insisting upon a fat premium to recompense them for impending rates volatility.

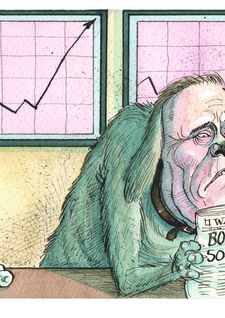

Market uncertainty wasn’t helping. Well before the terms of the deal were up on the screens, the markets were gripped by the apparent certainty that the US Federal Reserve was going to begin tapering its US$85bn a month asset-buying programme. Spreads had widened throughout the summer – and that only made an already tricky acquisition financing deal more difficult.

With a spike in rates seen as a virtual certainty, how much did investors need in coupon? How much, in the end, should Verizon be willing to pay?

Long time coming

The deal was some 10 years in the making. At the turn of the 21st Century, Verizon Communications and Vodafone tied up to create Verizon Wireless. Yet it wasn’t long before the transatlantic marriage started to show signs of strain.

Vodafone turned out to have very little influence over its largest US asset. The technical operating synergies and marketing advantages that had been hoped for failed to materialise. And the UK partner in the marriage had no control over the timing of dividend payments.

Telecoms behemoths are not natural bedfellows anyway, and the relationship between the two companies – and their leaders – swung in short order from friendly to acrimonious before the pendulum eventually swung (somewhat) back again. Even so, as Verizon became keen to buy out Vodafone’s 45% share of Verizon Wireless, it was no easy task to find common ground on how much that stake was worth.

What was clear was that Verizon wanted full ownership of the mobile unit – badly. As one of Verizon’s investment banking advisers said: “This deal had its moments a couple of times in the last decade. Our client wanted to buy this for a very long time.”

So at the start of 2013, the two chief executives – Verizon’s Lowell McAdam and Vodafone’s Vittorio Colao – returned to the negotiating table in earnest. Before the month of January was up, Verizon had made an offer: US$95bn. After that was turned down, the CEOs met again in February. In March, McAdam made another offer that was in effect the same: US$95bn. Vodafone said no again.

But while Verizon’s offer hadn’t changed substantially, its own need for cash had. According to Moody’s, the US telecoms operator would see its cash requirement more than double to US$19bn in 2014 from US$9bn in 2013.The company became convinced that the cashflows from the wireless unit would exceed new debt costs – as well as the cash that would be required to pay dividends on Verizon stock – so if it could obtain debt capital at a low enough cost, consolidating the Vodafone stake made perfect sense. As long as the coupon on a new debt issuance remained in the low 5s, the financing would work more or less like a self-funded leveraged buyout.

Verizon’s board met in early May, several days before McAdam and Colao sat down to haggle again. On June 10, Verizon sweetened its offer to US$120bn. But that still wasn’t enough. Vodafone took less than a fortnight to come back with a counter-offer: net proceeds of US$140bn, all cash, for the total consideration. In addition, the UK telecoms giant was insisting on a UK-style certain-funds basis. If the deal was going to happen, Verizon’s banks would have to stump up the cash – a lot of cash.

That was then, this is now

The state of the markets had changed immensely during the months of negotiation. By June, intense volatility had emerged in the US Treasury market. With fear in the air over Fed tapering, the US primary debt market was slowing up – and investors were starting to show a decided preference for floating-rate notes and shorter-dated maturities.

Trickier markets helped to focus minds on both sides of the bargaining table – and convinced Vodafone not to hold out for the full US$140bn.

“Vodafone realised that the cost of financing was not an insignificant price driver,” one banker said. “Vodafone management realised they could lose their window. That created a much more earnest player at the table.”

At the same time, the size of the potential bridge risk took on different and even scary proportions. Bank CEOs were already in on the discussions, and some were already even talking to ratings agencies about the scope of the risk – the likely size of the loan that Verizon needed would put them near the regulatory limits of exposure to a single name.

Meanwhile, Verizon management was also very aware of the shifting sands in the market. After months of stability, the volatility was striking.

“It’s safe to say that every conversation I had with banks for the six months leading up to the deal included their thoughts on how to finance Vodafone,” said Matthew Ellis, Verizon’s treasurer.

By the end of July, discussions were getting close to bearing fruit, and Colao eventually accepted McAdam’s counter-offer: US$130bn, consisting primarily of US$59bn cash, US$60bn in Verizon stock, US$5bn of Verizon notes, Verizon’s US$3.5bn stake in Italy’s Omnitel – and an additional US$2.5bn of debt in the form of preferred stock.

In what may well have been yet another record, it was nearly a month before news of the deal started to leak out. The companies’ respective boards agreed the sale on September 2 – and then the real race against time began.

Ticking clock

Verizon had decided on its strategy months in advance: it preferred duration and size to squeezing the last basis point out of investors. It was aiming for a low 5% target, but it also wanted certainty. Once Vodafone agreed the price, the financing absolutely had to happen.

“Failure was not an option,” Ellis said. “We had to get it done no matter what.”

Morgan Stanley, one of Verizon’s initial financial advisers alongside JP Morgan, had privately been suggesting the company would be able to take out something like US$30bn.

Those were unprecedented numbers – nearly double the size of the biggest corporate bond ever: the US$17bn trade done by Apple a few months before. There was no road map for a deal of this magnitude. Most analysts seemed to think that a trade of that size would involve months of prep work, and a deal in several different markets and currencies.

There was, however, a ticking clock. The Fed was expected to announce it would begin scaling back its asset-buying programme that had been greasing the wheels of the bond markets for months at its September meeting. On September 6 – a Friday, and just four days after the boards had approved the sale – the yield on benchmark 10-year Treasuries hit 3% for the first time in two years.

The US dollar deal was announced the following Monday, a day or two earlier than planned, with Verizon offering a new-issue premium of 50bp over outstandings. This was at least 100bp wider than where its paper was trading before the acquisition financing was announced.

The next day, Verizon had to make perhaps the most important decision of all: should it follow the tried and true process of going out with wide whispered levels, build a huge book and then pull in pricing? Or should it experiment with a deal size that was unlike anything the markets had seen before?

In the end it was a relatively easy decision. If it left the price talk unchanged, Pimco and BlackRock would stay in the deal and would be the biggest buyers by some margin. But if guidance was revised, they might leave the table.

“The key turning point was on Tuesday morning, when the sales desks said investors wanted to know if we would price close to initial price thoughts or would we look to tighten it in,” said Ellis. “That’s where all of us were in unchartered territory – how much extra spread brings in extra demand? And where do you tap out demand, no matter what the spread is?”

Verizon sent back the message that it wasn’t planning to stray too far from the whispered levels. “And that’s when the book really started to take off,” Ellis said.

Having made a deal with his financiers to cut the bridge quickly, taking the entire US$49bn in one fell swoop seemed to be the sensible option. The order book blew up to a record US$101bn. Planned euro and sterling pieces of the financing were dropped – Verizon had just pulled off the biggest corporate bond of all time.

Comfortably done

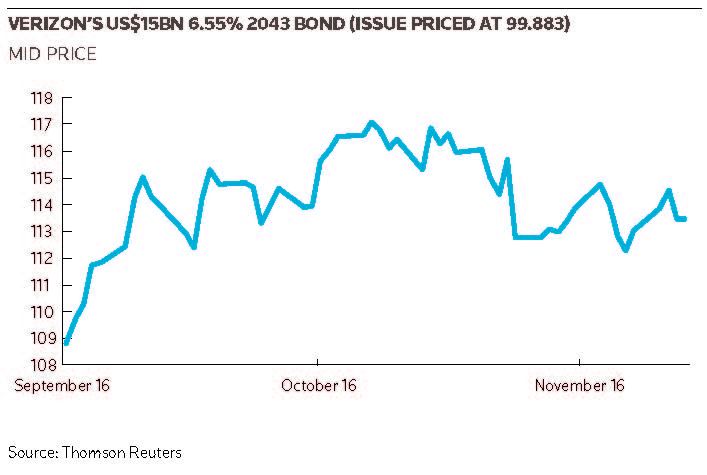

In the end Verizon hit its yield target comfortably. The weighted average coupon on the deal was 5.15%, and the average weighted tenor was 15.5 years. “With this trade, Verizon managed to lower the average coupon on its entire debt portfolio by 24bp and extend its duration by 2.5 years,” said one investment banking adviser.

Half of the deal went to just 10 of the 1,206 investors who put in 3,000 line items. And 25% of the bonds went to just two asset management giants: Pimco, which bought US$8bn, and BlackRock, with took on US$5bn.

The whopping deal seemed to show that a high-grade company would be willing to pick up the M&A baton that private equity dropped in 2007. After years of waiting, the big deal finally came to fruition. It’s unclear if others will follow suit, but the record transaction has without question extended the limits of what is possible.

The deal wasn’t without its critics, however. After all, the record-shattering mega-bond – theoretically, at least – left some US$2.5bn on the table, as it snapped five points tighter on the break.

One market stalwart said privately: “I just don’t think there was any price discovery.”

But on Wall Street, one global head of debt markets said just a couple of days later: “If you have to raise finance for a deal that is going to transform your life, you do not worry about paying a 5% premium to make sure it happens.”

To see the full digital edition of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com