A plunge in commodity prices has left many energy exploration and production companies locked out of markets and struggling to refinance. Some are starting to get creative in an effort to ensure continued funding for their ongoing businesses.

Issuers breathed a sigh of relief when bond markets finally reopened to high-yield energy companies in February. CrownRock, encouraged by a 20% rally in the price of crude over the previous three days, rushed a deal to market, breaking a three-month hiatus – and in style, gaining US$1.5bn of orders for its planned US$300m deal.

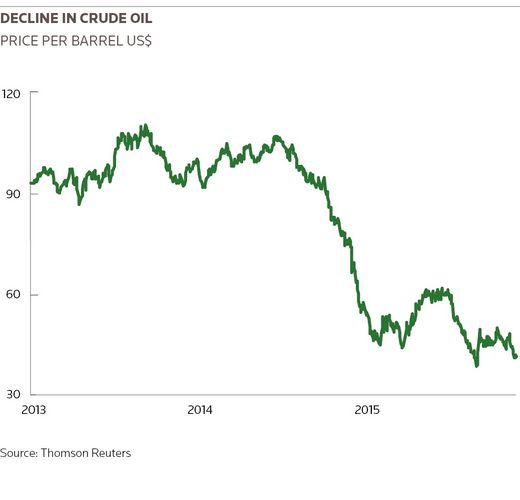

As oil rallied back above US$60 over the next few weeks, others followed in its wake. Bumper deals returned as investors bet the precipitous drop in oil – crude had plunged from US$107 a barrel to US$42 in just six months – had gone too far. Energy XXI Gulf Coast and SandRidge Energy managed to print deals north of US$1bn each.

But while markets had reopened, oil price volatility had left investors shaken. Finance was once again available – albeit at a price. Energy XXI’s second-lien bonds were priced at a whopping 12%. Put off by such levels, and despite having seen the market abruptly shut only months earlier, other companies chose to wait in the hope that costs would come down.

A second leg-down in oil caught many off-guard, and as crude plumbed new lows of US$37 during the summer, many companies rued their decision to wait. Brian Gibbons, an analyst at CreditSights, said many had expected crude to rally strongly, as it had done after its initial steep decline when Lehman Brothers had collapsed.

“Memories are short, and many of these companies thought the oil price collapse would be a re-run of 2008, when markets quickly snapped back,” he said. “As a result, many of them who held off refinancing at higher rates, as bond markets once again shut down, found themselves locked out. Refinancing has fallen through the cracks.”

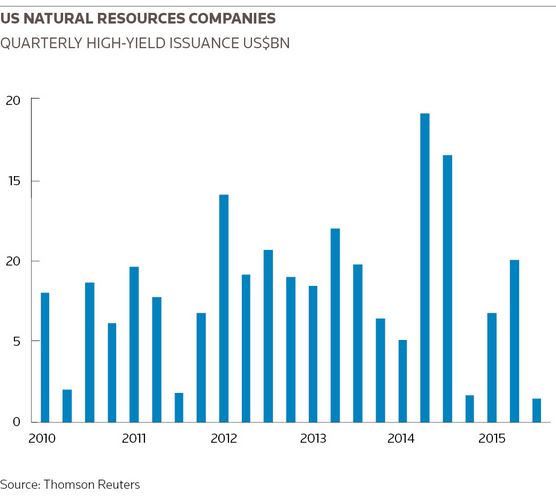

The closure of the high-yield market has removed an important source of financing for the sector. US and Canadian energy companies averaged US$40bn a year of high-yield issuance between 2011 and 2014. Despite a strong first half this year, issuance has since stalled, and will likely be half the previous years’ levels.

Inability to access bond markets has hit the energy industry hard, prompting round after round of cuts to reduce financing needs. The number of oil rigs hit a record 1,609 in October 2014. Two-thirds of them have since been halted as companies seek to cut their losses.

It isn’t only oil that has been affected: the number of gas rigs is one-seventh of what it once was.

Bankruptcies dent confidence

But aggressive cost-cutting has not been enough to save some companies. Samson Resources and Sabine Oil and Gas – the former with US$4.2bn of liabilities and the latter with around US$1bn – have both filed for bankruptcy in the last few months, further denting investor confidence and reminding them of the very real possibility of losses.

With high-yield markets shut, companies are having to think outside the box. Lightstream Resources, a Canadian oil and gas exploration and production company focused on light oil in the Bakken and Cardium fields, became one of the first to move after the second leg-down in oil.

“Liquidity is a good thing to have, but it comes at a cost, and companies are constantly seeking to balance the two against each other,” said Peter Scott, chief financial officer of the Calgary-based company. “But as the macro situation worsened and the oil price continued to fall, we decided we wanted to add credit capacity to our capital structure in the case of a lower, longer price recovery.”

Fortuitously for the company, existing bondholders provided the solution. Lightstream had printed US$900m of eight-year senior unsecured paper with a coupon of 8.625% in 2012. As oil plunged, the company’s bonds did too, falling through the 70 level in June and prompting a call from some major holders of the paper keen to protect their investments.

Under the deal, investors agreed to exchange US$465m of existing notes for US$395m in second-lien notes with a higher coupon of 9.875%. The investors also agreed to buy an additional US$200m of the notes, with Lightstream using the additional cash to reduce the borrowing amount under its credit facility.

“We had some large bondholders that were interested in exchanging unsecured bonds for secured bonds and providing new capital given the quality of our asset base. The exchange structure allowed us to reduce overall debt and interest expense, and the new capital allowed us to reduce bank borrowings and increase our credit capacity, ” said Scott.

An acute problem

Reliance on bank loans had become an acute problem for the industry by September. Banks had more than US$100bn extended to US and Canadian high-yield E&P companies. Scheduled biannual redeterminations in April had already led to banks pulling financing. With the October redeterminations fast approaching, lines were set to be cut again.

To make matters worse, banks – at least in the US – were coming under intense pressure from regulators, keen not to be caught napping on the job as they arguably had been during the credit crisis, to reduce their exposures. The pressure created a dilemma for banks: heed regulators and risk killing their clients, or stand by and accept the consequences.

“Banks are very carefully trying to balance the risks,” said Gibbons. “Many of these lending relationships go back years or even decades – banks want to stand by their clients, and certainly don’t want to jeopardise their ability to stay afloat by prematurely cutting lines. But they were also under pressure from regulators to reduce their exposure.”

Although banks dramatically cut their exposures – by as much as 40%, according to estimates from law firm Haynes and Boone – in some select cases banks did stand by their clients. In some cases, they even extended credit, helping their clients to weather the difficult environment, and even take advantage of the situation.

Seizing an opportunity

One such company was RSP Permian, a Dallas-based oil and natural gas company focused on the eponymous Texan field. The oil price plunge opened up rare opportunities to expand that the company didn’t want to miss. In July, it struck an agreement to acquire undeveloped acreage and oil and gas producing properties for US$274m.

When it came to financing the deal, the company knew it needed to be conservative. Despite the oil price backdrop, it managed to negotiate a US$100m extension of an existing bank credit line, and sought feedback from its investors to issue an additional 6m shares to finance the remainder.

The company was no newcomer to equity markets, having visited numerous times over previous years. In the end, Goldman Sachs ran the deal and found sufficient demand to allow for an option to increase the commitment to 7m shares at US$22.50, a 1.1% discount to the August 4 closing price.

Buoyed by the market reception, the company decided to hit the bond markets the next day with a view to reducing the additional bank lending it had conservatively taken on as guaranteed money to pay for the deal, arranging a US$200m reopening of its debut US$500m eight-year non-call senior unsecured bond it had completed less than a year earlier.

Negative sentiment towards E&P has ironically made issuing additional equity that bit easier. With short positions on their stock, a number of companies – including RSP, Concho Resources and Parsley Energy – have opportunistically printed new stock, wrong-footing investors, forcing them to cover positions, providing support for the deal.

The tactic has been made easier by investment banks keen to boost their fees against a fast-disappearing pipeline of E&P IPOs. Some have become aggressive in pitching to do such deals, offering to buy entire deals and backstop issuance at price levels that are extremely attractive to the boards of the energy companies.

“Some banks have begun to make primary equity offerings much more enticing, offering to be the single lead on bought deals, back-stopped at extremely attractive prices,” said one E&P CFO. “Only a few banks are willing to put their balance sheets to use and take on the risks inherent to such deals, but it is making the economics enticing to companies.”

“Some banks have begun to make primary equity offerings much more enticing, offering to be the single lead on bought deals, back-stopped at extremely attractive prices”

Filling the void

There is another source of financing for E&P companies that might be in difficulties: private capital. Ben Freeman, a former global head of oil derivatives trading at Goldman Sachs, set up HudsonField in 2014 to provide financing, risk management, analytics and logistics to the E&P industry. Even before the plunge in the oil price, he spotted the opportunity for private cash to fill a void created by retreating banks.

“Some of the regulatory change post-crisis has made it harder for banks to finance across the entire capital structure, and many clients have become sub-economic to service,” said Freeman. “Clearly, the large decline in commodity prices has increased the need for more expensive forms of capital, which is harder to provide under a banking platform, and that is a void that we are seeking to fill.”

““Some of the regulatory change post-crisis has made it harder for banks to finance across the entire capital structure, and many clients have become sub-economic to service”

The firm is yet to sign its first financing deal, but has been getting a good reception from potential clients. It has been boosted by a tie-up with AllianceBernstein’s private middle-market lending platform, which has US$2bn of capital available. With so few deals being originated by banks, the idea is that HudsonField will work its contact base to generate new flows of loans, providing a destination for AB’s money.

One advantage is that HudsonField can do deals that the heavily regulated banks cannot: a uni-tranche, where the producer issues a single large senior secured loan in place of a traditional first and second-lien capital structure; production pre-payments, where the producer monetises the value of a portion of its reserves; or reversionary structures, where investors partner with an E&P operator to develop non-producing assets.

“In this depressed crude price environment, capital markets activity has dried up and made it even more necessary for oil and gas operators to find other sources of capital,” said Freeman. “If prices remain low, capital markets activity will remain depressed, and it’s become all the more necessary for E&P operators to finance themselves through direct lending and equity transactions.”

Still, some are hopeful that access to high-yield bond markets will come back before long, enabling E&P companies to refinance debt and gain capital for new investments in a market they know. That will all depend on the price of oil, however.

“I think market access will depend on where commodity prices are – and a few analysts are becoming more bullish on forecasts,” said Lightstream’s Scott.

“There is cash out there and I think investors are willing to provide capital in the right circumstances, it is a question of market sentiment and where the oil price is and where it is projected to go. It is quite possible that the market could reopen as quickly as it closed.”

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .

<object id="__symantecPKIClientMessenger" style="display: none;" data-extension-version="0.4.0.129" data-install-updates-user-configuration="true"></object>