The trick for the FOMC this week will be to deliver a shift in communication without provoking the markets into a repeat of last year’s taper tantrum.

The dots from the SEP will be used to support the FOMC’s message that mandate-consistent levels for employment and inflation would still “warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run”.

Specifically, new forecasts will see the majority of the Fed looking for federal funds in 2017 to be around 3.0%, still below the so-called terminal rate of 3.75%.

While the Fed does not believe that financial stability risk is high, it will be wary of the need to avoid spooking the markets. The taper tantrum likely delayed the start of tapering QE as the Fed worried about the sharp rise in bond yields.

This time around, the worry will be that low volatility and the search for yield have tempted many into taking excessive risk. Although cognisant of triggering instability, the Fed will not let these concerns prevent it from adopting a more data-dependent stand.

The Fed could wait until October, but it seems likely that the release of updated Fed projections as well as a press conference will be enough of an advantage to change the script at the Sept FOMC meeting.

The Fed will be successful in limiting fallout because:

1) the market is more comfortable that the tightening cycle will be very different both in terms of speed and magnitude, and

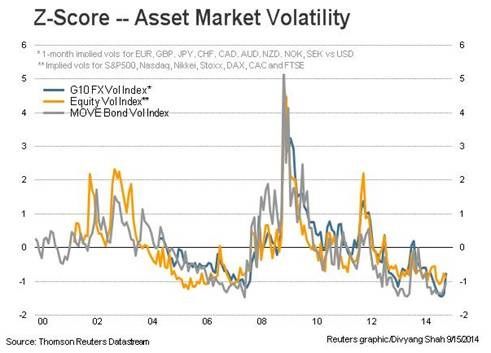

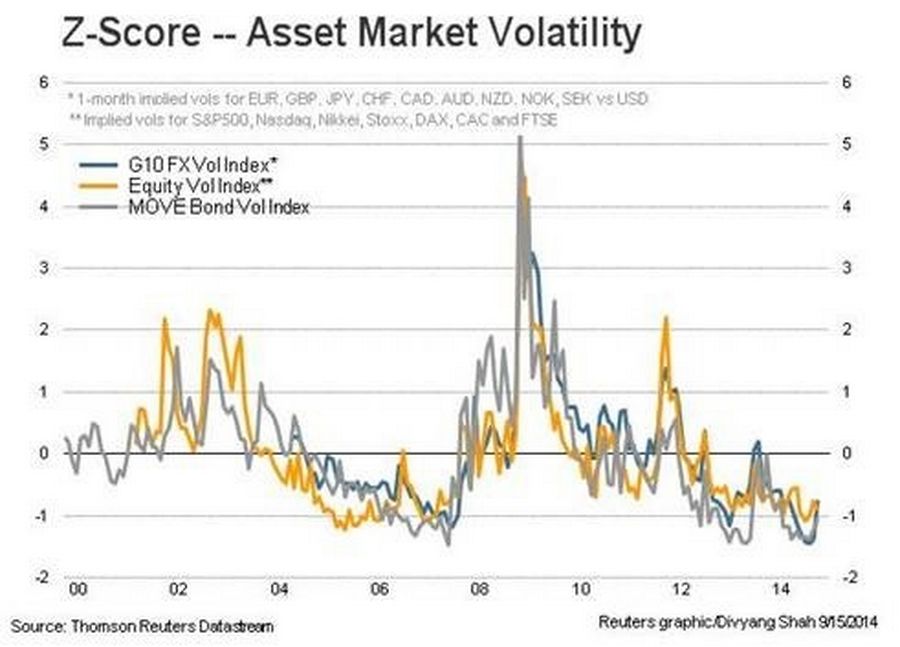

2) there is a better understanding of which markets are vulnerable, especially in EM. If there is an accident, it is likely that contagion will be limited. It will be important to keep an eye on the turnaround on FI, FX and equity implied volatility, which have bounced from their lows and could put pressure on carry trades. For a chart on Asset Market Volatility (z-score) see chart.

Z-score

For now, the movement on implied vols is likely to be welcomed by policy makers, who had been concerned about complacency on the part of investors.

We should expect the risk taking to resume, aided by the ECB’s desire to inflate its balance sheet and possible further QE from the BoJ next month. All of this is happening at a time when Fed and BoE policy will remain accommodative and is expected to normalise in 2015 at a very gradual pace.