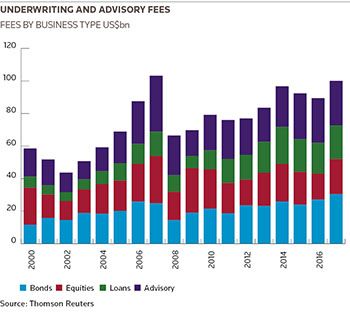

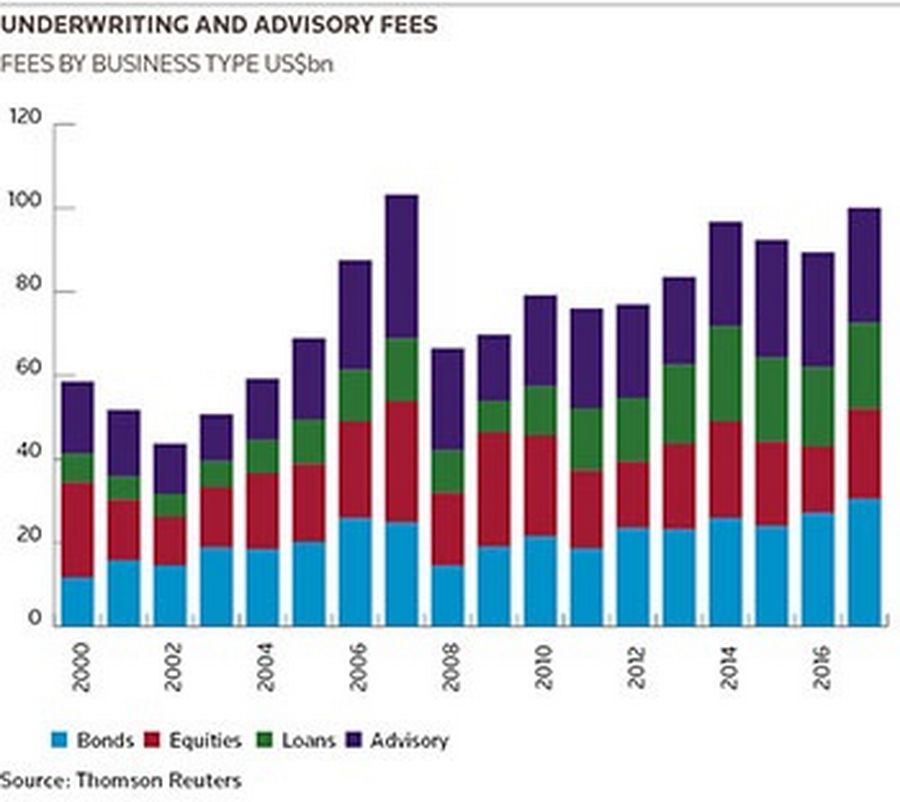

Christmas has come early for investment bankers, after the annual haul of fees from underwriting and advisory work last week topped US$100bn for the first time in a decade, following a last-minute rush of deals that capped a bumper year of issuance.

According to data from Thomson Reuters, fees earned from bond and equity underwriting, loan and advisory work are within a whisker of breaking the US$103bn they earned from dealmaking in 2007, still a record year for the industry.

Debt capital market bankers will lead celebrations after notching up a record US$30.5bn in fees, up 12% on last year. Equity capital market fees were up 36% to US$21.5bn, and loan fees up 9% to US$20.6bn, while advisory fees were flat at US$27.5bn.

The ECM and advisory hauls remain 30% below their respective peaks in 2007, while loan fees are 15% below the 2014 high. Still, a record year for bonds fees and steady issuance elsewhere meant overall figures were the best in a decade.

Bankers said issuers were keen to raise funds while such accommodative conditions last, with many rushing deals out in the early part of the year ahead of planned elections.

“We ended the year slightly bigger than what we’d expected and above last year’s numbers,” said Jean Luc Lamarque, global head of debt syndicate at Credit Agricole. “We had a record Q1. We knew that there would be elections and had advised issuers to hurry up with funding plans. People were ready for action.”

SHIFT IN ISSUANCE

The record fee haul for DCM comes despite a slight dip in issuance. Global investment-grade corporate issuance at US$3.5trn was 2% down on last year, while the US$1.6trn of sovereign, supranational and agency issuance was 15% lower.

Notwithstanding the dip in overall volumes, the two asset classes produced some big deals, including a US$22.5bn trade from AT&T in July, US$17.25bn from British American Tobacco in August, and a US$12.5bn sale from Saudi Arabia in September.

But that slack in the IG and SSA space has been taken up by a substantial increase in other asset classes where fees tend to be higher. Issuance from emerging market corporates was up 16% to US$306bn, while high-yield corporate issuance climbed a whopping 37% to US$468bn.

High-yield issuers Tenet Healthcare, Avantor, Valeant and Park Aerospace all managed to print deals of at least US$3bn. Meanwhile, a €4bn deal from Pemex was the largest euro trade ever seen from an EM corporate, while Abu Dhabi’s ADNOC raised US$3bn on its debut in bond markets.

Heading into 2018, bankers are expecting a tougher year.

“We anticipate a modest slowdown as we go into 2018,” said Dan Mead, head of US high-grade syndicate at Bank of America Merrill Lynch. “We have the pending tax reform, which will lead to a slowdown in issuance needs as some sectors benefit from repatriation. The risk of rising rates could put a dampener on supply as well.”

EQUITY COMEBACK

ECM bankers, meanwhile, have bounced back strongly after a torrid 2016. Buoyant equity markets, low volatility and increased appetite for equities from investors have driven an uptick in activity in all regions and across all products – from IPOs to follow-ons and convertibles.

Indeed, IPO proceeds in the US were almost double what they were a year ago, following a number of sizeable deals including the US$3.9bn listing of Snap in March, the US$2.2bn IPO of Altice USA in June and Invitation Homes’ US$1.8bn listing in January. Global IPO proceeds were up 30% to US$172bn.

But it was far from straightforward: a number of high-profile deals, including some big Chinese listings in the US, struggled – either in the bookbuilding stage, or in the aftermarket. In addition, the pipeline slowed noticeably in the fourth quarter, although many expect the slowdown will prove to be fleeting.

“It’s been a really mixed bag in terms of what’s performed and the size of the deals,” said Frank Maturo, vice chairman of Americas ECM at UBS. “There was not any rhyme or reason. You really had to pick and choose the deals you wanted to invest in.”

“Some of the China-to-US deals did not go very well,” he said. “There’s a huge backlog of those still to come. Some of the US tech deals, even though they have been small, have gone very well.”

BLOCKBUSTER EUROPE

While Asia struggled to produce the big deals it did last year, blockbuster European IPOs were back in force. Three deals from Europe – Pirelli’s €2.3bn IPO and BAWAG’s €1.7bn listing in October, as well as the SFr2.3bn (US$2.4bn) listing of Landis+Gyr – made the global top six IPOs of the year.

“Volatility was low throughout the year almost regardless of the political situation and there were steady, positive equity markets in Europe,” said Martin Thorneycroft, head of EMEA ECM at Morgan Stanley. “When you combine low volatility and investors making money, there was good confidence to back IPOs for much of the year.”

Perhaps the biggest single source of fees was from the recapitalisation of European banks. Over just a few months, four banks – UniCredit, Credit Suisse, Deutsche Bank and Santander – raised a collective €32bn to bolster their balance sheets, raining down fees on ECM bankers in the region.

Bankers say that, while the big bank recapitalisation jobs are done, prospects for next year remain good.

“We’re not expecting some of the big FIG fee events to repeat themselves, but there are still some pretty big names already in view for 2018,” said Thorneycroft.

(Additional reporting by Helene Durand and Robert Venes in London, and Natalie Harrison in New York)