With Europe’s efforts to emulate the US financing regime, where corporate bonds are the norm rather than the exception, the regulation-bound, scaled-down banks are on a difficult path, but one heading in the right direction, thanks to the Capital Markets Union.

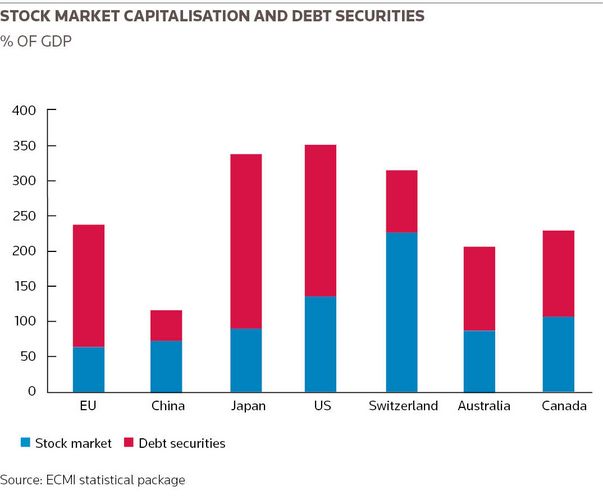

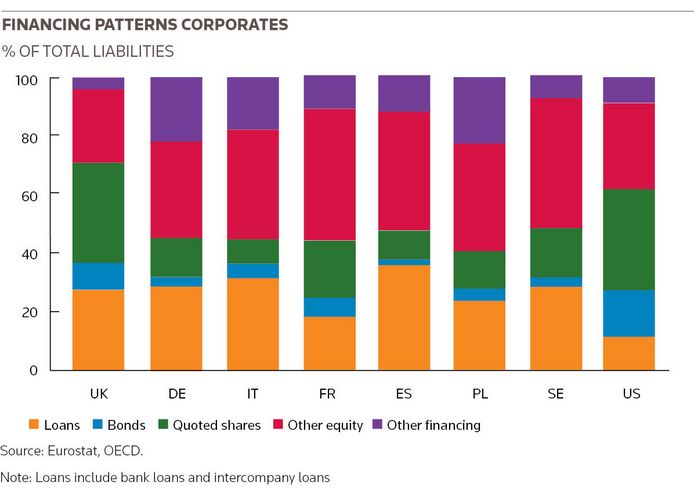

Europe has long looked enviously at the US financing regime. There, about 70%–80% of debt finance is raised in the bond markets – roughly the proportion that is provided by bank loans in Europe, as is also the case in Asia. The Capital Markets Union is Europe’s latest attempt to edge towards the US model, shifting the burden of financing away from the bank market and on to the debt capital markets.

The US DCM culture is partly a product of its history. When its robber barons conquered the interior they needed more capital than its young banks were able to provide, forcing them to turn instead to private investors via the bond markets.

Having grown up in this environment, US corporates are used to issuing bonds, and the process that goes with it. In Europe, many corporate treasurers are accustomed to the far simpler process of arranging a loan with their bank manager. For them, the prospect of compiling a prospectus and going on roadshows seems more arduous.

Ultra-low rates mean that for those that can still secure a loan from a bank, that route is cheaper than issuing bonds in Europe. This may change over time, as it did, briefly, during the financial crisis. But even if it doesn’t, corporates will still be better off diversifying away from the bank market.

“Financing on the capital markets will increase costs for borrowers, but this is not necessarily a bad thing if you get extra liquidity,” said David Clark, chairman of the Wholesale Markets Brokers Association.

Ultimately, though, the initiative is less about the convenience of individual corporates than filling the vacuum created by the slimming down of Europe’s banks.

Focused firepower

In today’s world of expensive capital and KYC requirements, banks have to be selective about the loans they offer. Most are focusing their fire power on their biggest clients – the same clients, on the whole, that have the necessary scale and recognition to issue bonds in the current market. The European Commission is therefore eager to find ways to make it easier for SMEs to access the capital markets.

Europe has cultural, as well as legal and regulatory hurdles to overcome before its capital markets can truly flourish. This, in essence, is what the CMU is all about. According to the Commission’s website, it will allow the Commission to “explore ways of reducing fragmentation in financial markets, diversifying financing sources, strengthening cross-border capital flows and improving access to finance for businesses, particularly SMEs”.

As such, CMU is a process – a journey, rather than a destination. And it is arguably one Europe has been on for some time.

“We already have CMU to some extent, in effect regulations such as the Prospectus Directive, EMIR, MiFID, UCITS and Solvency II are its building blocks,” said David Shearer, a partner at Norton Rose Fulbright. “There may not be many headline-grabbing reforms left to do. What is likely needed are lots of smaller changes to the nitty gritty of how things work, but these can be tough to implement at the European level.”

“In the short term, there is scope for quick wins in things like improving the securitisation market, prospectuses, private placements and creating a better understanding of infrastructure financing. The question is whether it will have the ambition to tackle harder subjects like harmonising solvency law and tax”

Increasing intra-European harmonisation is a goal in itself. Some countries, such as France and the UK, have a relatively established DCM culture.

“In France we see 40% of financing done in the capital markets, compared with a European average of 25%,” said Sebastien Palle, deputy head of public affairs at Societe Generale, responsible for drafting the bank’s response to the CMU consultation paper.

“I think that is because of the universal bank model in France; banks do both lending and capital markets work and so can objectively advise their clients. Furthermore, French statistics show that capital markets financing and bank lending can develop alongside one another.”

It remains to be seen how ambitious politicians will be in the pursuit of CMU.

“In the short term, there is scope for quick wins in things like improving the securitisation market, prospectuses, private placements and creating a better understanding of infrastructure financing. The question is whether it will have the ambition to tackle harder subjects like harmonising solvency law and tax,” said Palle.

The problem is that the questions being asked about CMU are deeply technical and while the Commission can set the direction of travel, it will fall to national governments and technocrats to complete the details. This is where the process of compromise, fudge and postponement for which Europe is so notorious kicks in.

Up for discussion

A key area is tax treatment.

“If a holding company is in one country but it has a subsidiary in another, will there be a tax arbitrage making it more efficient to borrow from one entity than the other? Ideally, it should make no difference, but that will be politically very difficult,” said Shearer.

Europe needs to offer the same kinds of tax advantages to investors buying bonds as the US does for its 401K plans, or for investing in municipal bonds, for example. While the UK has attempted something similar, it still falls short, while elsewhere in Europe a variety of different regimes are in place.

If investors can invest in bonds with no tax on the interest, principal or capital gains, it will generate more interest. If they can do the same across the continent, the advantages will be enjoyed by corporates in Estonia and Bulgaria as much as in the UK and Germany.

Another area particularly ripe for harmonisation is Europe’s disparate insolvency laws, which vary considerably between jurisdictions.

“There have been efforts to harmonise European insolvency regimes before but they have never made much progress,” said Shearer. “Instead, the focus has shifted to determining which country will have jurisdiction in each case. Bonds should charge a lower interest rate than a loan from a bank.”

And then there is the prospect of a greater level of coherence in the prospectuses drawn up by corporates across Europe looking to issue bonds. This would help investors compare credits across borders and level the playing field for issuers in different countries.

Shearer said: “The Prospectus Directive III could be the flagship for CMU, the consultation for it asks some existential questions such as whether we should even have prospectuses. We could certainly see some modernising of the passporting regime for prospectuses, to make prospectuses more truly pan-European.”

“If they [European regulators] make full use of their powers and are aggressive in resolving fragmentation issues, there is no reason why we cannot achieve CMU without any new transfer of powers to European regulators”

Whether all of this is going to revolutionise SMEs’ access to the capital markets is still debatable. There is a big question about how SMEs can get the ratings they need to raise capital in the bond markets. But the more philosophical question is whether Europe is looking to the old world for solutions that are better solved in new, innovative ways.

“We are seeing real innovation in the peer-to-peer lending space and it may be that is where the solution to Europe’s SME financing problems lies,” said Shearer. “But that opens up a new debate about whether that needs equivalent regulation [to securities offerings] and if so, does that choke off the very innovation in SME financing that Europe needs?”

Securitisation situation

There is also some debate around the role securitisation will play in financing SMEs. For some it is potentially crucial.

“SMEs need a European securitisation market and that means, as controversial as it is, serious consideration needs to be given to reviving the originate to distribute model,” said Shearer. “We may need to accept that there will be the occasional blow-up and junior tranches may not always perform that well, but not making the regulatory capital treatment punitive, so that it is economic for institutions to buy them.”

But others believe its potential is overdone. “I believe securitisation will play more of a role for assets such as real estate than for SMEs,” said Palle. “There is still a lot of work to be done for the securitisation market for SMEs to get off the ground, even in the US. In particular, it is crucial to set up a private European network to gather information on the quality of such assets.”

Whether securitisation takes centre stage or not, if CMU achieves even some of the reforms currently envisaged, European DCM will be the better for it, and at least some SMEs will find the route to market clearer than before.

Regulatory union

But while there are many helpful proposals up for discussion, the Commission has also been criticised for measures not being considered.

“CMU has navigated right around the issue of derivatives, which is surprising,” said Alex McDonald, CEO of the WMBA. Especially as CMU will actually increase corporates’ need for risk management tools like derivatives to hedge their bond exposures.

“Other regulations like MiFID, EMIR and Dodd-Frank in the US specifically cover derivatives, especially in terms of clearing and margins, making them more expensive,” said McDonald. “If derivatives were brought into the scope of CMU it could be viewed as endorsing their social worth. However, since most bonds are issued with a derivatives hedge or transposition, it’s hard to see the rationale for leaving them out unless it was a political decision.”

This has led to some questions about the coherence of Europe’s financial regulation strategy.

“Banking structure reform and the financial transactions tax weaken European market-making and fragment the market in the eurozone, just as CMU is supposed to be harmonising it. It is difficult to understand where European financial regulation is going when there is this fundamental contradiction,” said Palle.

In its response to the Commission’s paper, the International Capital Markets Association said: “The more transactions are subject to FTT and the higher the effective rate of any FTT that is imposed, the more this will serve to impede the effective use of the affected transactions in order to advance the objectives of CMU.

“Whether the FTT is on fixed-income securities, equities or derivatives, study after study shows that there will be a significant negative impact as a result of increased economic financing costs, which will largely have to be borne by investors.”

Derivatives are just one good example of this confused thinking. Infrastructure finance is another.

“CMU seeks to make it easier for infrastructure projects to get financing, the European Commission has said this is very important,” said Palle. “And yet Basel’s prudential requirements make it very difficult; they do not fairly reflect the risks. We need to think hard about achieving consistency in European financial regulation.”

Sand in the wheels

McDonald said: “We need a liquid, yet heterogeneous and transparent bond market. Certain provisions of regulations like MiFID and the financial transactions tax throw sand into the wheels of that goal, for example pushing issuers towards certain currencies and tenors, making it harder to be flexible.

“Let’s use CMU as an opportunity to improve our interpretation of MiFID. After all, regulation is not set in stone; in the US we have already seen the interpretation of Dodd-Frank changing in response to problems that have arisen.”

Given the scope of the changes being discussed, and the prospect of some of these concerns being tackled following the consultation, it is impossible to predict in what direction CMU will go. It will probably take 10 years or more for Europe to achieve the kind of CMU currently being envisaged. Even if it doesn’t get there, the exercise should pay dividends. Any improvement to the market is worth making.

It is also an opportunity for Europe’s new regulatory bodies to come of age.

“European regulators have been given a lot of powers, which they still mostly do not use,” said Palle. “If they make full use of their powers and are aggressive in resolving fragmentation issues, there is no reason why we cannot achieve CMU without any new transfer of powers to European regulators.”

The cynics will always harbour doubts about Europe’s ability to get anything done. Certainly, it will be a challenge encouraging nations to cede control of things such as tax and insolvency law. But Palle is optimistic, citing the experience SG had internally in a working group on insolvency.

There were some areas where the retail bank and the investment bank had complementary views, and others where there were fundamental differences, he said.

“Ultimately, we arrived at a single position, which was a very positive result. That made me more positive that such an agreement can be reached between countries in Europe.”

“I believe Europe is keen to do this but it is easy to imagine it being shelved if bigger events divert attention away from it,” said Shearer.

“It is not the sort of thing that the average voter wakes up thinking about. It would be easier to achieve if it was one big initiative, but it is likely to be a series of smaller ones and it will be hard for the Commission to maintain its focus.”

But Clark is more upbeat. “CMU taps into a lot of the common ground that exists between European member states,” he said. “It is likely to have broad support across all EU countries and thus had a good chance of being realised.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com