Fast-growing companies seeking to build confidence in their business models and raise financing are increasingly turning towards private fundraising rounds. So far, the trend has been limited but it could become to IPOs what Uber is to public transport.

Pre-IPO fundraisings entered the mainstream as a source of funding for fast-growing technology companies in the US and Europe in recent years. But they also have the potential to disrupt the traditional IPO process.

Uber Technologies became the world’s most valuable start-up in 2015 with a series of private fundraising rounds that pushed it beyond the US$50bn valuation carried by Facebook before its IPO. But while Facebook’s last round of capital-raising was soon followed by its public market debut, Uber has no such plans.

In adopting this stance, Uber is proving a disruptive force not just in its own industry, but in the capital markets more broadly. Late-stage fundraisings are commonplace in the US technology sector, where fast-growing companies such as Uber, Dropbox and SnapChat have all raised billions of dollars privately rather than go to the public markets.

Hunting for the next winner

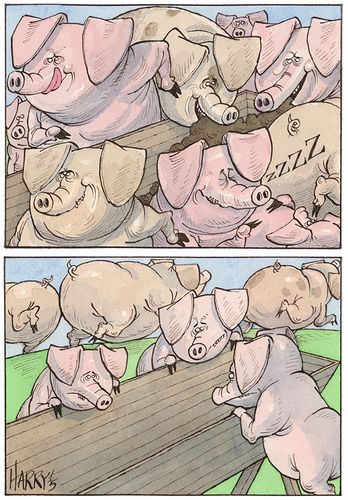

A slew of successful pre-IPO fundraisings have triggered a stampede by investors looking to pick the next winner. Traditional fund managers are starting to allocate a portion of funds to private investments, while family offices are becoming more sophisticated at putting money to work.

Bankers say sovereign wealth funds are increasingly attracted to fundraisings while private equity firms are tweaking their traditional investment approach that focuses on acquiring majority control and adopting a longer-term view.

Now they are coming to Europe and banks are dedicating increasingly more resources to generating private fundraising deals.

Notable transactions in 2015 included one from Swedish music-streaming company Spotify, which raised US$526m in a funding round that valued it at US$8.5bn, a sharp rise on the US$5bn valuation placed on it by investors a year ago.

In April, Funding Circle, the online marketplace for business lending, raised £100m in equity capital, in a round led by DST Global, with participation from Baillie Gifford, a fund managed by BlackRock, Sands Capital Ventures and Temasek. In October, Scottish Equity Partners hired Goldman Sachs to offload 10% of online airline comparison website SkyScanner that would value the company at £1bn.

A different route

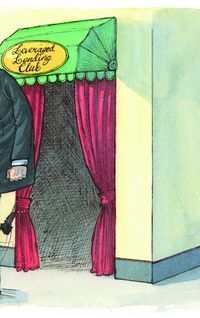

In some cases, companies are disintermediating banks and going directly to potential investors. This was the route taken by HelloFresh, a Berlin-based food delivery start-up backed by Rocket Internet, which raised €75m in a funding round from Baillie Gifford.

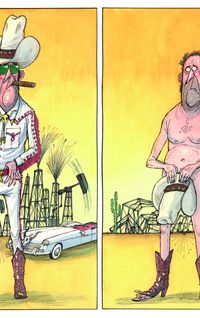

Late-stage fundraisings are most suited to technology companies but they have also been applied to the healthcare and financial sectors, especially where traditional businesses meet technology. During the last commodities boom there was plenty of private capital heading into natural resources companies.

Private placings are well-suited to technology companies because they are fast-growing and need capital. The current wave has its roots in the US, where traditional long-only fund managers such as BlackRock have started allocating capital to growth companies in private fundraisings. Those companies have then gone on to produce some of the biggest IPOs in the US – both Facebook and LinkedIn did pre-IPO fundraising rounds.

Fund managers have flocked to pre-IPO fundraising rounds because they can gain anchor investor status that bumps them higher up the pecking order for allocations when the IPO finally arrives.

“Over the course of the last 12 months this has become a positive, somewhat self-fulfilling process. More investors are willing to participate and that in turn has prompted more companies to consider private-stage fundraising,” said Dan Martin, head of European equity syndicate at Goldman Sachs in London.

For companies, this new wave of private fundraisings has created a compelling alternative to the IPO market because it provides the company with time to grow scale and establish its business model and revenue streams away from the scrutiny of the public company arena.

“Companies securing late-stage private financing are those that in a prior era might have gone to the public markets earlier,” said Martin.

This is in marked contrast to the dotcom boom of 1999, when the equity markets were flooded with internet start-ups with no track record of profitability.

But the race by investors for exciting new private opportunities has pushed up valuations and begun to cannibalise the new issue market.

The US boasts a deep private market, and as a result more and more private companies are raising money and are reaching a market value of US$1bn. In 2014, the value of private companies valued at US$1bn overtook the number of US$1bn tech IPOs.

In a best-case scenario, the proliferation of late-stage fundraisings could avert the bursting of tech 2.0, but they also store up problems of their own.

Investors are taking on the risk of an illiquid investment that could be difficult to off-load if there ever were to be a sector re-rating. While bankers insist that private-side fundraisings are conducted by companies that are ultimately headed for the public markets, they may not do so with the same urgency as Facebook.

“Often the terms and conditions of private fundraisings don’t offer investors clear certainty around future liquidity events,” said Tom Johnson, co-head of equity capital markets for EMEA at Barclays in London.

“It is increasingly common for investors in companies that raise funds privately not to be able to force a listing, or any other form of exit process,” he said.

“It is increasingly common for investors in companies that raise funds privately not to be able to force a listing, or any other form of exit process”

While valuations are rising, bankers say they still remain below those achievable in the public markets because of a smaller universe of investors. That makes it an attractive proposition for investors who are taking a longer-term view and are happy to have a minority illiquid holding in a fast-growing company.

“Investors arguably get a purer valuation in the private markets, conducting their own detailed valuation and diligence of the company’s business plan,” said Martin.

“Investors arguably get a purer valuation in the private markets, conducting their own detailed valuation and diligence of the company’s business plan”

For banks working on these transactions, these fundraisings change the rules of the game in relationships with growth companies. By helping out a company in this way, banks are developing a relationship that could pay dividends when the company launches an IPO.

However, until the company reaches that point, the bond is not as strong as when a bank helps bring a company to the public markets. That usually results in the global coordinators snaring a corporate broking mandate for the company following the IPO.

Bankers say no two fundraisings are alike and they are structured on a bespoke basis, allowing them to earn fees on a par with, and in some cases more than, an IPO on a relative basis. However, banks must also prove that they have the capability and distribution to source funding that goes beyond their relationships with traditional fund managers. To ensure they do, many banks are exporting the expertise gained on US fundraising deals to Europe.

The trend towards fast-growing companies tapping private sources of capital accelerated in 2015 and is likely to continue into 2016. It enables companies to access funding when public markets are closed due to volatility, and enables companies to establish their business models as private companies before being thrust into the public spotlight.

For now, the trend has been limited to growth companies in a small number of industries where technology is a key component.

“Late-stage private fundraising rounds are a viable alternative source of funding that will continue to appeal to issuers,” said Barclays’ Johnson.

“Most companies that make use of these private rounds will ultimately come to market, just later. That’s why they are not going to replace the IPO market, but they are a great tool for ECM practitioners to help companies fund themselves and develop without the scrutiny of a public listing.”

To see the digital version of the IFR Review of the Year, please click here .

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com .