Better co-operation and co-ordination between the Turkish government and the central bank would be a good place to start for the country to find a better level of economic stability.

The next few years promise to be a challenging environment for emerging markets, especially for Turkey as the US Federal Reserve looks to normalise monetary policy and hike interest rates for the first time since the global financial crisis. If Turkey can reduce its reliance on capital inflows and boost foreign investor confidence, it will be better positioned to meet this challenge.

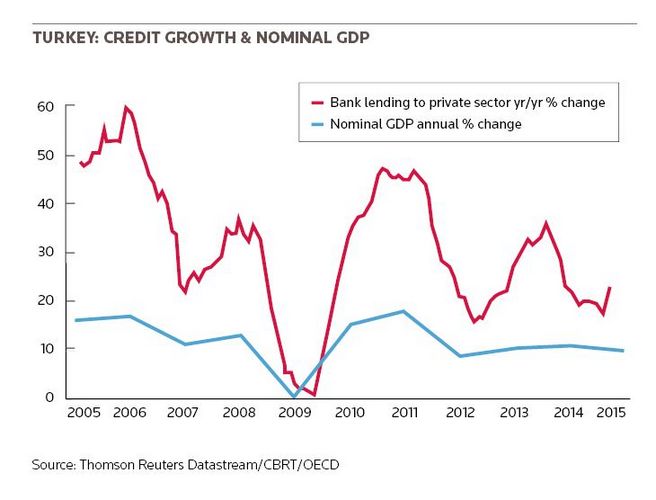

Turkey has been among the most heavily impacted by the Fed’s setting the stage for higher rates, exposing its reliance on foreign capital to fund a huge bank lending boom that probably needs to cool for the economy to rebalance.

Right now, the country’s central bank, the CBRT, is walking a fine line in trying to cool inflation, keep the lira from weakening sharply and supporting the government’s efforts to boost growth. The parliamentary elections in June will be key for shaping future policy.

Nervous foreign investors have cut back their exposure to the country, leaving the lira vulnerable and funding the current account deficit difficult. The vulnerability was on show in 2013 when the lira weakened sharply after the Fed signalled its intention to slow the pace of balance sheet expansion.

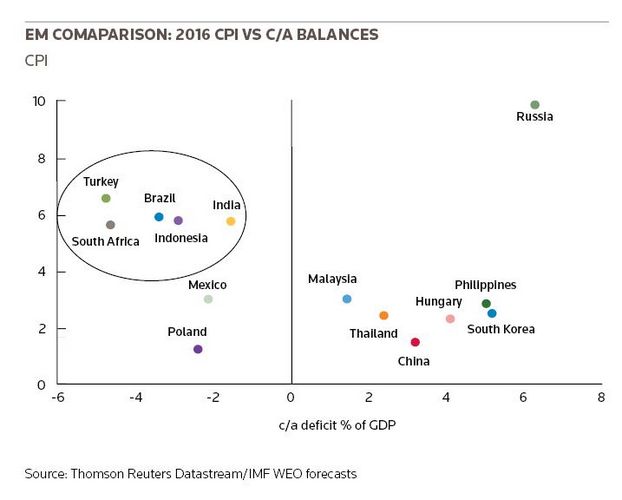

The most vulnerable EM economies tended to be those suffering from a twin deficit problem (of current account and fiscal deficits), dubbed by some analysts as the “Fragile Five” that included Turkey as well as Indonesia, India, Brazil and South Africa.

These countries tended to be susceptible to currency depreciation and high inflation, both suggesting central banks had been too lax on policy, especially if investment inflows slowed or reversed.

Most of the central banks from these economies responded by jacking up interest rates and finding a better balance between real rates and investment flows, ultimately slowing their economies and import demand.

Each of those central banks has since had to modify policies in different ways depending on each of their situations as US 10-year yields have calmed.

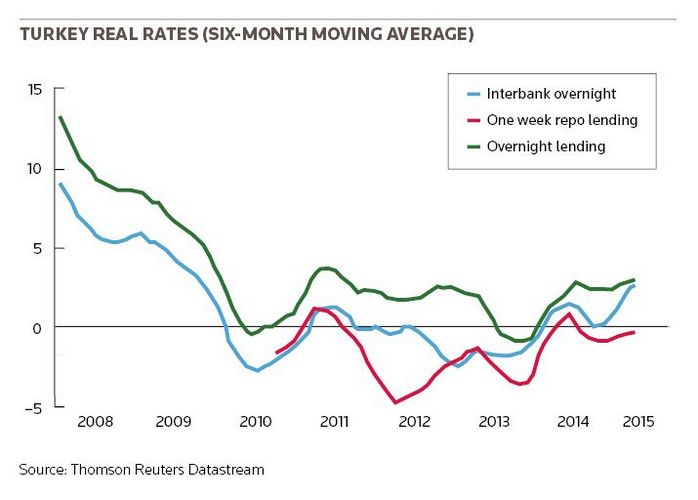

After an aggressive rate hike in January 2014 to shore up the lira, the CBRT has both cut rates and yet tried to take more technical measures to tighten liquidity and keep the lira from falling further, with limited success.

The challenge is to better align monetary policy with the economy’s needs to cool inflation and credit growth while making the environment for foreign investment, especially direct investment, as attractive as possible.

Turkey has features that make it alluring: a young population (26% aged 14 and under) and a vibrant democracy straddling many faster-growing, if troubled, regions of the world. It appears to want to position itself as something of a rival to Dubai and other Middle Eastern market hubs – indeed the new Istanbul airport is planned to be the largest in the world, costing a cool €7bn.

Measured approach

But achieving these ambitions is likely to mean taking a measured approach. The economy is starting to feel the pinch from its lending boom that led to such strong growth after the effects of the global financial crisis wore off in 2009.

That private lending remains so much stronger than nominal GDP, even with the country’s steep rate of inflation, shows that more macro-prudential measures need to be taken to rein in banks and ensure that lending is better tied to infrastructure and reform needs.

The windfall from lower oil prices is something that Turkey should take advantage of because its biggest weakness is a lack of natural resources and, as a result, limited FX reserves. Those reserves have already dwindled following the country’s modest efforts to limit lira depreciation and are one of the reasons why it remains so vulnerable.

Foreign capital remains problematic, still leaving the country and keeping the lira so weak. Turkey’s economic policy challenges could mean the loss of its investment-grade bond rating, with Moody’s poised to cut it below investment grade and follow S&P, meaning that even more foreign money may leave.

As Fitch noted in April, Turkey’s shrinking current account gap – forecast to be near 4% of GDP this year, down from nearly 8% in 2013 when the tapering tantrum struck – shows its capacity to ride out market volatility without sudden stoppages of capital, even if the reliance on external financing remains large.

Political uncertainty will also keep foreign investors nervous. But a failure of the ruling AKP Party to get a large enough majority to pass constitutional changes enhancing the powers of Erdogan and the presidential office would probably be seen as a positive by foreign investors. Certainly, many are hoping to see reduced political meddling in monetary policy.

Structural reforms are happening. As the IMF noted in its annual Article IV consultation last year, Turkey’s 10th Development Plan offers a “bold and well-targeted set of structural reforms” to reduce energy dependence, boost labour market participation and reduce corporate debt financing by promoting corporate use of equity markets.

Europe’s brewing recovery should be a positive for exports, which have been suffering from the troubles in Europe, the Middle East and Russia despite solid growth in the US.

Turkey is learning to live with slower growth to reduce its imbalances: after having expanded at rates near 9% in 2010–11, growth is seen staying in a 3.0%–3.6% range over the next five years, helping contain the current account gap but only gradually reducing inflation from current levels near 8% year-on-year.

Ultimately, many analysts want to see more transparency on monetary policy. The tinkering with various foreign currency and lira reserve requirements, while helping reduce some of the private sector’s reliance on foreign capital, is not seen as a sustainable bulwark against sharper lira depreciation, potentially leaving the CBRT at risk of having to hike rates sharply, as it did in January 2014.

A stronger monetary policy response via modestly higher policy rates would help Turkey find a better level of economic stability for reaching its potential over the medium term. Stronger co-operation and co-ordination between the government and central bank would be a good place to start.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com