The global economic recovery is accelerating, which bodes well for Germany’s automotive sector given that it needs a continued appetite from investors to meet its credit refinancing needs.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.

For more than three decades Audi, the majority-owned subsidiary of Volkswagen Group, has used the German phrase “Vorsprung durch Technik” – progress through technology – as the strapline for its television adverts. German cars have certainly earned a global reputation for high levels of technical quality and reliability. The same could be said of their bonds, which are attracting high ratings, strong investor demand and low yields.

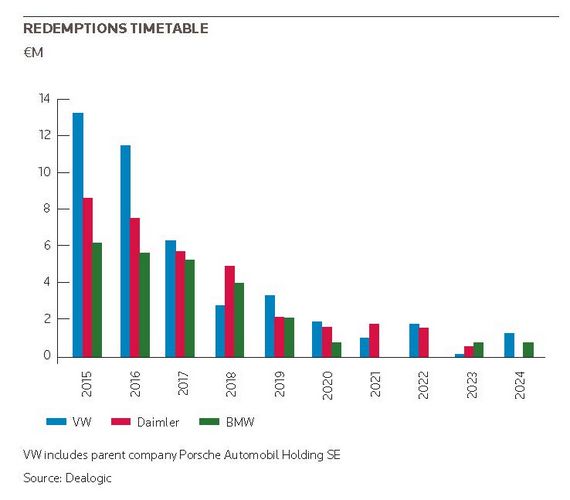

But a heavy funding schedule over the next few years combined with a hefty refinancing programme, the big three manufacturers – Daimler and BMW as well as VW – will test investors’ appetite for the debt.

All three have taken advantage of the positive market reception to a high-octane sales performance in the first quarter of 2014. Daimler saw sales surge ahead by 14% while BMW enjoyed 8.7% growth and VW’s passenger car business expanded by 3.9%.

“Given the strong sales momentum for German car makers and the ongoing refinancing needs of the companies, it came as no surprise that car companies tapped the credit market,” said Frank Hussing, senior credit analyst at Commerzbank in Frankfurt. “For the operational metrics the three companies are doing very well in the first three months and I would expect very solid operational cashflow for the next six to nine months.”

BMW came to market with a €1bn floating-rate note offering. Daimler issued an FRN deal and a sterling benchmark bond offering, while VW was able to come to the market with two new hybrid issues raising a total of €3bn.

But even these bulky totals are overtaken by the companies’ refinancing needs. Hussing points to VW’s €25bn refinancing requirement in corporate bonds over 2014 and 2015, Daimler’s €13bn and BMW’s €11bn. VW’s funding needs alone outweigh the combined €15.5bn requirement of Fiat, Peugeot and Renault.

On top of that, companies will need to issue new paper to raise extra funds. Their strong cashflows mean that they do not tend to need finance to fund their manufacturing operations.

Instead, demand is driven by the needs of their financial services arms that finance the 70% of car sales that are done through leasing or customer credit.

“German car companies have been very successful in recent years so with higher car sales, of which a considerable portion is financed or leased, this will ultimately lead to greater financing needs for their financial services business,” said Christoph Seibel, head of corporate debt capital markets Europe at RBC Capital Markets.

On top of this, the companies also need to come to the market to finance corporate activity. VW’s €3bn hybrid bond issue was taken out to finance its offers to take full control of Scania, the Swedish truckmaker, in which it holds a 62.6% stake.

Panda bear market

China is becoming an increasingly important market for German car companies, whose reputation for quality is attracting well-heeled Chinese buyers who particularly want SUV models.

“German car companies have an excellent model pipeline. I think the growth story is there for the next two years at least,” said Hussing. “I would expect that these companies will have to do a bit more of refinancing over the next two years because the business of the three German autos is growing very fast in China.”

In March, Daimler sold a Rmb500m (US$81.5m) Panda bond to Chinese investors – the first foreign, non-financial bond issue in China’s domestic market.

“For Daimler, it is due to the business in that country and is a natural hedge against costs,” said Hussing. “It makes sense from a company point of view to launch such a kind of issuance. It is too early to say if this is a trend as it depends on the business there.”

German car companies have also raised money in South African rand, Mexican pesos and the Brazilian Real.

“They are very good at diversifying their funding base and using as many tools as are sensible and available to spread their financing requirements,” said Dominik Huhle, head of DCM for northern Europe at Barclays.

While the auto companies often look to raise money in geographies where they have consumer finance facilities or production costs, like all investment-grade corporates they will exploit opportunities in other currencies.

In April, Daimler sold a NKr750m (US$127m) four-year note issue with a 2.75% coupon while VW Financial Services raised SKr600m (US$92m) from the sale of two-year floating rate notes in Sweden.

“Car makers continue to look at all of the markets and they look at where their best financing cost is on a post-swap charges basis,” said Seibel. “In some cases that is a pricing benefit that they derive by going into that market and then swapping it into the currency of the market where they need it.”

Using the toolkit

Siebel pointed out that as well as access to debt capital markets, German automakers have a bank that takes customer deposits and uses the securitised market to raise asset-backed bonds.

This puts the big three in a strong position, especially given their frequent issuance requirements. For example, in April VW raised €922m from a AAA rated 1.9-year auto loan securitisation.

“They are looking at all these different options and they are trying to answer: ‘What is my overall funding need for this year and how do I best fund it from each of those pools?’” said Siebel.

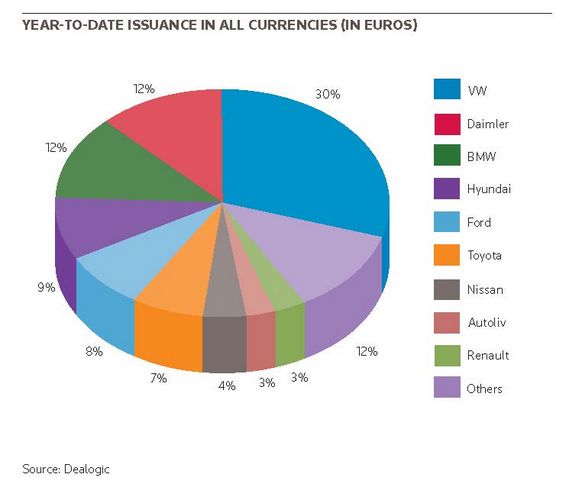

According to data from Dealogic, the three German automakers have so far this year issued more than the rest of the Top 20 industry players combined: VW (through its parent Porsche) has raised €10.8bn while Daimler and VW and BMW have each raised €4.3bn.

“They look at a combination of where is the best pricing and where do I actually need funding and then they try to blend that on a portfolio basis so they have a good match of currencies, a good match of maturities vis-a-vis their financial services portfolio,” said Siebel.

The automakers have generally good access to the markets despite – or perhaps because of – their continual need to refill the financing. Even in the depths of the 2008 recession they were able to finance themselves, albeit at yields of 8% or 9%.

Fast-forward six years and VW was able to secure coupons of 3.875% and 4.75% for perpetual non-call seven and non-call 12-year tranches respectively.

Huhle says there is a strong appetite for corporate bonds, which is benefiting German automakers. “Within Europe and globally people do feel very comfortable with global players that are based in Germany,” he said.

“All German companies have benefited from it as have all car companies. Not only do they trade very tight but they have been able to increase their volumes considerably despite keeping relatively tight pricing.”

Since the global financial crisis fund managers have increased their allocations to investment-grade corporate bonds. However, if investors fret about rising interest rates they may move away from bonds and into cash.

If investment-grade allocations by fund managers shrink because they are putting their money elsewhere, that may create more stress on the ability of the car companies to continue to raise the same volumes at the same spreads in these markets, according to Siebel.

“I don’t know what the answer is but in a scenario where considerably less funds flow into investment-grade credit, this would certainly have an impact on volume and spreads achievable,” he said.

One mitigating factor, said Seibel, was that the companies might not yet have fully exploited the options both in terms of capital markets outside Europe and the options available to them in the form of securitisation, access to bank deposits and use of their corporate cash piles.

“If there is a bit of stress, they always have the opportunity to go into other markets, extend the maturities even further and they have the option to change the mix between secured and unsecured,” he said.

BMW, for example, has not even accessed the US public market.

Huhle echoed this, saying: “We should not lose sight of the fact that car companies have been very diligent and smart about the tool kit that they have developed for efficient financing.”