The UK heads to the polls on May 7 in what could be a very messy election. The uncertainty over a clear outcome has left various scenarios in play ranging, from a hung parliament to a second general election.

The risk of an inconclusive election stems from:

1) the rise of the populist UKIP and its anti-immigration stance

2) the current fractured coalition government of Conservatives/LibDem and

3) general public fatigue of politics.

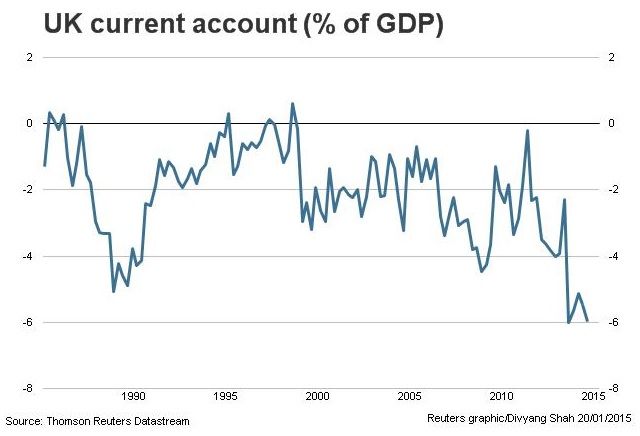

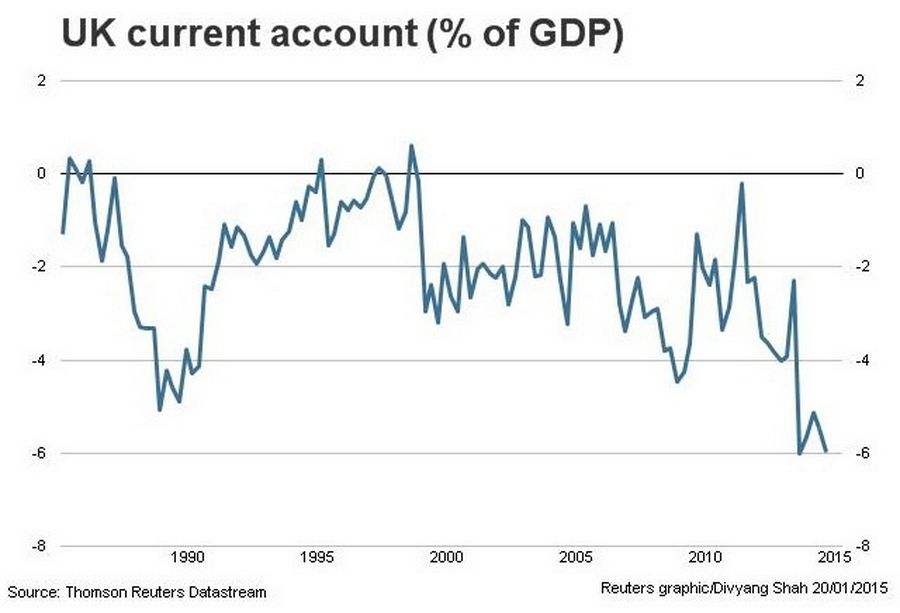

Financial markets view political stability when investing, so uncertainty will likely weigh on UK assets in general. Reduced portfolio inflows should only make it more difficult to finance the record UK c/a deficit.

The freely floating exchange rate is likely to bear the brunt of market uncertainty, with GBP falling sharply heading into the May 7 election.

We expect broad-based GBP-weakness especially against the USD and EUR. Cable is likely to trade below the 2013 lows around US$1.48 to US$1.45, making it attractive to hold OTM 6-mth GBP puts/USD calls.

We have suggested holding a 6-mth US$1.40 Cable put. An alternative is to hold a 6-mth 1.40-145 GBP put/USD call spread, which has a theoretical cost of 108 pips.