IFR: Bettina, let’s talk a little about the notion of unrated, less well known or lower-rated issuers. The expectation this year in Europe is around €35bn in high-yield issuance across Europe in euros. What challenges do unrated or sub investment-grade companies throw up? There’s certainly a lot of credit work required on the investor side. Is this kind of issuance realistically going fill the gap left by the big utilities and the big prime corporates in Germany?

Bettina Streiter: Yes and no. I think specific investors will dig into high-yield and do their credit work; others, because they know the name and the dynamics of a certain issuer, will partly step into high-yield bonds as we saw with the Conti bond3. We had a lot of questions on our desk from retail investors about the bond regardless of the denominations of 50K. A lot of different investor bases are looking at higher-yielding assets because there are few alternatives available and high-grade borrowers will probably be sidelined for the rest of the year; you will see some, but not as much.

And we will see a lot of people who focus on absolute coupons looking at BASF or Linde for less than 2% or Conti at 8.5%. You will see a certain dynamic of even people who don’t do the professional credit work but will look more and more into high-yield or unrated.

There’s one big advantage in Germany which is this big domestic investor base, whether it’s retail or professional. We have a very large base and with the crisis we have suffered over the last couple of years, we are seeing a phenomenon of nationalisation where you will see people buying national credits rather than going overseas. As a German investor, you might buy Telefonica because you know what they do, but you won’t buy another high-yield name in Spain but you certainly would in Germany.

Olaf Sarges: Some of the market’s broader dividing lines that were in place until 2007 have, in my opinion, faded away. If you went back to 2007 and asked investors or your sales people about sub-benchmark size, unrated or high-yield, they would have said no. Either people didn’t buy it, or it was a completely different investor base. Today, people don’t necessarily baulk at buying crossover names. For good double B names or unrated credits, you may see some funds walk away, but many are staying in, and sub-benchmark size seems to be no problem for many of them.

There are funds who want to trade the index and who want to have €500m size but many of them are fading away. The split we had in the past, where investors needed to see Triple B flat, and where even with a negative outlook it was difficult because they needed to sell it if it went down by two notches; or where investors needed to have coupon step-up language or whatever; all that has faded., so I think the borderlines in the investor universe have to a certain extent, faded away during this crisis.

Richard Curtis: And that’s a function of what’s happened to the rating agencies as well. Investors are doing a lot more of their own work and not relying on what the rating agencies say. Now people are saying: “I know the name. I know the credit, I like what they do. They’re in a non-cyclical sector, I can walk out on the street and see them and feel comfortable”. One of the advantages of the bond market is that issuers whose credit quality depends on the investor’s opinion can get away with low level, more investment-grade docs than high-yield docs. This is an area where the bond market can give the issuer a better deal, relative to the loan market.

The number of step-ups that are out there in this stressed environment is pretty low. Investors are not necessarily asking for step-ups, for borderline credits. The demand is such that you either don’t participate or accept it as it is. The momentum at the moment is you have to accept the docs as they are. Probably maybe for certain credits we’re storing up trouble down the line but at the moment it’s plain sailing.

Bettina Streiter: And we’re in an interesting cycle. I think it’s the right cycle for exactly these credits because we’re not seeing any deterioration in credit where people are being picky. Credits are strengthening so I think the environment is very fruitful for high-yield, for unrated, for crossovers. They don’t even need a rating because they can probably sell themselves as being better than they really are because everybody is feeling comfortable at the moment.

Johannes Heinloth: If I just may ask a question to Richard, because he mentioned this earlier; is the documentation for an unrated or crossover credit really that different from loan documentation?

Richard Curtis: If it was marketed as a high-yield name, you would have high-yield covenants. But if it’s a well known name that isn’t rated and it’s well perceived by the retail type investor, you can get away with investment-grade documentation, which is a lot less onerous.

Thomas Kull: There is more flexibility in bond documentation. Banks negotiating normal bank loan documentation look much more deeply into the credit story. I think the starting point on the bond documentation is different. You are, in general, comfortable with the credit, and during the lifetime of the bond you don’t want to enter into any covenant discussions. You want to be paid back at the end and get your coupon on time.

Marc Mueller: I would disagree. On the issue of documentation, be it for rated or unrated issuers, if you want institutional investors in the book, there’s a requirement to have the standard features. In terms of unrated issuers tapping the market, those that will do well are the ones that come to market infrequently, who don’t want to go through the rating process and have quarterly and half-year meetings but who simply want to tap the market now and perhaps again in three years’ time. That lowers the barrier of entry into the market.

I think we will see a lot more large Mittelstand names enter the market. We’re not going to see much growth in large caps; it’s the second line of corporates that will grow. I was asked recently whether the unrated segment represented a new market, but it’s the same market. You talk to the same investors with two differences, they are starting to look at the credit and are not relying on the rating agencies; on the institutional investor side, the criteria for investments have broadened a little, which wasn’t the case three years ago. It was a lot stricter.

Richard Curtis: But you’re also getting the domestic buyer coming in, as Bettina said. The smaller retail targeted deals are almost 100% bought by the country of origin. In an institutional deal you’re seeing 25% Germany, 25% France, 25% UK etc, because institutional buying patterns are similar. But when you target deals more at the domestic investor base, they will accept a lower margin than the institutional investor.

Marc Mueller: At the short end of the curve.

Richard Curtis: Yes, at the short end. You can’t do a 10-year retail deal.

IFR: On the point of duration, we recently saw Deutsche Telekom price a 12-year benchmark, its first at that tenor. They’ve also done a couple of semi-private 10 and 15-year deals as well. Is there a potential opportunity for corporates to issue at the long end of the curve? They can get the pricing that works for them at that point in the curve.

Olaf Sarges: Definitely. You will see more and more issuers locking in the lower yield levels at the long end. The next question on the hunt for yield alongside high-yield or longer maturities in my opinion will be the corporate hybrid market. The rating agencies have now finalised all their methodologies and if M&A activity picks up, I’m certain that more and more corporates will have a look at the balance sheets and that hybrids will play an important role. This won’t be for everyone, but I think for well-rated corporates where the hybrid itself lies within the investment-grade area, I think we’ll see the first examples this year.

IFR: Any names in particular?

Olaf Sarges: No.

IFR: Does anybody have any thoughts on long-dated issuance?

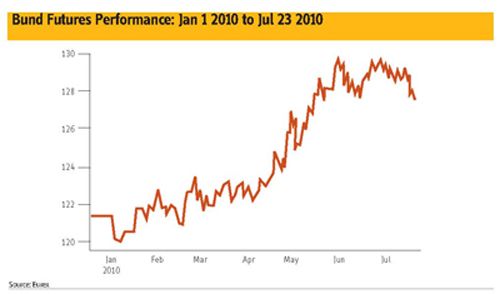

Richard Curtis: It’s the insurance bid; give me 4% and I’ll buy it as long as it’s a name I recognise and I’m happy with the credit. The curve is so steep. If you get, say, 60bp for two years and the two-year swap rate is 70bp or something, you’re getting 1.3% at that tenor. You’ve got to wait a long time before you get your money back. You might as well just go down to the casino and stick it on black or red, at least you get 50/50 there.

That is not going to encourage people to invest at the short end. Investors always need yield. We have a situation where Europe is basically in difficulties, but yields are low. It doesn’t make sense. You’ve got challenging credits out there complaining about the yields they’re paying but they’re low compared to the last 20 years.

We’re in a cycle. I agree with Olaf that rates aren’t going anywhere certainly for six months, maybe a year, but they will pick up. One day issuers are going to say: “I could have got 4% for 12 years (in the case of Deutsche Telecom)”. And you’re going to turn around and say: “I can’t go wrong if I’m buying money at 4% or below for 15 years”. That has to be a good decision over that cycle. Maybe not tomorrow or in six months but in two, three, five years’ time they’ll be sitting there going, “Brilliant”.

IFR: I’d like to touch briefly on prospects for M&A. On paper, they look very promising. There’s a lot of cash in the banking sector, a lot of cash in the corporate sector and good funding opportunities yet there’s very low levels of M&A activity. Japanese corporates are saying they’re looking to Europe to buy companies, and there’s evidence that the cash sitting in US money market funds not knowing what to do next is going to come to Europe to buy corporates. Does the group have any views on M&A into 2011, 2012? Asset prices are still relatively low so presumably there is some good deal flow potential.

Johannes Heinloth: I had this discussion the other day with a corporate client and I came up with a similar argument. I said: “Look, asset prices are pretty low”. And he said: “You’re wrong. They’re pretty expensive”. That’s the point: it depends on which angle you’re viewing it from. There’s a huge amount of

disagreement around the right price.

And secondly, there’s a huge amount of uncertainty with regard to this double dip scenario and about the huge amount of volatility in the market. Few people will dare to borrow a huge amount of money to finance a big acquisition at the moment.

Marc Mueller: I would mirror the uncertainty point to some extent but I’m very positive that 2011 will see higher volumes. We’ve seen a couple of trades being announced or contemplated this year, but it’s not the volume that we used to see on a permanent basis. There’s a lot of volatility and uncertainty that makes any decision a lot more complicated today than it was two or three years ago. Volumes have been muted due to the crisis but they will come back.

Johannes Heinloth: Don’t forget that we are just a couple of months out of one of the biggest financial crises ever, so I think the mindset in many companies is still very uncertain and still very much focused around security and protecting what is there rather than on growth scenarios and opportunities going forward. But it’s really a question of time and it will come. I think we just need to wait a little more before the mindset changes again.

Matthias Gaab: Activity will probably start with the best credits and then trickle down. In the current environment the argument will probably be at least from my perspective that there was hardly a time when it was more beneficial to have a good rating as opposed to a meagre rating. Back in 2006, 2007 there was a fairly minimal stretch differential between Triple B, Single A and a Double A minus whereas today there’s a huge gap between them. So in conjunction with the uncertainty around forthcoming economic developments, people are concerned about preserving their credit quality over time even in the weaker scenario.

Johannes Heinloth: With regard to the cash position of companies, I think there is a question whether on a net basis corporates are really awash with cash. There is still a huge amount of debt sitting on balance sheets, but even if they’re hoarding cash, they’re keeping it for a rainy day. Whether this cash will be used to buy back shares, repay debt or make acquisitions remains to be seen.

In the meantime, we are advising our clients to tap the market now, to think about low asset prices and the interesting funding spreads that Richard mentioned because everyone would probably agree that interest rates will go up significantly in the medium term, so therefore if you can lock in interesting margins and spreads now, it certainly will help you through the next three to five years.

Mathias Noack: The majority of my corporate clients don’t have access to the capital markets so there are plenty of deals for us to do on the syndicated loans side. I guess at some point the question might arise as to whether we on the bank side, will start competing with investors on the debt capital markets side, because banks need funded assets. I think the Telefonica deal, as we mentioned, is a very aggressively priced term loan. On the other hand, we need funded assets from top-quality credits. Would we rather take on this kind of credit risk or not do anything and just provide unfunded backstop facilities?

For the time being, funding spreads are still an issue but I think also over time these will stabilise and then banks will start competing with DCM investors for funded assets.

Thomas Kull: Unfortunately for some of us [on the origination side], issuers have the right approach to current market conditions saying: “I’m not just raising money because it’s cheap. I want to tap the market because I need the funding”. Corporate borrowers bear the cost of carry if they just hold it on their balance sheet so are not just grabbing the opportunity and locking in money because they can get it.

IFR: Ladies and gentlemen: that’s as good a place as any to bring our discussion to a close. Thank you for your comments.

Click here to view the Online magazine version.

| Top 10 German high-yield bonds, 1/1/2009–24/7/2010 | ||||

|---|---|---|---|---|

| Issue date | Issuer | Proceeds (US$m equiv) | Currency | Maturity |

| 17/11/2009 | Unitymedia | 3,871.60 | € | 01/12/2017 |

| 14/10/2009 | HeidelbergCement | 3,646.70 | € | 31/10/2014 |

| 09/07/2010 | Conti Gummi Finance | 938.6 | € | 15/07/2015 |

| 15/01/2009 | Fresenius US Finance II | 801.4 | US$ | 15/07/2015 |

| 22/06/2010 | Heidelberg Finance | 793 | € | 15/12/2015 |

| 09/07/2010 | Oxea Finance & CY | 639.2 | € | 15/07/2017 |

| 09/07/2010 | Phoenix PIB Finance | 632.1 | € | 15/07/2014 |

| 13/10/2009 | Hella KGaA Hueck & Co | 443.4 | € | 20/10/2014 |

| 13/01/2010 | FMC Finance VI SA | 357.7 | € | 15/07/2016 |

| 02/07/2010 | Nordenia Holdings | 347.5 | € | 15/07/2017 |

| Source: Thomson Reuters | ||||

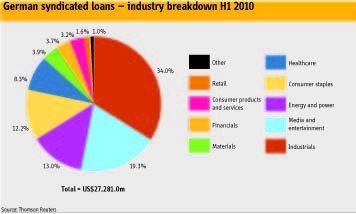

| German syndicated loans — H1 2010, 1/1/2010–30/6/2010 | ||||

|---|---|---|---|---|

| Bookrunner | Proceeds (US$m) | Mkt. share | No. of issues | |

| 1 | Commerzbank | 4,391.10 | 16.1 | 28 |

| 2 | Deutsche Bank | 4,138.50 | 15.2 | 21 |

| 3 | LBBW | 1,855.40 | 6.8 | 9 |

| 4 | UniCredit Group | 1,813.00 | 6.7 | 11 |

| 5 | BNP Paribas | 1,743.40 | 6.4 | 6 |

| 6 | RBS | 1,444.50 | 5.3 | 7 |

| 7 | JP Morgan | 1,138.80 | 4.2 | 4 |

| 8 | Goldman Sachs | 1,071.10 | 3.9 | 2 |

| 9 | Bof A Merrill Lynch | 1,031.10 | 3.8 | 3 |

| 10 | Citigroup | 1,030.60 | 3.8 | 5 |

| 11 | HSBC | 987.4 | 3.6 | 6 |

| 12 | Barclays Capital | 918.5 | 3.4 | 3 |

| 13 | Societe Generale | 738.8 | 2.7 | 3 |

| 14 | Societe Europeenne de Banque | 722.9 | 2.7 | 2 |

| 15 | WestLB | 645.4 | 2.4 | 6 |

| Total | 27,281.00 | — | 40 | |

| Source: Thomson Reuters | ||||

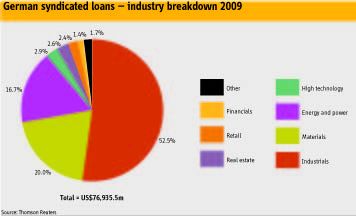

| German syndicated loans — 2009, 1/1/2009–31/12/2009 | ||||

|---|---|---|---|---|

| Bookrunner | Proceeds (US$m) | Mkt. share | No. of issues | |

| 1 | Commerzbank | 12,869.40 | 16.7 | 29 |

| 2 | Deutsche Bank | 11,051.90 | 14.4 | 22 |

| 3 | UniCredit Group | 6,675.90 | 8.7 | 11 |

| 4 | RBS | 6,156.30 | 8 | 7 |

| 5 | LBBW | 4,270.80 | 5.6 | 9 |

| 6 | BNP Paribas | 4,252.20 | 5.5 | 8 |

| 7 | Credit Agricole CIB | 4,108.80 | 5.3 | 5 |

| 8 | Barclays Capital | 3,690.80 | 4.8 | 5 |

| 9 | Bayerische Landesbank Giro | 3,432.30 | 4.5 | 5 |

| 10 | Nordea | 3,024.50 | 3.9 | 1 |

| 11 | Credit Suisse | 2,372.60 | 3.1 | 2 |

| 11 | UBS | 2,372.60 | 3.1 | 2 |

| 11 | Santander | 2,372.60 | 3.1 | 2 |

| 14 | JP Morgan | 2,290.30 | 3 | 5 |

| 15 | Mitsubishi UFJ Financial Grp | 1,555.10 | 2 | 2 |

| Total | 76,935.50 | — | 47 | |

| Source: Thomson Reuters | ||||

| German syndicated loans — 2008, 1/1/2008–31/12/2008 | ||||

|---|---|---|---|---|

| Bookrunner | Proceeds (US$m) | Mkt. share | No. of issues | |

| 1 | Deutsche Bank | 15,424.60 | 18.2 | 18 |

| 2 | Commerzbank | 8,783.40 | 10.4 | 28 |

| 3 | RBS | 8,198.80 | 9.7 | 14 |

| 4 | UniCredit Group | 7,299.90 | 8.6 | 15 |

| 5 | BNP Paribas | 5,575.00 | 6.6 | 11 |

| 6 | JP Morgan | 5,104.20 | 6 | 7 |

| 7 | WestLB | 4,235.20 | 5 | 11 |

| 8 | HSBC | 3,414.70 | 4 | 4 |

| 9 | Credit Agricole CIB | 3,381.20 | 4 | 6 |

| 10 | Citi | 3,316.00 | 3.9 | 4 |

| 11 | Barclays Capital | 3,233.10 | 3.8 | 3 |

| 12 | Mitsubishi UFJ Financial Grp | 2,293.60 | 2.7 | 2 |

| 13 | Credit Suisse | 2,203.20 | 2.6 | 2 |

| 14 | HSH Nordbank | 1,421.30 | 1.7 | 5 |

| 15 | LBBW | 1,187.70 | 1.4 | 5 |

| Total | 84,665.00 | 100 | 76 | |

| Source: Thomson Reuters | ||||