To view the digital version, please click here.

Keith Mullin, IFR: Christian: Are you with Marc in terms of the ability for the bond market to finance in big size?

Christian Reusch, Unicredit: Absolutely. As was already said, no transaction will fail because of lack of liquidity in the market. As long as it’s properly structured, as long as there’s a proper story that people can believe in, you can get it done. There is no doubt about that.

Keith Mullin, IFR: So away from event-driven financing, what can we expect in terms of refinancing or any other kind of activity? Are there big redemptions coming up next year, Claudia?

Claudia Hopstein, HSBC: It looks to be quite a normal year. There’s nothing material that needs to be refinanced. That’s true for the private placement market as well as the public market. Available liquidity is much, much higher than redemptions. With regard to event-driven financing, the bond market would love to see jumbo deals, as liquidity is so huge. As for normal refinancing many German corporates have repaid their bonds and bond investors are sitting at the table and are a bit desperate, saying: ’can you do another bond; we would love to invest in you?’ But there was limited demand from the corporate side.

Christian Reusch, Unicredit: I think what we might see is more lengthening of duration because as long as there is appetite with investors, why not take advantage? Long-only investors who need long-term assets to match their long-term liabilities have understood that yields will remain at a very low level for quite a foreseeable space of time.

They’ve waited for too long in the hope that spreads will rise and this hasn’t materialised. That’s good for issuers; bad for investors. At a certain point, though, you have to fill your long-term liability gap with long-term assets. So one thing I personally see into 2013 is a lengthening of duration.

Johannes Hack, DZ Bank: It strikes me, not being a bond guy, but you’ve got this huge surplus of liquidity and there’s project finance. They need the liquidity, they need the long tenors and they’re all sitting there twiddling their thumbs wondering what’s going to happen to them. I mean it’s interesting and I think it will be interesting to see whether the divide between leveraged finance, project finance and corporate finance is going to remain or whether perhaps some of that liquidity will effectively flow to other uses of funds.

Keith Mullin, IFR: Good question. This is one of the biggest questions around. A lot of banks are exiting infrastructure lending because it doesn’t suit them any more. Karin, would your clients like to see infrastructure risk in the bond market? It’s quite difficult to model for bond investors, right?

Karin Arglebe, Commerzbank: It’s difficult to model and to educate bond investors around the risk. I don’t think we will see many bond deals coming from this area.

Marc Mueller, Deutsche Bank: I’m more positive about this because investors - and I agree with Christian - investors either need to go out duration, down the credit spectrum or look for alternative pockets. Buying more complexity on structures or from a different asset class could be an alternative way to earn a higher credit spread. I’m actually more positive that liquidity will eventually spill into those pockets as well.

Karin Arglebe, Commerzbank: Maybe as a private placement where we can have a more tailored dialogue with investors. When it comes to the huge public bonds, I think it will take a little more time.

Claudia Hopstein, HSBC: I think there needs to be a new development in the bond market to catch up with these sorts of projects because a straight bond doesn’t normally match the project requirements from a cashflow perspective. A straight bond is a fully-funded immediately paid-out instrument. But for a 25-year project, you need tailored drawdowns to meet cashflow requirements that normally don’t match a bond. You can develop the market in a way that matches these projects, but it looks a bit too early to me.

Johannes Heinloth, BayernLB: In the US they have been trying for quite some time to tap new sources of liquidity and it seems to be very difficult. Instead, new banks are entering the scene, like the big Japanese banks or the Chinese banks, and they’re providing the liquidity. But you still need to have this capacity to analyse the deals, to really understand the risk and the cashflows to feel comfortable investing.

Christian Reusch, Unicredit: It’s not standardised so from that perspective, you need to find a minimum standard to make things more comparable. This can be quite interesting from a yield perspective as long as you have the capacity to conduct your own analysis. But to open it to a broader audience you need to at least a few standardised boxes.

Reinhard Haas, Commerzbank: Maybe you have to securitise these different project financings in order to buy into a basket of risk. That would make it easier for an institutional investor at least, but even there it’s a specialist market.

Claudia Hopstein, HSBC: Coming back to one of the very first questions you raised, about the difference in the credit analysis of DCM investor and a bank, the bank has very specific teams and capabilities to look at these sorts of projects. This is not what an institution investor is there for. They don’t have such teams so these capacities would constitute purely new developments.

Keith Mullin, IFR: Last time we had this roundtable in 2010, we were seeing a stream of corporate hybrids and everyone was getting very excited about it. So staying on this area of alternative sources of finance or alternative sources of yield for bond investors, there’s long-dated or inflation-indexed utility bonds and there’s hybrids. Are these things going to continue to be just one offs do you think, Marc?

Marc Mueller, Deutsche Bank: We’ve seen hybrid supply in the utility space this year. When you look at the yields that issuers need to pay in the current environment, they’re very attractive. The question is: outside the utility sector, is there a need for equity credit at the moment in the corporate space? These are the situations where we would see a wave of hybrid issuance. The instrument is very well recognised in the corporate treasury arena and it’s very attractive to issue at the moment but the application itself is rarely seen currently.

Keith Mullin, IFR: In terms of the loan market, looking forward to next year away from event driven financing, is there a big re-financing demand that’s going to keep you guys busy?

Johannes Heinloth, BayernLB: I wouldn’t say big demand but there will be some refinancing activity certainly. Corporates will look further out and think about refinancing existing facilities even it they don’t expire until 2015 or so because their view is that pricing levels in the loan market will go up. That will certainly be one of the drivers.

It very much depends on which way the economy goes. If growth rates turn south, then we’re potentially talking more about full restructurings or at best covenant restructurings. That could keep up busy. Or we may see growth rates rising from 1.5% to 2%-2.5%. If that’s the case, we’ll be busier with event-driven transactions.

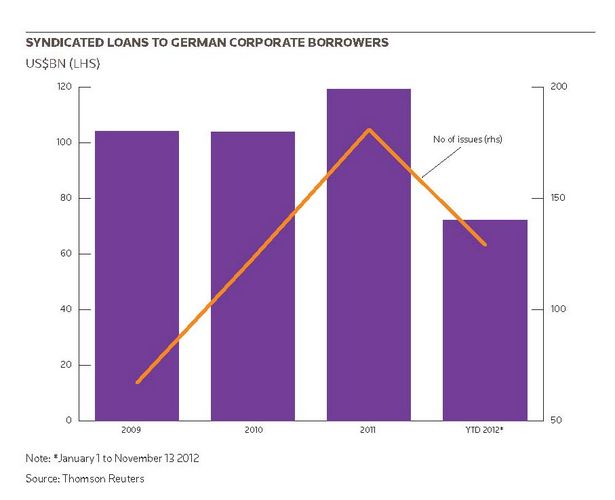

But my general expectation is that we won’t be too busy on the loans side and we’ll probably have to reconsider the budget that we set up a year ago for the next five years. All-in-all it should be OK because if you look at previous years, even 2008 and 2009, there was always activity in the loan market. You always have to somehow service your clients, as Matthias has already mentioned, and this gives me sufficient comfort to support a positive outlook.

Matthias Gaab, Deutsche Bank: I expect flat developments in 2013 over 2012 for the reasons Johannes mentioned. We have already seen a lot of refinancings. We’re no longer talking about 2013 or 2014 maturities because borrowers have done that already. Some did this last year rather than this year.

However, with Basel III becoming more and more concrete, people might ask themselves: ’is the loans market likely to improve over time or likely to deteriorate over time?’, which might prompt them to consider at least early refinancings of 2015 or 2016 maturities to ensure they have another five-year or whatever the tenor facility in place and then take it from there.

I try to differentiate between numbers of deals and volumes because volumes are always difficult to predict. I think from the perspective of the number of deals, we should probably stay flat and we’ll hopefully have a ’surprise event’ like SAP or Linde, which is going to help the market. But even if economic developments significantly deteriorate, I don’t believe 2013 will see much action because as opposed to 2007 companies are in a much healthier state with much lower leverage relative to that period.

I would guess that if a negative environment does emerge, it will only be in 2014 when this would really put corporates into a situation where you would need potentially to restructure transactions. I don’t personally believe that that’s likely to happen in 2013.

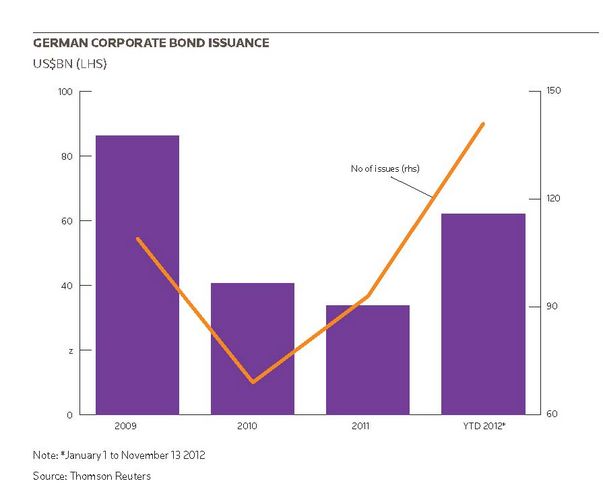

Reinhard Haas, Commerzbank: I would agree with that. Adding to the point that was just made with respect to volume versus number of deals, when you look at the evolution from last year to this year, we had a year-on-year slump of 15% in deal numbers in Germany, compared to 44% in Europe so it’s a very different situation. In Germany, though, the average volume of deals went down from about €425m to €250m where deal size went up to about €485m in Europe in general.

The effect is dramatic because you saw a complete disappearance of SME issuers from Southern Europe and a concentration of volume on some very large corporates that had to pay the price. You had single A names paying 250bp or more. That obviously was not affordable for the mid-caps.

That is very different in Germany where loans have remained affordable and actually rather inexpensive over the last few years. I would expect not only refinancing but maybe also first-time issuance by certain SMEs will offer potential for us in the coming year. In this, we should compare ourselves, let’s say, to the UK market where the penetration rate into the SME segment for capital markets product is far higher than in Germany and there is a lot more to do for us here. If there’s any growth, it’s going to be in deal numbers and with SME clients.

Keith Mullin, IFR: I know this is the six million dollar question, Johannes, but where do you see loan pricing going?

Johannes Hack, DZ Bank: The one thing I’ve learned is that predictions are difficult particularly when they concern the future. Honestly, based on my current scenario I would guess flat. Actually I think two things. I think they’ll remain bifurcated. They’ll be far more differentiated than they used to be up until about 2009 when a large group of borrowers by-and-large got the same pricing.

I think the really good credits will continue to get world-class pricing and the reasonably good ones will struggle slightly more. That’s baseline. I have a downside scenario where it’s not so much eurozone but real-economy troubles and it’ll go down further than we’d perhaps like to think. In that scenario, pricing could pick up, but that’s the downside scenario.

Reinhard Haas, Commerzbank: I would agree but I think there are two technical barriers to a large variance in pricing. One is competition, which usually drives pricing down. We’ve just agreed there’s probably not going to be a huge rise in deal numbers. That also usually tends to keep pricing down.

Two, when you look at the liquidity costs that many banks have, this acts as a boundary where for certain banks it’s just not worth it. And that’s why we’re not exactly stuck in the middle but there is a tunnel in which this can evolve for the time being.

Keith Mullin, IFR: On the bond side, Christian, do you see yields continuing to be compressed, assuming we have the same technical conditions and assuming we see no eurozone blow up?

Christian Reusch, Unicredit: Well, I don’t believe in a eurozone blow-up but that’s another topic and we could elaborate on that for hours. I do believe that for Germany or core Europe we might have seen a bottom building in terms of where the overall cost of funding can go although I still believe yields will remain very, very low. On the spread side, there could be some volatility but I think baseline for core Europe we have more or less found the bottom.

Just look at the recent few weeks: when OMT and the German Constitutional Court ruling came in, appetite for peripheral debt picked up substantially. You hadn’t seen core European names failing to deliver strong order books or fine pricing but what you did see was the magnitude of outperformance in secondary markets certainly much lower than before.

On the question of new-issue premiums, you can always argue back and forth about what the real new-issue premium is but I think investors have reached a point where they’re maybe thinking twice and saying: ’OK maybe I’ll go into it maybe I won’t with the same magnitude I’ve done before because performance might be limited’. That’s my feeling.

Keith Mullin, IFR: A bit of a blue-sky question, Claudia but there has been talk of an asset allocation shift out of fixed-income into equities. If we do see a technical shift out of bonds, where does that leave spreads?

Claudia Hopstein, HSBC: I think corporates will remain the preferred asset class at least over the next year and particularly in Germany. German is a favoured nation from a pure economic point of view and from an economic strength point of view. To Christian’s point, there’s always the argument that we have reached the bottom and it can’t go lower, but we often say that only to see another move down.

But you do need some secondary market performance and that’s going to be limited. The question is really about headline risk rather than the economic environment, or what will the operational performance of an individual company be. It’s the overall market theme which is driving prices these days and that means you might need to pay a higher price this week compared to last week.

I fully agree that we’re going to see increased volatility in credit spreads. And the other question is inflation and what will that do to our basic yield terms, but that would be another two and a half hours of conversation.

Keith Mullin, IFR: Karin, do you think German corporate DCM volumes will increase in 2013?

Karin Arglebe, Commerzbank: That’s difficult to answer because 2012 was a very, very good year; better than we thought. At the beginning of the year, we always make our own evaluations, list them and see who wins. This year, I was very, very optimistic but by chance I was right.

I think we will have more debut transactions next year that will drive the market because as we said before there are a lot of small corporates in the Mittelstand and in the SDAX and MDAX and you would be surprised to see how few of them have tapped the market. A lot of these names have never done a transaction in the bond market. They’ve done Schuldscheine or they have loans, but now they are seriously considering the bond market. That’s a good thing. Of course, the frequent borrowers; the car makers, the utilities; will do transactions. So I think we’ll have a decent market and volume-wise a market like this year.

If you go through the new names that are considering tapping the markets, they’re also going for volume, so not just deal sizes of €250m so. A lot of new names will definitely go for benchmarks in connection with M&A activity, for example. So more names, more new names; volume wise I would hope the same.

Keith Mullin, IFR: And final word to you, Marc. What are your thoughts and expectations for next year?

Marc Mueller, Deutsche Bank: I share Christian’s outlook. The yield environment and the overall funding environment will stay attractive for corporates. In terms of supply, that will come. Maturities next year will be higher than this year - in excess of €50bn - and that will need to be refinanced. Plus we will have this continued shift from loans into capital markets. That’s something which will also continue so that will contribute to net positive new issuance next year.

And as we discussed earlier, if M&A picks up, I’m very positive that we will have a greater amount of issuance coming to market than we’ve had this year, which was higher than 2011. The long-term trend is intact. The all-time best year for the bond market could be 2013.

Keith Mullin, IFR: Ladies and gentlemen: thank you for your time and comments.

| Corporate bonds by industry sector | ||||

|---|---|---|---|---|

| Volume (US$m) | Mkt share | No of issues | ||

| 1 | ?Industrials | 26,590.70 | 42.8 | 63 |

| 2 | Consumer products and services | 8,549.90 | 13.8 | 21 |

| 3 | Materials | 7,123.00 | 11.5 | 13 |

| 4 | Energy and power | 5,241.30 | 8.4 | 12 |

| 5 | High technology | 5,059.30 | 8.1 | 5 |

| 6 | Telecommunications | 3,910.50 | 6.3 | 7 |

| 7 | Retail | 1,932.50 | 3.1 | 9 |

| 8 | Media and entertainment | 1,766.70 | 2.8 | 4 |

| 9 | Consumer staples | 1,322.10 | 2.1 | 6 |

| 10 | Healthcare | 660.8 | 1.1 | 1 |

| Industry total | 62,156.70 | 141 | ||

| *January 1 to November 13 2012 | ||||

| Source: Thomson Reuters | ||||

| Corporate syndicated loans by industry sector | ||||

|---|---|---|---|---|

| Volume (US$m) | Mkt share | No of issues | ||

| 1 | Industrials | 18,664.50 | 25.8 | 41 |

| 2 | Materials | 15,961.10 | 22.1 | 27 |

| 3 | Energy and power | 6,894.30 | 9.5 | 7 |

| 4 | Media and entertainment | 5,901.00 | 8.2 | 10 |

| 5 | Telecommunications | 5,229.30 | 7.2 | 1 |

| 6 | High technology | 4,642.00 | 6.4 | 5 |

| 7 | Healthcare | 4,459.90 | 6.2 | 10 |

| 8 | Consumer products and services | 3,063.70 | 4.2 | 5 |

| 9 | Retail | 2,819.80 | 3.9 | 8 |

| 10 | Consumer staples | 2,376.10 | 3.3 | 8 |

| 11 | Real estate | 2,261.40 | 3.1 | 7 |

| Industry total | 72,273.00 | 129 | ||

| *January 1 to November 13 2012 | ||||

| Source: Thomson Reuters | ||||