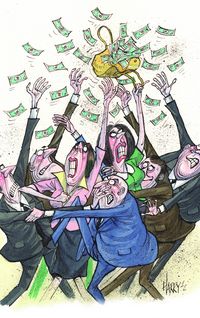

From the ECB’s cheap money to the wildly different price expectations of buyers and sellers, there are plenty of reasons why Europe’s banks are not deleveraging quickly enough. Will they pick up the pace in 2013?

To see the full digital edition of the IFR Review of the Year, please <a href="http://edition.pagesuite-professional.co.uk//launch.aspx?eid=24f9e7f4-9d79-4e69-a475-1a3b43fb8580" onclick="window.open(this.href);return false;" onkeypress="window.open(this.href);return false;">click here</a>.

The pace of European bank deleveraging did not quite live up to expectations in 2012, and many in the market say they now believe the process could take at least five more years.

From the ECB’s easy money to the ongoing uncertainty in Europe to the persistent gap in pricing expectations, there are a host of reasons why banks have been slow to clean up their balance sheets.

“A confluence of factors has restricted the much anticipated flow of transactions in the loan portfolio market,” said Graham Martin, head of portfolio solutions group and corporate finance partner at KPMG.

“For one, the ECB’s three-year money has largely been used by banks to strengthen their balance sheets through profitable carry trades, reducing the pressure on them to sell non-core assets at non-desirous prices.”

The IMF says that European banks need to shrink their balance sheets by US$2.6trn, 75% of which is likely to come from asset sales. But out of an estimated €2.5trn of non-core loans now on those balance sheets, banks will have sold off just €50bn in 2012, according to advisers.

“The predicted wave of loan portfolio disposals by European banks has not materialised,” KPMG said in its Global Debt Sales Survey 2012.

“The combination of cheap ECB money, difficulties in accessing debt to fund transactions, suppressed appetite from acquisitive banks and an, albeit narrowing, price expectation gap has meant that €1.5trn of non-performing loans are still sitting on European bank balance sheets.”

For now, only very distressed assets sold at deeply discounted prices still continue to trade. The disposal of very large portfolios of long-dated residential mortgages and project-finance loans, which are not heavily loss-making for banks, has largely been shelved.

“There have been aspirations to sell performing loans but they are harder to shift, as there is no institutional money,” said David Edmonds, portfolio lead advisory partner at Deloitte.

“Banks can’t take the kind of hits buyers are looking for. They can only sell assets they have already taken provisions on.”

In a Deloitte survey of 18 European financial institutions representing €11trn of assets, 71% said that deleveraging could now take at least five more years to complete.

“The combination of cheap ECB money, difficulties in accessing debt to fund transactions, suppressed appetite from acquisitive banks and an, albeit narrowing, price expectation gap has meant that €1.5trn of non-performing loans are still sitting on European bank balance sheets”

And 56% said that natural run-offs, rather than divestments, would play the most important role in asset reduction – particularly in countries most affected by the eurozone crisis, where there are fewer potential buyers.

“Twelve months ago, we would have been surprised to learn the extent to which run-offs are now being relied on to deleverage,” said Edmonds. “But with the pricing issues the market now faces, we are not surprised.”

KPMG’s Martin stressed that run-offs and refinancings are not a feasible long-term strategy.

“Banks have kicked the can down the road when it comes to refis,” he said. “But soon, with increased regulation and the increased capital you have to hold against these assets refinancing, run-offs just won’t be feasible.”

Selling it cheap

Where deleveraging has taken place, much of it has focused on stressed and non-performing portfolios, such as commercial real estate.

KPMG estimates that out of a total of around €1.5trn in European NPLs, €600bn of it is with UK, Irish and Spanish banks alone.

Lloyds in particular has been quite aggressive in selling commercial real estate and leverage loans. The UK bank sold a portfolio of private equity investments to Coller Capital for £1.03bn in August, and a nominally valued €360m Irish commercial property loan portfolio, Project Prince, in April to Kennedy Wilson and Deutsche Bank at an 83% discount. It is also selling a heavily defaulted €2bn Irish loan portfolio, Project Pittlane.

In Ireland, Allied Irish Banks and Bank of Ireland have also been successful in selling offshore assets, especially in the UK and US, and have achieved “significant deleveraging in relation to targets”, according to Edmonds.

AIB reportedly sold Project Kildare, a mix of non-core and non-performing loans with a nominal value of around €650m, to distressed debt fund Lone Star at a near 60% discount. Despite all this, however, the overall total sale value of property portfolios by European banks is expected to dip in 2012, according to global real estate adviser CBRE.

It said that 2012 deals completed in the UK and Ireland were worth €7.5bn as of October, with European banks currently marketing more than €11bn of loans. Even if all were completed by the end of the year, it would still tot up to less than the €20bn of real estate debt that CBRE reckons was sold by European banks in 2011.

In Spain, meanwhile, amid an especially troubled economy and exceptionally weak real estate market, there has been a pocket of activity in personal lending.

“We are currently doing 12 deals in Spain in the personal lending space, and have already advised on 25 deals this year,” said Richard Thompson, a European portfolio advisory group partner at PwC.

“These deals tend to be smaller, sub €100 pricing in the 10–15 cent in the euro range.”

Another factor contributing to the slow pace of deleveraging has been the creation of bad banks, which has delayed assets coming to market.

Germany in particular has seen very little activity, with many assets locked up in long-term bad bank schemes such as SoFFin and EAA, the former bad bank of WestLB, now Portigon.

“There is cheap funding behind many of these assets which have long-term business plans, between nine and 22 years, as a result they are not coming to the market,” said Deloitte’s Edmonds.

Getting better?

Despite this year’s lacklustre performance, some in the market expect deleveraging to pick up speed in 2013. Increased provisioning by banks, the availability of cheaper leverage, and pressure from new regulations such as Basel III could kick-start divestments.

“Banks are increasing provisions and growing their capital base so they can absorb greater losses,” said Edmonds.

“As a result, pricing expectation levels will fall slightly and come closer to market expectation,” he said. “Buyers are also accessing leverage into transactions at cheaper rates, so [they] can increase their offers.”

This could be facilitated by the wall of capital chasing those opportunities. According to PwC, investors – predominantly US distressed funds – are sitting on €65bn of funds available to invest in loan assets. And activity will be fuelled by a bottoming out in particular markets.

“I expect a lot of activity in 2013–15, especially in Spain and Ireland,” said KPMG’s Martin.

“In commercial real estate, one of the challenges is reaching the floor, and I think in Ireland we have reached that floor,” he said.

“There has been roughly a 55%–60% drop in pricing since 2007 across property. There are now trades and data points which you need to entice investors.”

But Thompson sounded a more cautious note.

“Next year will see another €50bn of deals,” he said. “We have consistently said this deleveraging will take at least 10 years.”