Greece and its creditors may have only two weeks after this weekend’s referendum to come up with a new bailout agreement, a lot less than many market participants expect, with the country set to default by July 20 if it is unable to come up with funds to repay bonds held by the ECB.

After the beleaguered nation was unable to meet a €1.6bn debt obligation to the IMF due last Tuesday, focus turned to a July 20 €3.49bn payment on bonds held by EU institutions led by the ECB as the event that could push Greece into “true” default.

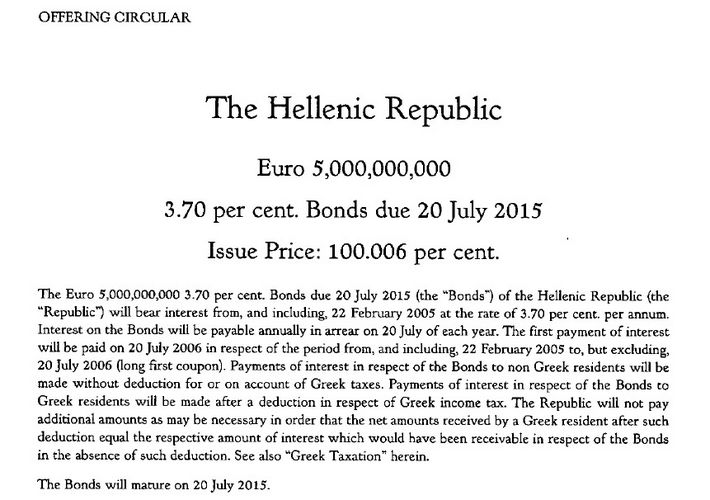

Many market participants believe that the country will have a 30-day grace period after the July 20 repayment date, but a prospectus pertaining to one of the original bonds uncovered by IFR suggests that there is no grace period, and the sovereign will go into immediate default should it fail to pay – though it will have seven days to remedy this.

“The Republic defaults in the payment of principal in respect of any of the bonds when due at maturity or otherwise and such default is not cured by payment thereof within seven days from the due date for such payment,” the document says.

The prospectus relates to the bonds issued by Greece in 2005. The ECB purchased these from private investors under the Securities Markets Programme, which it instigated during the depths of the eurozone crisis five years ago.

The ECB ringfenced the bonds by changing the unique identification codes (ISINs) when Greece restructured its private sector debt – via so-called private sector involvement – in 2012, but retained the maturity date and 3.70% coupon.

The ECB declined to comment when asked whether there was a grace period and whether the conditions outlined in the original prospectus were still applicable.

That refusal did nothing to dispel the sense of confusion among market participants.“I think a lot of people have confused the ECB bonds with the IMF debt, where there is a 30-day grace period. My understanding is that there is no grace period,” said one economist covering Europe.

A failure to repay those bonds could prove much more punitive for Greece than a failure to service IMF debt.

“Missing an IMF payment has very light immediate consequences. Missing the ECB/EIB payment on July 20 triggers tougher consequences: it may mean a freeze in bank ELA liquidity,” said Alberto Gallo, head of macro credit research at RBS.

It will also trigger legal default, cross-default on other obligations, and default by rating agencies, he said.

ELA threat

The ECB also would not clarify if a failure to pay on July 20 would result in an immediate freeze on the emergency liquidity assistance that is currently supporting Greek banks.

“We do not want to speculate,” an ECB spokesperson told IFR.

In addition to the ECB bond payment, Greece also has €2bn of T-bills maturing on July 10 and an €88m-equivalent Japanese yen obligation maturing on July 14; a failure to pay either of these would also lead to a default. Analysts think it likely that Greece will be able to roll the maturity of the T-bills as these are held by Greek banks, though there is less clarity about whether it can or will repay the yen bonds.

Previously, market participants were focused on a €1.6bn payment due to the IMF by June 30 as the deadline for Greece to agree with its creditors to renew an existing bailout mechanism.

“Although the missed payment to the IMF is a default in the legal sense, it would not constitute a commercial default under S&P’s criteria,” analysts at Citigroup said in a note.

EFSF warns

Going into arrears on the IMF payment does give Greece’s main creditors, the European Financial Stability Facility, the option to accelerate payments on some of the loans dispersed to the country.

The EU’s bailout fund, which holds €130.9bn of Greek debt, warned last Wednesday that it was looking at various options including acceleration of the loans made to Greece after the country went into arrears on the IMF repayment.

The EFSF has now put forward three options to the Eurogroup Working Group and the EFSF board of directors, of which the most drastic would be acceleration. The others are waiving its right to act or waiting.

“We think this is very unlikely – not least because Greece can’t, as well as won’t, pay,” said David Riley, head of credit strategy at BlueBay Asset Management.

Greece was last week downgraded one notch to CCC– by Standard & Poor’s with a negative outlook, and a notch by Fitch to CC.

S&P believes that a commercial default is inevitable within the next six months, barring “unanticipated favourable changes in Greece’s circumstances”.

It also believes that there is a 50% chance that the country will exit the eurozone.

CDS trigger

As for the credit default swap market, such instruments referencing Greek sovereign debt will not be triggered by the missed payment to the IMF, but failure to redeem bonds held by the ECB could trigger payouts on US$584m of net notional outstanding in the instruments.

In the event of a missed ECB payment, CDS holders are expected to ask ISDA’s credit determinations committee to consider a potential failure-to-pay credit event. But the decision is unlikely to be clear-cut as Greek sovereign CDS does not apply to debt instruments issued before the 2012 bond restructuring.

“Greek CDS is a special case as it is only intended to reflect the PSI bonds and doesn’t respond to debt that pre-dates the restructuring,” said Soren Willemann, a credit derivatives analyst at Barclays.

“Non-payment to the IMF won’t trigger CDS because the money was borrowed before February 2012. Whether a missed payment to the ECB will trigger CDS depends on how you view the cut-off date and whether it applies to when the money was borrowed or when the bond was physically created.”

Bonds held by the ECB reflect legacy debt instruments that were picked up via the SMP. They were, however, exchanged into new instruments with new ISINs after the cut-off.

“We lean quite strongly to the interpretation that non-payment on those bonds would trigger CDS. Ultimately, if Greece doesn’t pay the ECB, it’s unlikely that they would pay others anyway,” said Willemann.

Missed T-Bill payments due on July 10 would also trigger CDS, but those are expected to be rolled. The €88m Samurai coupon payment, due July 14, represents legacy debt and would not trigger CDS.

If a failure-to-pay credit event is determined, it would lead to two separate auctions that could deliver different recovery outcomes. New CDS definitions introduced in 2014 permit a broader range of assets for delivery into an auction, including bonds, loans and GDP warrants. Holders of contracts under the old rules must deliver specific reference obligations (See “New-look CDS faces potential Greek test”, IFR 2068 p4).

Notional outstanding is believed to be evenly split between the two contracts, leading to potential arbitrage opportunities as the 2014 contract is expected to deliver higher recovery.

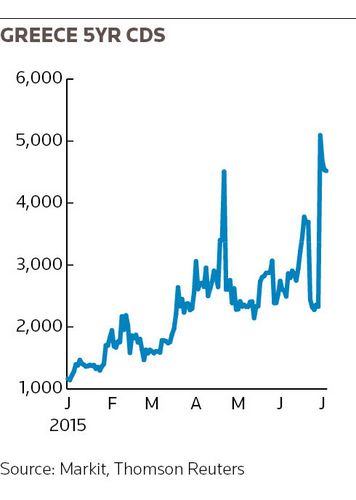

Trading in Greek sovereign CDS has been very light, primarily as a result of the EU’s short-selling ban that prevents naked sovereign CDS exposures. Last week, Bloomberg stopped quoting the instruments on its trading platform in response to client feedback after capital controls were introduced across the banking system.

Five-year protection spiked to over 5,000bp last week, with the contracts trading at 57% upfront, meaning that it costs US$5.7m to insure US$10m of debt. The contracts signal an 87.6% default probability according to Markit data.