Greece is hoping to lure back some of the €120bn that nervous depositors have pulled out of their bank accounts over the past few years through the creation of so-called “new money” accounts that will not be subject to capital controls.

By exempting new deposits from capital controls, which restrict withdrawals to just €60 a day, authorities hope to entice back some of the cash that was parked under mattresses, locked in safes or sent abroad as tension built between Greece and its creditors last year.

Bankers in the country see the accounts as an important next step in the full removal of capital controls and the normalisation of funding for Greek banks, which have spent the past year dependent on emergency assistance from the ECB in order to remain operational.

“You need several steps to reduce capital controls,” George Poulopoulos, acting CEO of Piraeus Bank, told IFR. “A first step is that we need to incentivise people to bring back their money, and we are discussing the idea of ‘new money’ accounts that can have withdrawals at any time, that aren’t subject to controls.”

Withdrawals

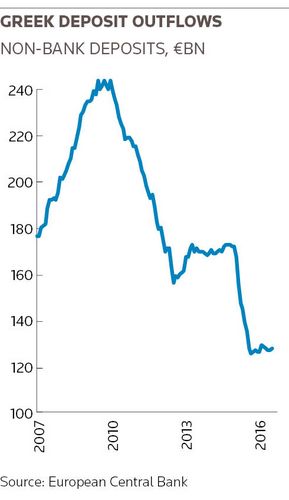

Greek banks have seen customers withdraw €120bn – about half of all deposits – from their accounts over the past six years.

That has partly been due to Greeks running down their savings because of rising unemployment, falling income and higher taxes. But fears over the health of the banks and worries about leaving the euro have also fuelled the withdrawals.

“We need to incentivise people to bring back their money, and we are discussing the idea of ‘new money’ accounts that aren’t subject to controls”

In the seven months in the run-up to capital controls being imposed last June, €45bn left the system.

The “new money” accounts are unlikely to offer high interest rates, however. Unlike back in 2011, when Greek banks offered interest as high as 5% to attract deposits, banks now have access to ample and cheap liquidity from the ECB.

Greek bankers say there is little appetite among banks for a deposit war. Instead, they hope potential customers will see the benefit of depositing their cash rather than keeping it at home, where it runs the risk of being stolen or even lost.

“This money is under the mattresses of many Greeks, and hopefully this slight easing of capital controls will lead to inflows for us,” said the chief financial officer at another Greek bank. “It is very dangerous to keep the money at home.”

If successful, the “new money” accounts could help Greek banks further reduce their funding costs, helping boost profits – and so generate fresh capital to make new loans and enable them to further write down the bad loans sitting on their books.

Positive delta

Last month, the ECB helped Greek banks further reduce their funding costs by lifting a ban on the use of Greek government collateral in its normal liquidity operations. The move is expected to lower funding costs by around €60m a year.

“There is a direct financial impact of the move,” said a board member at a third Greek bank. “It’s not make or break, it’s not a game changer, but it is significant positive delta.”

The country’s banks still have some way to go towards funding themselves normally, however. They are still heavily reliant on central bank funding, with outstanding borrowing at around €100bn – equivalent to around a third of their total funding needs.

Other, traditional sources of funding are returning – albeit slowly. Greek banks lost access to private repo markets in early 2015, but have begun to tap that market again in recent months, primarily using securities that are not eligible at the ECB.

For Piraeus, for example, while usage of private repos is half what it was in 2014, it now provides €4bn of funding. Smaller rival Eurobank Ergasias is an even bigger user of the market, tapping €5bn.

“It has taken some time to win back the confidence of the repo providers – not that long ago, no credit committee wanted to deal with Greek banks,” said Poulopoulos. “But confidence has started to improve, and we are gradually regaining access to the market.”

Return to market

It may be some time before the one final missing funding component – the bond market – returns, however. After years of being shut out, a window opened briefly for Greek banks in 2014, prompting issues from all the main lenders.

But last year’s re-escalation of the crisis has once again shut bond markets. Investors have been left wary as recapitalisation exercises last November led to significant losses for bondholders. After a series of exchanges, those holding the bonds issued in 2014 were paid back only a fraction of what they invested, while others have been given equity in the banks.

“Markets have short memories, but it’s going to be late 2017 at the earliest before we see banks back in the market,” said the board member. “First we need to see the sovereign rebuild its yield curve, then the banks can build on that.”