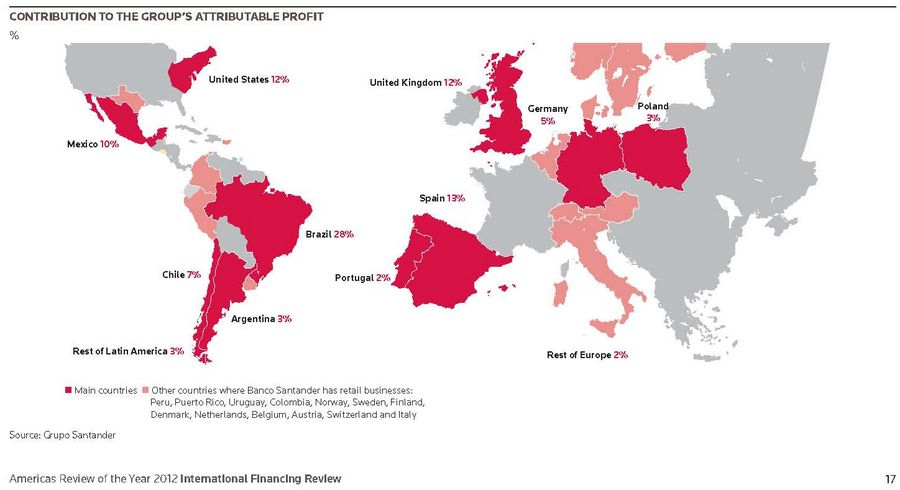

The woes of Spain have taken their toll on the country’s banks, not least because of all that exposure to bad loans. Their subsidiaries in Latin America, though, have been coming to the rescue, helping to shore up their capital positions.

To see the full digital edition of the IFR Americas Review of the Year, please click here.

The Latin American subsidiaries of Spanish banks have been extremely active in the region’s equity and debt capital markets this year, and that is likely to continue in 2013.

With their parent banks suffering from exposure to so many non-performing loans amid the crisis in Spain, their subsidiaries are playing an important role in shoring up their parents’ profits and capital positions. Indeed, the Spanish institutions look set to become increasingly reliant on their Latin American units.

“Broadly speaking, parent banks have had an ongoing policy of ensuring that their Latin American subsidiaries are self-sufficient, in terms of the capital they need to grow and the liquidity they need to perform on a daily basis,” said Monica Hanson, head of Latin America global finance at Barclays.

“The focus has been on ensuring the individual subsidiaries have very good access to local and international markets in their own name.”

Santander in Mexico took full advantage of that access at the end of September with a US$4.1bn dual-listed IPO – both the biggest public offering in Mexican history and the second-largest IPO in the United States in 2012 after Facebook.

“Broadly speaking, parent banks have had an ongoing policy of ensuring that their Latin American subsidiaries are self-sufficient, in terms of the capital they need to grow and the liquidity they need to perform on a daily basis”

In total, the Spanish parent sold 25% of its holdings in its Mexican subsidiary, valuing Santander in Mexico at US$16.5bn.

Opening the doors

The listing also provided a huge boost for Mexico’s main stock market, the Bolsa Mexicana de Valores. The BMV had previously been seen as a somewhat illiquid market, with Banorte being the only financial listed.

But the Santander IPO may have opened the doors for other financial services companies in Mexico to follow suit with their own listings. In mid-October, Credito Real, the Mexican consumer finance company, sold 29.9% of its share capital in a dual listing in Mexico City and New York that raised around US$200m.

“The Santander Mexico IPO was a very important one, as very few companies are listed on the Mexican stock market,” said David Olivares Villagomez, a senior credit officer in the financial institutions group at Moody’s based in Mexico City. “I think the IPO’s success will encourage other financial institutions in the country to consider going public. They see the public equity markets as a way of expanding their funding base and supporting their expansion plans.”

Alejandro Garcia, senior banking analyst at Fitch Ratings, said: “The IPO was absolutely good news for the Mexican stock market. It’s a big boost to the exchange, and I think many more companies will now seriously consider going public.”

Following the success of the Santander IPO, there were rumours that BBVA Bancomer – Mexico’s biggest bank, and the subsidiary of another Spanish bank, Banco Bilbao Vizcaya Argentaria – would follow suit, though it has since ruled out a public offering.

But Bancomer has been active nevertheless, raising US$1.54bn in international and domestic markets for the year to November 5 and US$2.03bn in 2011, according to Thomson Reuters data.

According to Fitch, Bancomer is a highly profitable asset that contributes more than 30% to the group’s overall earnings. BBVA group posted €9bn in operating income at the end of the third quarter, with gross income up by 13.6% to €17.1bn. During the third quarter, net profits in Mexico rose 12% to €435m.

“BBVA Bancomer is very important to the Spanish parent,” said Fitch’s Garcia. “The group wants to retain full ownership, as it’s aware that the Mexican economy is growing strongly and that the country has one of the lowest intermediation levels in Latin America. Credit is expanding at double-digit rates.”

Bancomer is one of the most diversified banks in the country, providing loans to the national government as well as being a vigorous player in Mexico’s fast-growing mortgage, consumer credit and corporate lending markets. The bank requires recurrent long-term funding and is an active player in the debt capital markets, as part of its asset liability management strategy.

“BBVA’s strategy varies from Santander’s in that it wants to hold 100% of its subsidiaries – it has not needed to raise capital and so is holding onto its Mexican franchise,” said Jeff Rosichan, head of Latin American equity capital markets at Deutsche Bank.

“At a group level, Santander and BBVA have good capitalisation levels now, so from this angle there is no pressure on them to tap the markets”

“Both banks had the opportunity to be the first one to realise an IPO in Mexico, as the country was badly in need of another publicly listed bank. Being first comes with tremendous advantages. BBVA had no interest but Santander saw all the advantages of being first.”

No pressure to tap

In fact, Santander has been especially active over the past few years.

In October 2009, Santander in Brazil also realised an IPO, selling a 16% stake in the bank and raising a total of US$8bn, the biggest public offering in Brazil and the US that year.

Santander’s Argentine affiliate applied to the SEC last year for an IPO, although the Spanish parent put the listing on hold due to uncertainty in Argentina.

And last December, Santander sold a 7.8% stake in its Chilean subsidiary, Banco Santander-Chile, the Andean nation’s largest bank by assets, deposits and shareholder equity. It raised US$950m while retaining a 67% stake in the unit.

From an equity markets point of view, financial institutions’ multiples have been going down in Brazil and going up in Mexico, where they are at historically high levels”

“At a group level, Santander and BBVA have good capitalisation levels now, so from this angle there is no pressure on them to tap the markets,” said Vicente Nogueira, head of Latin America financial institution coverage at Barclays.

“However, from an equity markets point of view, financial institutions’ multiples have been going down in Brazil and going up in Mexico, where they are at historically high levels. The Santander IPO shows there is a lot of investor demand to be fulfilled in Mexico.”

Banco Santander in Chile recently made its debut in the offshore renminbi bond market, proving a rare opportunity for Dim Sum bond investors to buy Latin American credit. The bank completed a series of meetings with fixed-income investors in Singapore and Hong Kong at the start of October, resulting in a Rmb500m (US$80m) two-year deal priced at 3.75% in November.

Also in November Santander Mexico placed a new 10-year 144a/Reg S US dollar senior unsecured benchmark bond, raising US$1bn. The deal, which was more than four times subscribed, priced at 260bp over US Treasuries.