The shipping industry may be one of the biggest threats to German banks due to rising NPLS and shipping firms failing to pay their loans and debts.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.

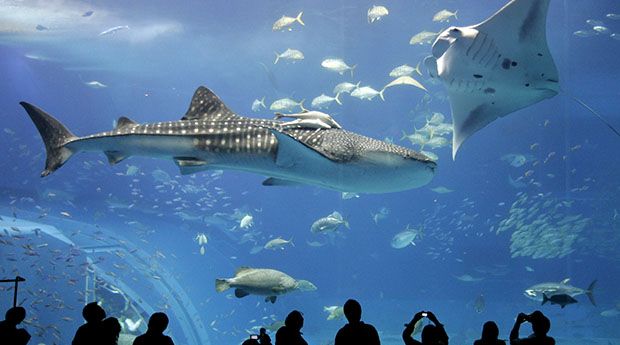

Like Ratty and Mole in The Wind in the Willows, Germany has always liked messing around on the water. Its modern economic incarnation may be as a large and worthy Central European industrial machine, but its heart once throbbed to the ebb and flow of the Baltic Sea and the open waves. For four centuries from the late Middle Ages, the city of Luebeck lay at the centre of the Hanseatic League, a commercial federation of guilds that supervised trade on Northern Europe’s high seas. Even today, many Germans still go a bit wistful when the salty ocean hoves into view.

Alas, the country’s banks have been messing around a little too much with the global shipping industry over the past decade – to their detriment. From mighty names such as Deutsche Bank and Commerzbank down to tinier regional lenders, many of Germany’s banks are in a rum old state.

A report issued by Moody’s in December found that “prolonged weakness” in the global shipping industry since 2008 had “raised credit risks for German banks”, which rank among the world’s largest shipping lenders. Nearly six years after the financial crisis, shipping firms are struggling to service debts to German lenders, pushing up non-performing loans across the industry.

Nor is this problem set to be solved any time soon. German banks controlled around one-third of the US$475bn global ship-finance market at the end of 2012. According to Swen Metzler, an analyst at Moody’s in Frankfurt, total shipping-related NPLs reported by German banks rose by 30% in 2012, to €21bn. Last year’s data are not in yet, but Metzler said there was a “high likelihood” that the quantity of soured loans rose further in 2013.

Herein lies one of the industry’s most pressing problems. The shipping industry is one that enjoys precipitous highs – the industry expanded exponentially for nearly a decade from the late 1990s, benefiting from the rise of China as a great maritime trading nation. But the lows are also concomitantly long. The container industry sank into recession in 2008, when the global financial crisis triggered a slump in global trade, remaining there ever since.

In May, Germany’s largest shipping firm, Hapag-Lloyd, posted a net first-quarter 2014 loss of €120m, up from €94m in the same period a year ago, due to low freight rates and a weak dollar, despite a rise in transport volumes and the return to health of Europe’s largest economy.

Rocky shores

Germany’s banks, which have an intimate and longstanding attachment to the shipping sector, now find themselves in a tricky situation. Do they stick with an industry struggling to extricate itself from its longest recession in 70 years, fold and cash in their chips, or twist, increasing their exposure to an industry that should, in due course, emerge again into profit?

Some have already chosen the middle option. In December 2013, Commerzbank sold a portfolio of shipping loans to US-based distressed debt specialist Oaktree Capital Management for €280m. In February 2013, the Frankfurt-based lender said it had achieved its goal of paring its total loan exposure to the shipping sector to €14bn, three years ahead of schedule.

Others face a more odious dilemma. Moody’s flags up eight lenders with “sizeable shipping exposure relative to their capital positions”, including five – DVB Bank, HSH Nordbank, KfW IPEX-Bank, Nord/LB, and Nord/LB subsidiary Bremer Landesbank – which are, the ratings firm said, “most exposed to persistent stress” in the sector. At end-2012, Moody’s said, the eight banks had a total of €105bn of shipping loans in their combined portfolio, comprising 137% of total Tier 1 capital. Soured loans, Moody’s said, had risen to 21% of all shipping-related lending at the eight banks by end-2012, up from 14% the previous year.

The antiquated nature of this data surprises anyone not involved either in the shipping sector or in the maritime division of leading banks. Commerzbank is one of the few German banks in recent years regularly to have posted updates on levels of both NPLs and loan-loss provisions. The shipping sector, analysts and bankers said, remained almost wilfully ignorant of the glaring need to provide investors and regulators with existing, future, and potential loan losses related to an industry still struggling for profit and direction.

After issuing its December 2013 report on the sector, said Moody’s Metzler, “we noticed that banks improved their disclosure levels somewhat. Beforehand, only Commerzbank issued their shipping industry-related NPLs. Since then, one or two other banks have started to do it as well. So there is some improvement in transparency but disclosure in this sector is still a little opaque.”

Neither HSH Nordbank, the world’s leading maritime lender, nor Nord/LB, Germany’s third-largest shipping lender, report separate restructured loans in their financial reports.

Some of the lenders on the Moody’s list face a tough year ahead as they seek to raise capital and fend off intrusive questions from federal European regulators. HSH Nordbank warned in February that it might need a capital injection of up to €1.3bn in state aid between 2019 and 2025 to write off shipping-related losses. The Hamburg-based lender, which was bailed out by the state in 2009, reported €9bn of bad shipping sector-related debt in its fourth-quarter 2013 earnings, or around 43% of its entire lending to the sector.

Banks then find themselves at a fork in the road. Do they absorb losses, as Commerzbank did, by stripping out and selling soured assets? Or do they wait out the shipping recession in the hope that borrowers will repay old debts in the up-cycle?

Both options are, in their own way, unappetising. “Some of these banks are fairly small and undiversified,” said a Frankfurt-based banker. “They don’t want to increase their losses, and that is what will happen if they bite the bullet” and sell tranches of soured loans to distressed-debt specialists.

Yet the need to provision against shipping loans “continues to remain high”, said Moody’s Metzler. “It’s our understanding that banks previously had expected the cycle to turn [for the better] earlier, meaning they would benefit from lower loan-loss provisions in 2014 and 2015. But because of the severity of [the recession in the shipping industry] these expectations were dashed.”

Analysts believe the eight lenders on Moody’s list will need to report higher loan-loss provisions than originally expected both this year and next, heaping further pressure on their bottom line.

Other options exist for lenders determined to wait out what they hope are the final days of a desperately long industry recession, without selling loans at a knock-down rate. One possibility, being actively pursued by several banks is ship pooling, wherein profits made on repayments from one batch of shipping loans cover rising provisions on poorer loan tranches.

The other main challenge for Germany’s shipping banks is the European Central Bank’s Asset Quality Review. (See p xx.) This could cause considerable discomfort both for politicians in Berlin and for Germany’s shipping banks, as the European Central Bank gears up to become Europe’s federal banking regulator in November.

As yet, no one knows how the ECB will value collateral on €52bn worth of shipping related loans at just three lenders – Commerzbank, HSH, and Nord/LB. Many in the industry are concerned that the incoming regulator will ask many to raise additional Tier 1 capital to cover future losses.

Lars Heymann, a Hamburg-based partner at auditor PKF Fasselt Schlage, whose clients included shipping companies, said the need to boost capital was one of the most pressing concerns facing Germany’s shipping banks.

“Certainly in terms of the ECB’s upcoming asset quality review, it’s the one industry that, in terms of its asset exposure, is under particular focus in Germany. We regard its shipping industry exposure as one that will continue to dog several German banks for some time to come,” said Moody’s Metzler.

Most expect the ECB to come down hard on Germany’s shipping banks; any other outcome could lead to accusations of favouritism being levelled against the Frankfurt-based institution. Yet it remains unclear if smaller lenders will be able to issue fresh capital to meet higher provisioning levels: many regional German Landesbanken are controlled by complex public ownership structures, making it hard for them to issue equity capital.

The question then is – what next? Will German banks, for so long so enamoured of the shipping industry, return to an industry that has caused so much pain for so long? Or will they try and forget their infatuation with the deep blue sea, and learn to love messing around on dry land instead? Only time will tell.