Divyang Shah, Senior IFR Strategist

The S&P500 closed yesterday a fraction higher than when it opened on June 19 the final day of the last FOMC.

The price action highlights that the market in general has:

1) progressively become more comfortable with Fed tapering QE, and

2) the higher bond yields are not considered a real threat to the wider economy.

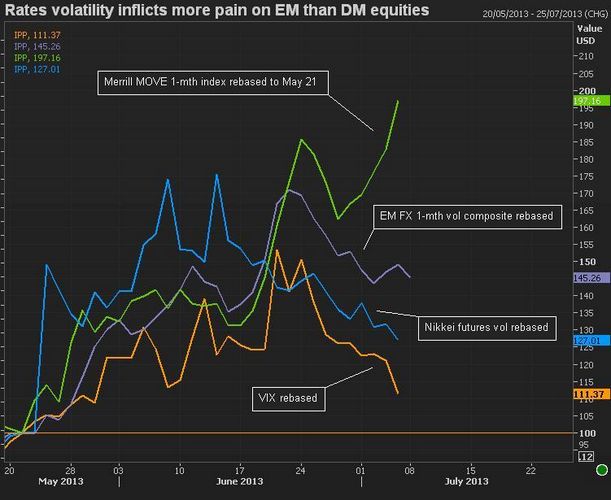

We had chosen to highlight the above recently by looking at the divergence in volatility that had opened up between bond market volatility and the volatility on other risk assets such as EM FX, Nikkei and VIX (see chart).

The fact that the bond markets are still not comfortable can be interpreted as a movement toward normalisation.

This is where the market has to adjust both in terms of price (yield) as well as trading pattern (volatility) to an environment where the Fed will not be a big buyer of Treasuries.

The movement in stocks and volatility will comfort the Fed as it looks to stay on the path toward a likely tapering of QE in September.

The data dependent aspect of tapering is that we will need very weak data for the Fed not to taper in September. This will be clear in the minutes of the June FOMC meeting (18.00GMT) that are released today and possibility backed up by Bernanke who speaks today (20.10GMT).

The gap between Bernanke and the minutes allows the Chairman to correct or even cement the Fed’s message that they are on track to taper QE.