Divyang Shah, Senior IFR Strategist

Despite plenty of Fed speakers since the June FOMC meeting the market has persisted in viewing an earlier rate hike profile. The Fed will be cognisant that any attempts to try and deviate from the script could sow the seeds of confusion on the timing of QE tapering.

The Fed as well as other major central banks have been keen to highlight how financial markets have misinterpreted the FOMC. This led the BoE and ECB to deliver radical shifts in communication in the hope that their own forward guidance will help to divorce what is happening with Fed expectations from impacting BoE and ECB rate expectations.

The Fed’s own hard version of forward guidance, with its numerical thresholds, has done little to stop markets from pricing in an early end to conventional policy once the unconventional policy easing comes to an end.

The unease from within the Fed on the bond markets is likely to have eased a little despite the fact that 10-year yields touched 2.75% after the release of June payrolls.

While yields have moved higher the equity market has on the other hand managed to recover much of the post-FOMC meeting losses so it’s worth not overemphasising the movement in the bond markets. Bond markets would have to become more volatile and destabilising for the Fed to want to tinker with its message.

Rather than misinterpreting the Fed, the bond markets are simply finding their own new equilibrium as they price in the impact of lower purchases.

This week we get a chance to hear from Chairman Bernanke as he speaks on 16.10EDT/20.10GMT Wednesday at a NBER conference where an audience Q&A is expected. The title of Bernanke’s speech is “A Century of U.S. Central Banking: Goals, Frameworks Accountability” so it could be that he will choose to keep quiet on current monetary policy.

The next big focus will be on Bernanke when he delivers the semi-annual testimony next week to Congress on July 17/18.

Volatility divergences: QE tapering may be OK

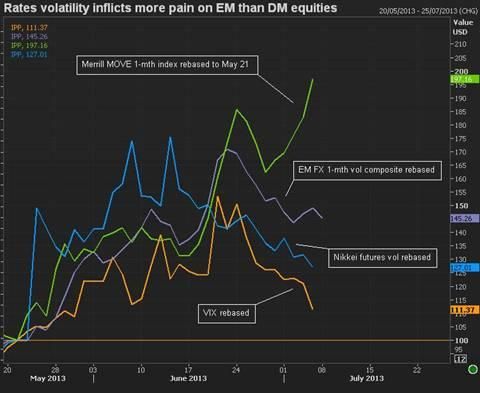

A significant divergence between bond volatility and volatility in EM FX and major equity markets is an important sign that asset markets are better able to handle Fed QE tapering than many think. This divergence is visible over the period just before the Nikkei embarked on its sharp one-day slide in May and encapsulates the June FOMC meeting.

The pick-up in volatility on Treasuries is understandable given the extent to which the financial crisis and then QE created one-way traffic into bonds, as well as the low volatility that was fostered by QE. The pick-up in volatility on a shorter time frame looks impressive but a longer term chart shows that this is about a return to normality for bonds.

The bond markets are simply finding their own new equilibrium as they price in the impact of lower and then zero Fed purchases. The divergence in volatility - especially between bonds and the VIX - confirms what we have seen with yields and equity prices and should comfort the Fed that they can continue with their tapering plan. But this also suggests that risk markets were not as addicted to global liquidity as had been feared.

The central banks of DM are putting up their defences (forward guidance) while EM assets that are suffering the most have:

1) c/a deficits or relied on hot money flows, and

2) more prone to the risks of a China hard landing where growth could slip below 7.5%.

Blaming Fed QE seems a simplistic default option in the current market.