Keith Mullin, KM Capital Markets: If I could just extend that point, we touched on it earlier, but what about brown issuers? They need to be incentivised to issue in this market as well. From a pure climate change mitigation perspective, having a big oil company do something which “greens” its activities, even if it’s a small percentage, is potentially more important from a planetary perspective than it is for a pure-play company to do a Green bond, where carbon emission mitigation is reduced. This is one of those knotty questions that the market needs to grapple with.

Stuart Kinnersley, Affirmative Investment Management: It is knotty. Because of COP21, we talk about targets for 2030/2050, but actually, we know that action has to happen now and it’s not about tweaking at the margins. If fossil fuel companies are committed to changing their business model and moving to low-carbon transition, we will support them. But if it’s just doing a PR exercise at the margin, we’re not really interested. Actually, it’s really dangerous for that to happen because this market will not be the driver of change that we need it to be. Having pretenders join the ride at this stage will create diversions and slow down progress.

Keith Mullin, KM Capital Markets: But there’s also the question of how quickly that happens. There are people out there who will say: ‘we can just shut down coal tomorrow’. It’s a reasonable thing to say but it’s not necessarily a realistic or practical thing to say.

Ines Faden, Tideway: Coal is, actually. It is realistic to shut coal; gas and others, not so much.

Stuart Kinnersley, Affirmative Investment Management: No, but I think it’s the ambition to change. You’re right, we have to be realistic. But when a lot of fossil fuel companies are still budgeting to pump trillions of dollars into exploration and research to find new fields on the basis that carbon-capture technology will allow those emissions to be mitigated, there needs to be much more ambition to change.

Darko Hajdukovic, London Stock Exchange: Going back to what Ines said, that companies have to run their own business, this is something that has to become business-as-usual for them. I always get asked by issuers: ‘What’s in it for me? Climate change, conscience - all fine - but if I’m going to convince my board, I need to give them something extra. Am I going to get better pricing?’.

Until last year, we were saying it’s just good to be issuing and there is an element that the perception of the company changes. But, actually, last year, there were three pieces of detailed research that looked at pricing. They found that certain issuers of Green bonds achieve better pricing. What I found fascinating, though, was that one of the studies found that the issuers who issue Green bonds achieve better returns on their equity by 1.7% over a 20-day period after they’ve listed their bonds. That is pretty material. It’s not just about climate change mitigation, but also it makes good business sense to do it.

Keith Mullin, KM Capital Markets: Clare, just on that specific point, in your Sustainability-Linked Principles, there are incentives for issuers if they meet certain sustainability targets. There’s a material pricing benefit to them over the course of that facility that we haven’t seen in the bond markets at this point. I’m curious to understand what impact you think that’s going to have?

Clare Dawson, LMA: There are two aspects that borrowers look at. One is the wider picture: you’ve got borrowers who are committed, generally, to improving their own performance. Clearly, if they are going to get pricing incentives, that’s going to be very attractive. It’s certainly something that can act as a motivating factor for companies to undertake some extra work they might have to do in order to meet the requirements, from filing reporting requirements and the evaluation process and potentially getting external review. I think it certainly broadens the market.

The loan market tends to be pretty tightly priced. How much potential there is for that to go completely across the board remains to be seen. But I think it’s something that is a motivator in addition to the broader sense of borrowers just feeling that they ought to do this, or stakeholder engagement or the other, if you like, slightly softer incentives. This is clearly a very key, hard incentive.

Keith Mullin, KM Capital Markets: Is the prospect of getting better pricing enticing?

Ines Faden, Tideway: Pricing is a language people understand very well. A number of companies are well advanced in understanding the need for transition and are very committed to being green. A lot of others are not there yet and talking pricing is a much simpler language. But in the bond market it’s a little bit more difficult. I think there’s some evidence [of better pricing] but it’s complicated. It’s the same cashflows, so are you achieving better pricing because of scarcity or because people are putting a premium on it? If we’re looking five years down the road and all the reporting is there, we won’t have to do additional due diligence, but I think there’s growing evidence on pricing, which is interesting.

Stuart Kinnersley, Affirmative Investment Management: I think it’s pretty marginal. The World Bank, and possibly EIB when they were first issuing, were hoping that they would get a pricing advantage. I don’t think it’s materialised, at most a few basis points here and there. From an investor’s perspective, we’re very much operating on the basis that we’re going to generate mainstream return and not compromise return. We’d look at the yield curve, and there are plenty of issuers that have issued across the yield curve and their Green bonds are not massively priced differently from the rest of the curve.

I think issuers have other advantages. They’re diversifying their investor base and it’s a more stable one. If an issuer is hoping to get a pricing advantage, that’s probably not a good enough reason, given the extra work involved with it. From an investor’s perspective, in the long term, we would argue that it’s risk mitigation, that we’ve got a lot more information coming from the company and, over time, that will help improve risk-adjusted returns. There’s nothing empirical to back that up quite yet, but common sense suggests that would be the case.

Dominika Rosolowska, EIB: I agree with what Ines said, that the risk of the issuer is the same whatever type of bond – Green or not – has been issued. It is therefore difficult to expect a priori different pricing in the primary market. You might see some secondary outperformance of Green bonds. Explaining this might not be so straightforward though – rarity value might play a role by itself as the amount of Green bonds that an issuer can issue is naturally capped by the amount of eligible activities, which tends to be smaller than the whole funding programme of an issuer.

Then again, there are some studies that have shown a pricing differential for some issuers. One of the investment banks conducted a study correlating the performance in the secondary market versus the quality of the reporting provided by the issuer. This shows a correlation between the quality of the impact reporting – including the credibility of the external review – and outperformance in the secondary market.

Some issuers – we can observe this in euros, where our conventional and green curves are well established – can use this secondary market outperformance as an effective reference for primary pricing. So maybe there are marginal price differentials that an issuer can lock in, but yet without consistent patterns over time and across issuers.

Monica Filkova, Climate Bonds Initiative: There is a growing market interest in exploring Green bonds and pricing. The sort of topics they’re trying to explore are: if you have a Green bond programme, does it impact your share performance? There have been a number of studies that have looked at this but also if you have an external review or certification into the Climate Bond Standard, does it impact how your bond prices?

We’ve been doing research on the Green bond market and pricing in the primary market for a few years now. Every now and then, there are bonds that price inside the yield curve. But the evidence is mixed. One of the reasons is that there is still a fairly limited number of bonds that are priced in liquid currencies so you can actually observe and compare, and where there is enough issuance from the issuer to create a yield curve in the first place.

One thing we have noticed with respect to EIB’s vanilla and Green bond curve is that the green curve sits inside the normal curve. That would indicate on a very generic basis – and yes there are different events that might impact the pricing of individual bonds and how they perform – that investors are perhaps placing value in the greenness of the bond.

But the EIB is the only institution where we’ve been able to build a green yield curve since they’re the only one that has issued enough bonds in sufficiently big sizes, so in this case the evidence is not anecdotal.

One of the other aspects that is quite interesting is people trying to connect the level of information provided on a bond to how it prices. At the end of the day, that’s probably the more important thing. You need historical evidence. The Green bond market has been around since 2007 but in terms of meaningful issuance volumes, it’s just five years old.

As the market grows and we’ve got more historical evidence, we will be able to figure out how a bond performed relative to the rest of the market over a period of time.

Cristina Lacaci, Morgan Stanley: I think it’s very difficult to quantify the “greenium”. We try to analyse this for each transaction, but it’s always difficult to quantify. That said, it’s true that when you execute a Green bond, it usually attracts more investors because you have the mainstream investors but also sustainable and green investors. As a result, you have more momentum, which means that the dynamics tend to be better.

At the end of the day, this translates into a few basis points. Of course, you need to take into account that the credit risk of the bonds is the same. As such, the difference is not going to be massive but you will likely see a difference due to the positive technicals. From an issuer perspective, no-one will do this just for the price. It’s about the commitment to sustainability; it’s about showing their direction of travel rather than just the technicals that you can achieve on a specific day.

Audience question: I feel that investor engagement is still not as strong as it could be. Is this where a real paradigm shift needs to happen?

Stuart Kinnersley, Affirmative Investment Management: In terms of our own engagement, it’s pre-issuance a lot of the time ie, before an issuer comes to market. They will be asking our opinion and guidance on how to structure things, how to report things. When the issue comes to market, they will often have taken that into account. And then post-issuance in terms of disclosures and reporting. One of the big positives for the Green bond market that is often overlooked – and it has been mentioned here—is when companies go through this process of pre-issuance engagement, they start to look at their own internal processes and change the way they do things. That’s something we’re quite supportive of.

They’re not just issuing the Green bond but they’re consistent in terms of some of the things they’re looking at. We’ve found some issuers went back and changed their corporate social responsibility policies and looked at greening throughout the company, as a result of going through the process of issuing a Green bond. I think that engagement at all levels is essential.

Audience question: How does the Green loan market break down by industry? And as for green investment in the manufacturing industry, what does the future look like?

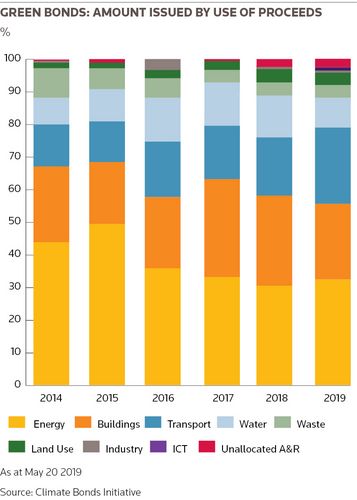

Clare Dawson, LMA: The Green loan market is beginning to show the same sort of diversification in terms of the borrowers, and the industries that they represent as the Green bond market. It started very heavily in energy and utilities but you’re definitely seeing a much wider range of company in the Green loan market now. If you move beyond purely green to sustainability-linked finance, there are lots of ways that manufacturing companies can tackle various impacts that they have; as you’ve mentioned, plastics, recycling, sourcing materials, water usage. There are lots of ways that I think manufacturing companies and their lenders can set meaningful targets.

Audience question: Looking at FIs trying to get sustainability financing, do you find it’s often that they will look back at their assets and think: ‘Actually, we’ve got enough here for a bond anyway’? Or do you find that they’re going out and originating new assets? How much are banks actually changing their systems and going out and generating new sustainable financing?

Cristina Lacaci, Morgan Stanley: I think it depends a lot on the issuer. When you start to look at issuing a Green bond, you look at the loans you are extending, your internal processes, your sustainability strategy and whether you should set specific targets for new products.

It’s not only about what you already have in your lending portfolio at that stage, it’s also about your strategy going forward. When meeting investors, they will ask you about it and will expect you to have a strategy.

Keith Mullin, KM Capital Markets: Ladies and gentlemen, we have to draw to a close there. Thank-you for your comments.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com