IFR: Raman, ratings have come up in a couple of answers so far. We’ve talked about the strong economy. How does that square against the credit quality of Indian corporates from a rating perspective?

Raman Uberoi, CRISIL: Well credit quality for corporate India over the last three years has adapted pretty well. In the 2008-2009 period, rating downgrades outstripped upgrades, which put huge pressure on credit quality. There were three broad reasons for this. One, clearly, was the drying up of money. Whether it was foreign debt or equity capital, it just wasn’t available. There was money available on the domestic side, but primarily in the banks and to some extent in the bond market, but availability of money and pricing of money became a little difficult. So corporates started feeling the pressure.

Secondly, demand just dried up. Going back to what Rakesh mentioned earlier, export-oriented businesses saw a huge dip in demand. The third area was the currency. All three factors played pretty heavily during the period of 2008 through 2009 and rating changes were typically in one direction: down. We actually started seeing defaults whereas none of our rated entities had defaulted over the previous four-year period.

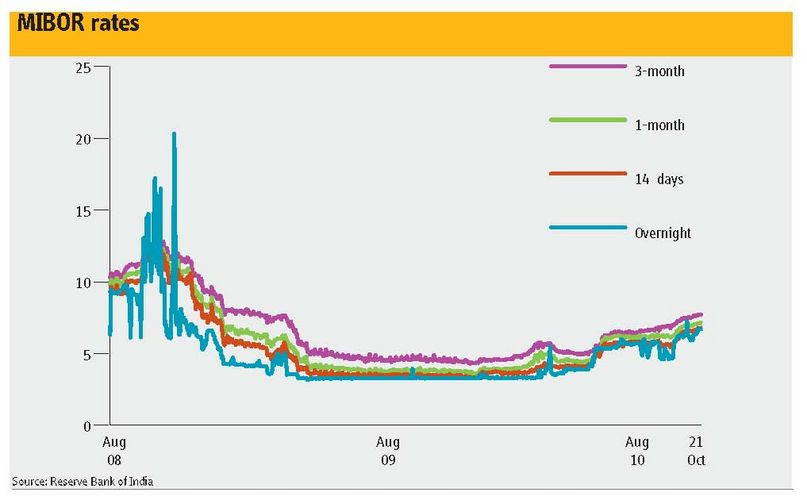

What’s been pleasant is that things have changed very quickly. I think it’s even surprised us. We had not anticipated demand coming back so strongly. Domestic demand and domestic-related sectors have really started doing well. The auto sector is just one example. It really was very, very surprising how the market has came back. Availability of finance also eased quite a bit, so in the equity market in India, we suddenly saw IPOs and the primary market was doing well. Debt was also available. The cost of financing came down and even international money started coming back. So demand and financing costs and availability of finance eased.

The only thing which still remains is currency volatility. We were used to a unidirectional move in the currency. but now it just goes all over the place. So I think that issue still remains. But what the demand and the availability of financing have done is improve credit quality.

In the last six months of the current year, the number of upgrades we’ve done is nearly twice the number of downgrades, which is positive. But downgrades continue; they haven’t stopped, as some sectors are still under pressure. And some companies which were stressed are still stressed. Overall, though, I think corporate credit quality is definitely far better today and we are seeing ratings move up.

Kalpesh Kikani, ICICI BANK: I have a question for Raman, not necessarily related to domestic rating agencies. In that period you mentioned where we saw sharp downgrades onshore and all over the world, do you believe that the amount of criticism that rating agencies got from pretty much everybody was why the return to conservatism was so sharp? I’ll give you an example. One of the sectors that we were most bearish on as a lender was auto ancillary. You mentioned the bounce-back there, but in terms of geographical spread we were very bearish on Europe. We happened to have a bad combination in our book: auto ancillaries in Europe whose customers were European. So we went through about three to six months of pain where BMW, Volkswagen, Mercedes-Benz pretty much stopped buying.

We were tracking the monthly order book for our clients and my guess is by about the fifth month onwards, the orders were back. Other than that five-month period where we were probably all depressed and thought we needed to write down all this stuff, pretty much nothing changed in the corporates. So do you believe the rating agencies react to sentiment more than any fundamental changes in the world?

Raman Uberoi, CRISIL: With hindsight we can come up with all these things but there was stress in the economy and there was stress for these companies - I can talk more about what happened in India than globally. At the time, a lot of Indian ancillaries were stressed. The item that resulted in rating changes was the working capital positions of some of these companies, so if you were used to getting payment in 60 days you were getting it in 120 days, 150 days.

Problems of short-term liquidity resulted in rating changes happening. That short term pressure was impacting on long term credit quality. Auto ancillary was one sector that suffered a lot of downward rating changes. That’s now moving in the opposite direction as some of the financing constraints have eased. So I think that short-term stress was there. And as I said, we never anticipated the auto sector turning around so fast. I think it just surprised everybody and that’s why the ratings are up.

IFR: Let’s move to discuss infrastructure financing. Sunandan I’d like to come to you on this. Do you think current Indian infrastructure requirements are financeable and over what period of time? Also, projects in India tend to suffer from delays and cost over-runs. Is this a problem?

Sunandan Chaudhuri, SBICAP Securities: The first thing to note is that under Twelfth [Five-Year] Plan, the infrastructure target has been doubled to US$1trn, so we are looking at an even larger potential promise. As to your question - is this achievable? - there is a funding issue and there is an implementation issue. On the implementation side, I think we need to get our act together a lot better. We talk of public/private partnerships but I think we should first look at public/public partnerships.

If you have nine ministries to whom you have to run for clearances, you’re not just getting your deal done; your project is not going to get off the ground. So I think much better co-ordination is required in areas like land reforms etc. I don’t think financing is a huge challenge, or at least as big a challenge as it’s made out to be, but what you lack on the ground is bankable projects so that both sides of the coin can meet and the developer can bring in matching equity.

So as we open the doors to foreign capital I think the domestic savings and investment gap can be successfully bridged, plus you have a very active rupee loan market. So I think financing is not that big a challenge but implementation is the key. Also as the corporate bond market becomes more vibrant, that should alleviate a lot of the perceived or otherwise stresses that go into infrastructure financing. And that is what is going to take us from an 8% economy to a 9%, a 10% economy.

Kalpesh Kikani, ICICI BANK: Financing US$400bn to US$500bn of projects is not really a challenge we worry too much about. Domestic capital and the international capital coming into it should be enough. I agree with Sunandan that the challenge on implementation on the ground continues. I think we’ve got a lot better at it. There have been some setbacks - land acquisition continues to be a sore point, for example. And fingers were pointed at people like the minister for roads, where people were saying you guys just can’t get your act together on getting roads built in India. But a lot of work has been done with specific ministries and things are improving significantly from where we were to where we are today. A lot more work on implementation will need to take place, but then there is so much to do and that’s an opportunity in itself.

Kishore Kumar, HDFC Bank: I think everybody recognises the compelling need to provide alternative sources for funding. Obviously we can’t depend on the same structures and the same sources to raise this kind of money so there has to be some changes there. But I think the government is already very positively working towards some of those changes. For example, in the road sector there have been a series of regulatory changes which have actually facilitated banks lending to that sector.

Similarly there’s a takeout financing scheme in place. We had been talking about it for such a long time but it’s finally seen the light of day and it’s helping with key issues such as tenor matching. We are also seeing a growing interest in refinancing loans taken out by infrastructure companies where the people taking the commissioning risk want to exit at a premium and the cost of borrowing comes down. We are also seeing growing interest towards securitising cash flows from some of these projects and that’s going to happen.

There is also talk about removing some of the caps on FII participation for these long-term markets, for funding of these projects. So many things are happening and private equity is coming in in a big way. There is a lot of dry powder out there waiting to be put into this so I think will all fall in place.

IFR: Nirav, one of the things that Kishore mentioned was the prospect of project bonds as well as other sources of financing. It’s an interesting channel. Will it work here in India?

Nirav Dalal, Yes Bank: I’m glad you asked me, Keith, because I actually have a slightly different view in the sense that I’d actually be very surprised if you see project funding happening through the bond route. That’s not the strength of the capital market investor. A capital market investor is primarily going to go by credit ratings, and few infrastructure projects are going to obtain the minimum rating requirement of bond investors. It is not going to happen. You can talk about credit enhancements of all kinds, but that’s not going to be very practical. So I’m equally optimistic as Kalpesh in terms of financing the infrastructure requirement, but I think expecting that to be done through the bond markets is barking up the wrong tree.

Prakash Subramanian, Standard Chartered Bank: Another challenge is the lack of equity capital. Most of the projects are done on a 90/10 or 80/20 debt-to-equity basis so from that perspective how much capital can promoters put in when projects are coming up one after the other? This is going to be a big challenge. No investor has come forward to invest in projects. Some have come in selectively but the returns they require are well in excess of 20, 25%, and promoters are not prepared to pay that. So it’s a chicken and egg situation.

Another issue is dealing with the asset-liability mismatch. While banks are financing these projects, it’s all on a floating rate basis. Now a project which is long-term cannot afford to take huge shots of volatility in the market so they technically need to look at fixed rate. The only fixed-rate investors in the market are bond investors, which are your insurance and pension funds. Other than maybe the likes of Life Insurance Corporation of India (LIC), how many bond investors have the ability to track the credit or do a fully-fledged project analysis? Most will rely on the credit rating. One of the things we need to look at is the ability to allow these guys to go down the rating chain and invest in this type of paper. So I think from that perspective there is a bit of a challenge in infrastructure.

We are also seeing a lot of foreign money flowing into in, but there are RBI restrictions on ECB for project funding. You can’t afford to have those restrictions and then say we need infrastructure funding. You have to ease some of the ECB norms and allow greater foreign participation.

Securitisation was one thing which was mentioned, but obviously RBI has its concerns on that, too. You need a mix of funding sources, where you have lenders willing to take the project commissioning risk, but then you could have foreign lenders willing to give cheap money at the early stage, for the first three to five years so it becomes competitive. Then you have local bond investors come in once it is up and running, and the rating agencies can rate the bonds. So a mix would be an ideal scenario. But for that, obviously the norms will have to be tweaked, including RBI relaxing ECB norms, or insurance companies relaxing the rating norms for insurance companies to invest. So it’s about a mix which every single lender today has to look out for.

IFR: So what about project ratings, Raman? And can you comment on sub-investment grade ratings. How are they perceived in India?

Raman Uberoi, CRISIL: We have seen some issuance in the Single A category and very few in the Triple B area, but very, very few. So in one way we are better off from where we were a year to a year-and-a-half ago when it was just a Triple A or maybe a Double A market. Speculative? I don’t think that’s going to happen for some time.

I think what will become a little critical, and this has been discussed, is having long-term money come to the infrastructure sector. If you look at the EPFO (Employees’ Provident Fund Organisation) which manages the largest pension fund money, there are only six or seven private sector companies in which they invest. The rest is just going to banks or public-sector entities that I’d say are in Double A category. So if that money starts going towards the infrastructure sector I think we will see some movement because infrastructure needs a lot of long-term money; it’s not about short-term financing.

And typically, we have seen a lot of project delays which you mentioned and which is one of the reasons why some of the large infrastructure project ratings are on the lower side. Unless you have a very strong sponsor who is there directly or indirectly to provide support, the ratings tend to be on the low side and then they just can’t access the capital markets.

IFR: Rakesh, I know you’re last to comment on infrastructure; that’s the downside of being at the end of the line. One of the things that was mentioned was an easing of the foreign investment restrictions into infrastructure. Is this likely in the short to medium term?

Rakesh Singh, Rothschild: I think any form of capital which can aid growth is welcome, particularly if it provides a differential tenor. But whether RBI relaxes foreign inflows or not, the bankability of projects is not the issue; the problems aren’t on financing side. It’s more on the operational side, the approval side, the bureaucracy, land reforms, your ability to complete projects on time. This is all very critical.

Number two, promoters are now warming up to the idea of involving private equity money in their projects. People are realising; indeed the government is realising that to attract private money into infrastructure they need to make the returns a little sweeter than usual. If you offer an IRR of 13% to 14%, the equity holder is much happier investing money. So you need to offer some kind of sweetener to investors to come into projects. The issue is not bankability; it’s implementation. Companies need to get their act together and implement projects more quickly.

IFR: Thanks. As you were last to comment on project financing, perhaps you can comment first on our next topic: M&A. India has seen a lot of activity in the telecoms sector where there are three or four deals in the market at the moment. We’ve also had the 3G auctions. Is M&A going to continue to be a good source of financing, not just in telecoms but across the economy.

Rakesh Singh, Rothschild: Clearly there is a need for more M&A financing and we will see it, but LBO financing will take some time to come back. It is still largely sponsor-driven, so if banks are happy with the sponsors, like they were on the Bharti deal they’ll queue up to fund the deal. If you move to a different sponsor altogether, you might see a different proposition.

We’ve seen mid-cap companies looking for money and that has only come from relationship banks. We’re not seeing independent banks like typical LBO banks coming in and supporting such acquisitions. So I think that will take some time to come back, given the amount of LBO debt which is still gradually unwinding in Europe through the bond market and through other markets, and where you’re seeing assets changing hands to much stronger sponsors.

I would say that until the global banks release that money and people warm to the idea of doing more LBOs, there will be questions about liquidity. It will be the largest, strongest sponsors who will be able get financed. Mid-cap companies will have an issue. We are hoping to see a fair bit of M&A activity because over the last couple of years, Indian companies have built up war chests and they are looking at acquiring interesting assets in the West.

Kalpesh Kikani, ICICI BANK: Of the three types of M&A transaction: outbound, inbound and domestic, domestic banks can only finance outbound. We cannot do inbound or domestic acquisitions and those will be very difficult to structure and finance. There is a non-bank finance market here which could finance them more expensively but the quantity of money available is very limited.

So on the issue of outbound, it’s interesting to note that if you looked at the IFR league tables three years back, you would be hard pressed to find an Indian bank in the top 10 of the Asia-Pacific loan league table. The last league table I looked at, four out of top five Asia-Pac banks were Indian banks.

The mix of lenders for outbound M&A has dramatically shifted in favour of the Indian banks. The multi-tranche structure with a mix of rupee and dollar lines is something that I am pretty excited about. On deal flow, there is a lot of interest in India in Western assets which are going begging at a good price. Sentiment is what ultimately drives our markets, and sentiment towards looking at some of these assets in the West is bullish. Financing standards are much tighter now from the banker’s perspective. Covenants are better and leverage levels are more modest. Deals will happen.

IFR: Sunandan from a general perspective, domestic consolidation would be a positive thing in terms of making some industry sectors more efficient. Certain sectors are quite fragmented. Do you see domestic M&A gathering speed?

Sunandan Chaudhuri, SBICAP Securities: Absolutely. From my vantage point I think it is essential and indispensable that Indian companies achieve scale. M&A is an obvious way to achieve that. We are talking about achieving scale in the financial services sector, we are talking about achieving scale in other parts of the economy so I think this is a very productive dialogue that we are having. Domestic lenders are potentially constrained by the existing relationships they have with their client base. Maybe one can look beyond existing relationships and try to see the merit in funding an individual M&A transaction.

Click here for Part 3 of the Roundtable.