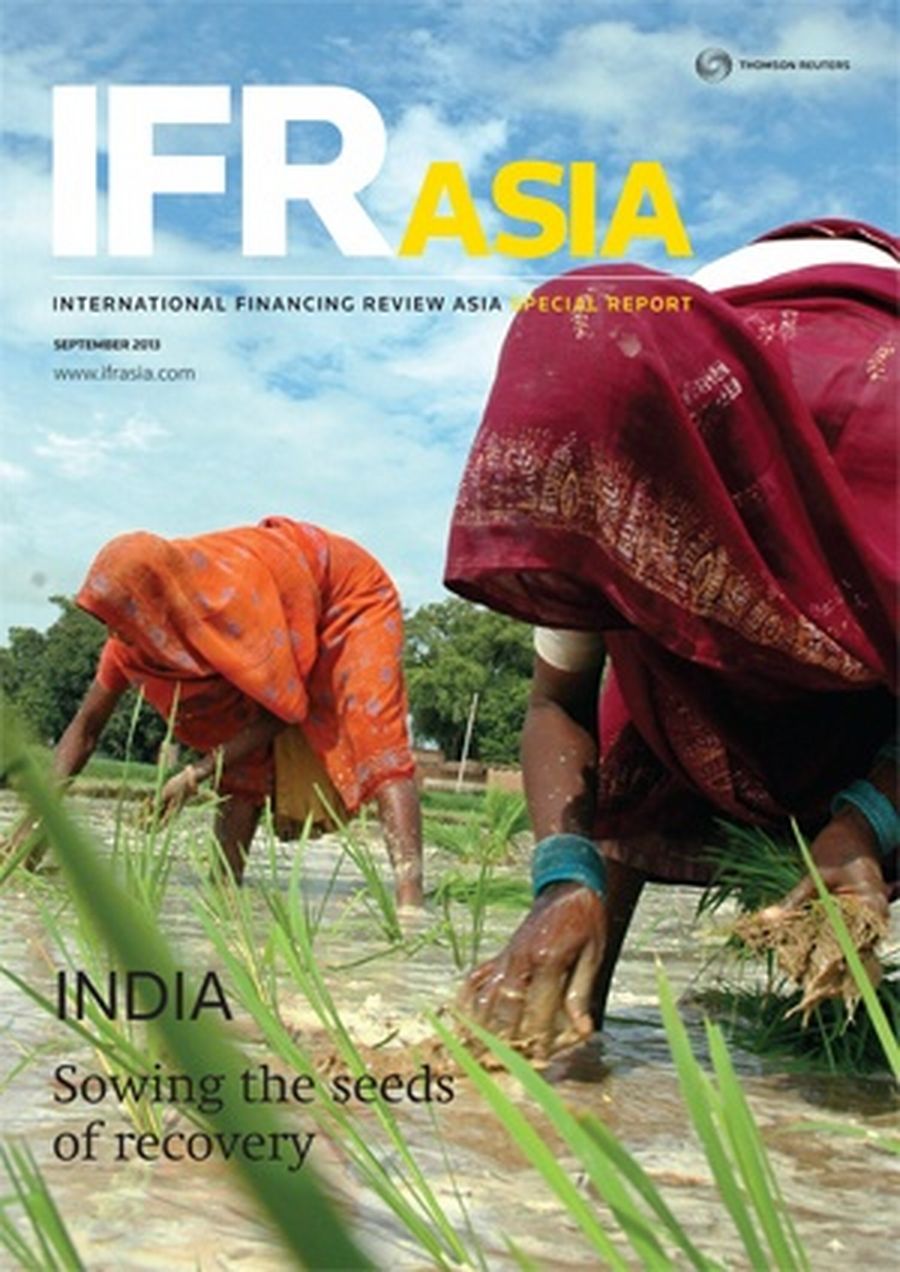

Source: Reuters/Jitendra Prakash

Indian women plant rice plants in their field in Malaka, in the northern Indian city of Allahabad.

To see the digital version of this report, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.

This year’s India report comes at an especially challenging time for the world’s second most populous nation.

The near-20% slump in the rupee is the most obvious symptom of the crisis of confidence buffeting the country, and also one that risks making things worse by eroding unhedged balance sheets and importing inflation.

Comparisons with India’s balance-of-payments crisis in the early 1990s are becoming more commonplace. The situation today is not yet as serious, but India risks falling into a full-blown fiscal crisis if it cannot reverse the outflow of investment.

From a capital-markets perspective, it’s not hard to see how India has ended up in such a precarious position.

In many respects, India is its own worst enemy, with a long-standing habit for self-defeating policies and contradictory regulations. The confusion that followed last year’s withholding tax cut on overseas bonds and the rupee’s reaction to tightening measures from a panicking central bank are just two of many such examples.

Similarly, pushing borrowers overseas to relieve pressure on the currency means little without a meaningful review of cost, size and tenor restrictions under the external commercial borrowing regime.

India’s problems are well documented. While this report cannot ignore the reality, it also aims to analyse potential solutions that can help lift India out of its present predicament.

The financial markets certainly need to develop further, and recent measures show some welcome recognition that the lack of depth in the domestic bond market is a serious shortcoming.

However, a straw poll of market participants confirms that funding is far from the country’s biggest hurdle. Debt finance remains available for capital expenditure, and even the biggest projects have successfully secured funding in recent months.

Overseas bond markets remain open – albeit at a price – and local equity markets have begun to respond to the government’s efforts to restore confidence. The rupee, too, has recovered some ground after plunging to a record low against the US dollar.

Many of India’s biggest challenges are self inflicted, the result of cumbersome regulations and a bloated bureaucracy. Implementing structural changes will not be easy, but the latest market rout may prove the ideal backdrop for the government to push through long-overdue reforms.

If India can address policy and structural issues, this challenging period could prove to be one of the best times to invest.