IFR: Brett, you may have some ideas. Your firm has certainly been impacted by this trend.

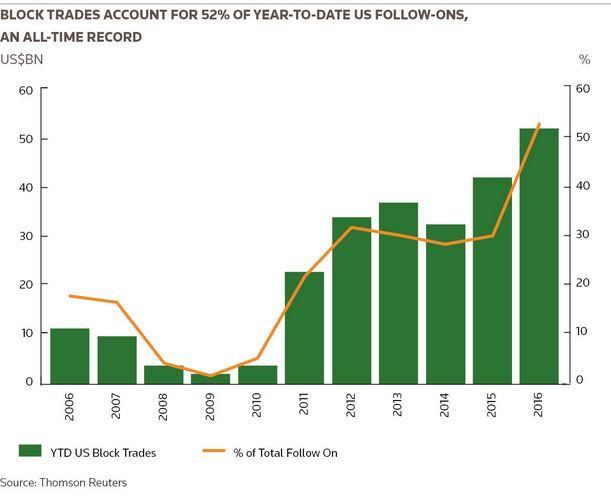

Paschke: There is no question that there is significant appeal to the seller – the price certainty, the quick execution, and not having to publicly announce – and some of the ways blocks have been executed have been tremendous. It’s been a huge development over the last couple of years in particular.

There is impact to the ecosystem though, that is maybe now just starting to [take effect]. Just follow me for a second on this. One challenge is if you are one of the six or eight banks that underwrite an IPO, you spend a year with the company. You’re working on the prospectus. You’re working with the management team. Your sales force gets geared up.

You do the IPO. Your research analyst gets geared up. You’re ready to report. You have that company come to your conferences, you take them on non-deal roadshows once they’re public, you make recommendations to their board of directors, you pitch them on M&A ideas – all the things that all the banks are supposed to do when they’re involved in an IPO.

All of those things are done for free. Then when it comes time for a follow-on offering because the private equity firm or others want liquidity, they bid it out primarily to balance sheet-driven banks, because that’s who can be most aggressive in size.

All those people who are underwriters who aren’t balance-sheet banks are either not participating or participating in very small measure, and usually after the fact, and usually at a price set by someone else.

In an environment where you’ve got very low follow-on volumes that are marketed, you have very low IPOs, and then the follow-ons that are happening are happening on a block basis, it starts to impact the ability for the other firms to continue to invest heavily in research, aftermarket support – all the things that are helping create the demand that is enabling blocks to happen in the first place.

One of the things with big, powerful, balance-sheet banks, Barclays being a great example, is that they have such trading acumen they can often participate in deals that they really aren’t as involved with. Other times, probably their best candidates are ones they know the best, I’m sure.

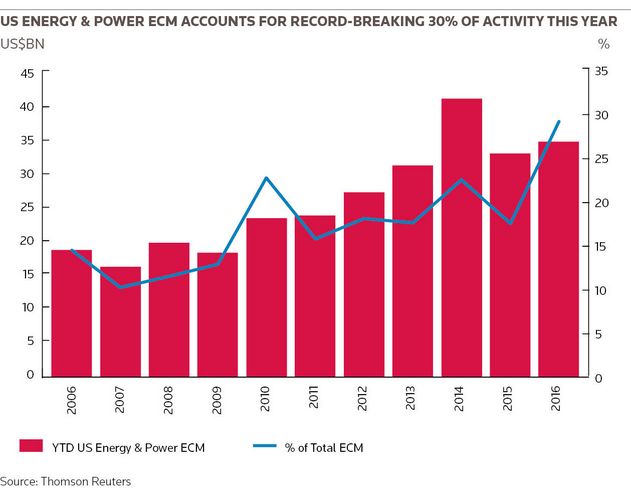

I agree with Brian, the genie is out of the bottle. If anything, it’s going to extend, potentially, to more primary shares, as well as it has in the energy market.

One thing that is going to happen is that those making the decisions as to who participates [in bidding for blocks] are going to try to get it a little bit back towards the syndicate that have been helping build value for the companies.

Exact Sciences is an example. They went out basically to the underwriters who have been covering it with research, supporting it in the aftermarket, as opposed to a tight group of more balance sheet-oriented banks. That would be a good development.

Delp: And we’re seeing more two and three-handled blocks.

Paschke: Yes, exactly.

Delp: It is starting to become a little bit more of a norm in the market than sole books.

IFR: Moving on, we have the presidential election coming up and we’re all looking forward to next year. Nelson, what are your expectations for the capital markets around the election? How will companies and investors respond? And what do you see happening next year?

Griggs: God, yes (Laughter). I’ll just talk about the IPO market real quickly, which I think the other panellists would probably agree that we do have deals that are active in September, October.

We’ve got a pretty busy calendar in September and October. I think the end of October is predicated on these deals doing well so that the momentum continues. Then, as we talk to our partners, I think we’ll see a slowdown with the election, and then it’s a matter of how do we restart again.

At the end of last year we thought there was going to be a slowdown in November and December but then pick up. That did not happen. The capital markets really did not get out of the gate at the beginning of the year. We’re hoping that that’s not going to happen in 2017. We’re in a market right now where IPOs have performed really well. If we continue to see that demand is there, we feel pretty good about next year.

Our current clients that are already listed are looking at the election, but not that much. They looked at Brexit for a day or two and that went away. The Fed is much more of a concern for anyone than I think what’s going to happen with the election, unless it really doesn’t go the way people are thinking it may go right now.

Based on our dialogue we certainly have companies that want to go public next year. We have been incredibly busy prepping companies for potential IPOs. We have about five or six global companies that are looking to list in the US, so we’re hoping that continues to pick up.

Everyone’s waiting to see what’s going to happen with the tech market because it is such a big driver of issuance. You just do the math on how many IPOs we have a year. If there are 100–120 IPOs in a big year and tech is 15% of that, that’s 15 to 20 deals a year. But there are a tremendous number of unicorns, so something’s got to give. We’ll see what happens in 2017 and whether or not they do decide to go public maybe at valuations that they’re not thinking about today.

Delp: There are 175 unicorns out there right now valued at about US$625bn. From the beginning of 2014 until the third quarter of last year, there were 70 created through venture rounds of at least US$100m. That funding gives them something like six to eight quarters of cash burn. Only 17 of those 70 have done follow-on private rounds.

Those companies basically have three avenues to exit. They can either do M&A, they can raise another round privately, or they can go public. So the rubber is going to hit the road for a lot of those companies in 2017 in terms of their next financing vehicle.

Pinedo: We’ll see many more foreign companies, to Nelson’s point. Some of the dynamics that we’ve been talking about regarding the ecosystem in the United States, and companies being able to raise private capital, has not necessarily extended outside the United States. You don’t see that robust environment outside the United States, be it in Europe or Israel, for the very successful privately held companies.

Also, there are quite a number of companies that are listed on foreign exchanges – the AIM market, Frankfurt – where there may not be the same depth of trading, the same liquidity that exists on US exchanges. As a result, some of those companies may be undervalued relative to sector peers in the United States.

For investors that are concerned about valuation levels, it makes good sense to take a look at a lot of those foreign-listed companies, as essentially they’re doing their re-IPOS in the United States and looking for the depth of trading that the US markets offer.

Audience member: Biotechs have been a big source of IPOs this year. What factors are driving that and do you see it continuing?

Delp Walker: Healthcare has been dominating new issuance in the IPO market this year, yes. The approval rate at the FDA is near an all-time high, which is helping drive the need for capital. Approvals are driving the performance in a lot of these stocks. In an environment like this, investors are looking for alpha, and there is a decided lack of places to get that right now.

Historically you’ve had a dedicated group of investors that have been invested in the biotech space – most of them with MDs, PhDs, really doing a deep dive in the science. But given the performance of a lot of these companies, given the performance of the XBI [the SPDR Biotech ETF] and the BTK [NYSE Arca Biotechnology Index] you’ve seen a lot of generalists crossing over into the biotech market to make investments.

A lot of those investors are taking a basket portfolio approach, thinking that if they buy 10 of them and one or two hit it big and the other eight go to zero, they’re still winning overall and creating alpha in their portfolios. The participation of crossover investors has led to a lot of volatility in the biotech market candidly. Because a lot of these companies are very small, they’re very illiquid, and a lot of investors have not done the diligence to necessarily know what they’re buying.

Toward the end of last year and the beginning of this year, the investor base has reverted back toward dedicated investors that have historically invested in the biotech market being the ones that were participating in transactions. There have been more club deals as opposed to deals that were 10 or 15 times oversubscribed and attracted a lot of the generalist money.

We saw tremendous inflows at the end of last year and beginning of this year into the biotech funds. There was a lot of capital to be put to work, even in the dedicated funds run by people that are the very, very smart money in this space.

As I said before, the norm on a lot of biotech IPOs is that crossover investors really have visibility on where a company is going before they launch. You may get five, six, seven, maybe a dozen new investors on the transaction, but outside areas such as gene therapy and some of the hotter spaces you haven’t really seen double-digit levels of oversubscription that we saw in the past.

I would point out that there are certain areas of healthcare that are different. Services are one area that has been quite active. We did an IPO for a services company prior to Labor Day that was double-digits oversubscribed, and traded very, very well in the aftermarket.

Reilly: Ashley made some great points about the long-term trends driving biotech, but tell me if you disagree – there’s one reason why there’s been more biotech IPOs than any other sector: it’s because they’ve been done with insiders, right? They’re really not public deals.

Delp: Yes.

Reilly: I don’t know if that’s been every deal, but at least for the first several months of the year. I remember in March there was not a single IPO in the US market other than biotech and SPACs. I don’t think there was any other sector.

All of those biotech deals were done with insider participation, with maybe some stock sold to public investors. But insider and crossover participation has been driving biotech issuance for a large part of this year, that’s driving the numbers.

But a lot of generalist money has piled into this sector over the years, and there has been a lot of innovation. We talked about the JOBS Act and the trends toward broader investor education. But this year issuance has really been driven by the insider participation. Generalist investors really are not participating on biotech IPOs.

Audience member: Regardless of the profile of the next administration could you comment on what the outlook is for carried interest and long-term capital gains rates, and what sort of influence or what type of behavioural response you might get from the PE and VC crowd?

Scharfenberger: Yes. I like carried interest (Laughter). No it’s obviously a controversial topic and it’s very misunderstood. We could have a whole forum on whether carried interest should be taxed as capital gains or ordinary income. The point of carried interest is to have risk capital or risk compensation taxed like capital gains.

Whatever administration [we get] will try to close loopholes. I don’t think carried interest is a loophole. There are ways that you can tax equity participation, whether it’s done at the fund level for the private equity managers or for the management teams to get some type of capital gains treatment.

Don’t throw stones at [private equity]. We only get paid on capital gains. The private equity compensation model is the fairest on Wall Street by a wide margin. We only get paid carried interest once our entire fund returns all of its capital, with a preferred return, and there are profits to share. That’s when carried interest gets paid, and that does not happen if we have one deal that works and the rest of the portfolio doesn’t work. We don’t have a high water mark, none of that stuff. We only get paid once our investors get paid with the profits.

There is not a strong lobbying organisation on behalf of the private equity community. We have one, but I don’t think it’s as powerful as some of these other constituencies. Carried interest is a very controversial and nuanced topic. I think you’ll continue to be able to find ways to have private equity managers participate in the deals that they do, and share in the upside, and hopefully be able to maintain capital gains treatment.

I don’t think anyone would say if you change carried interest the way it is today and tax it at ordinary income that people are going to leave the industry. That’s a lame argument, but I do think that there’s going to be ways to have private equity managers continue to generate capital gains treatment on the profits of each deal.

Reilly: Not a strong lobby in the private equity industry? Come on! (Laughter)

Scharfenberger: We have one and it’s relatively new.

Griggs: We’re a bit more focused on the transaction tax, which is in all the candidates’ platforms. You could picture some strong momentum in Congress around that, which we think is pretty misguided. We’re spending some time on that with a lot of people who’d be affected. It hasn’t worked well in most markets.

We just need to see how the election plays out. After that, priorities shift and other things that may take a wider focus such as healthcare or terrorism. Are they going to focus on transaction tax as a key reform? We’ll see, but we have a lot of supporting data that would indicate that it might not be the smartest move to do.

Paschke: One thing I wanted to throw out just quickly as a follow-up to something Ashley said, talking about the unicorns, that on average they raised about US$100m. By definition the valuations were US$1bn or higher, so they’re doing relatively small equity raises and then implying that valuation across the entire equity value.

You used the term, Brian, in your opening comments about the VCs getting religion about doing down rounds. There are some sub-US$100m equity investments in unicorns’ structure with ratchet protections that kicked in over time. These companies weren’t really worth what they were reported as being worth. In terms of this whole backdrop of they’ve got to understand they’re going to have to do down rounds, [because] there’s a difference between selling 25% or 30% of a company without protections in common equity that is freely tradable, versus a 5% investment for US$50m with ratchets.

For some reason, it’s hard to make that argument when you’re in Sand Hill Road, because they don’t want people to catch onto that game. But that really is what’s going on. (Laughter)

Audience member: Former Goldman Sachs partner and now Connecticut congressman Jim Himes made a lot of noise a few weeks ago, saying it was outrageous that companies had to pay a 4% underwriting spread on an IPO. Earlier I interpreted Ashley’s remarks to mean, when she said, “There are a lot of bigger companies out there that could come under the JOBS Act protocols,” that all those companies don’t have any reason to pay more than a few percent to go public.

Yet, Brett, when you were talking about all the missionary work that the non-balance sheet banks do to get the company to the block stage and then they miss out on that, I think it’s a strong argument for perpetuating the historical fees that banks are paid on IPOs.

Paschke: That’s 7%, by the way. We’re not going to do any price cutting here. We’ll be hung if we walk out of here with 4% as the new norm.

Audience member: But how can you reconcile those trends and those pressures that do appear to have some type of political motivation behind them?

Paschke: As capital raising gets more efficient over time, and marking periods get truncated, and overnight becomes the norm, there is no question that there will be fee compression. You’ve seen it in some of the follow-on offerings, particularly on blocks.

Fees on IPOs have held, though the gross spread definitely trails off for larger deals. Once you get above US$250m or US$300m raised, you start to see a break in the 7% fee. But I do think ‘missionary work’ is a very good term because a lot of the work is unappreciated and lost amid the populist rhetoric we see on so many things right now.

What people don’t see is we’re meeting many of these companies three and four years before they go public. We’re helping them make decisions. We’re introducing them to private equity firms. We’re bringing in executives and board members and introducing them to potential customers and clients. We’re helping them craft their story.

Many of those companies never go public. Some of them get sold. Some of them don’t perform. Some of them get consolidated elsewhere. Some of them get sold. Part of the reason that that fee has held steady is to help keep that infrastructure in place to allow capital formation to occur for fast-growing companies.

To look at it only on the marginal basis of the actual deal is a little bit similar frankly to the carried interest discussion. It’s isolating a variable that to me can’t be isolated without the broader context of all the things that go into getting one company public.

Pinedo: The letter that was written on the IPO under-pricing and fees was based on some academic studies, a study in particular by [University of Florida professor] Jay Ritter and others. It focused again on the misconception that Congress already had that the SEC study which IPO model works: Institutional bookbuilds, versus allocating a part of the book to retail, versus auctions.

It’s been proven time and time again that the other methodologies for pricing IPOs don’t work. The auction model has not borne fruit. You wouldn’t have so many European companies looking to the US markets or to dual listings if the necessary liquidity in the environment were created in their local markets and their home countries.

That largely has to do with all the things that Brett was talking about − the research, the investment, the secondary trading that come into that price. Like so many studies, academic studies can get twisted out of proportion by somebody who wants to put out a press release.

Reilly: Yes, all great points. The other thing in addition to everything they mentioned is balance sheet, or the amount of balance sheet that we’re extending to private equity and their portfolio companies, and corporate clients. To get a return on that balance sheet, we need to get paid a fee [on IPOs], so it’s more than just missionary work. But there is a lot of missionary work.

I do agree with both Brett and Anna. And I do think that we will see fee compression. We’re already starting to see it.

I don’t think we ever get to the point where they are in Europe, and I hope I’m right. There is just not the same level of competition in terms of number of investment banks.

Paschke: Very often management teams are absolutely shocked that we spend all the time that we do with them doing some of that ‘missionary work’, and there is no bill ever. We’re the one participant in the process where that’s the case. The lawyers are typically billing as they go, the consultants are billing as they go, and the accountants are billing as they go.

Pinedo: [We] bill when the deal gets done, sadly.

Paschke: You guys do, right?

Pinedo: We do.

Paschke: A lot of other law firms don’t.

Audience member: Can I have your business card? (Laughter)

Paschke: That was your best pitch of the day. (Laughter)

Pinedo: I saved it for the end.

Paschke: There is no compensation anywhere leading up to that deal, and there’s none afterwards for all those other things, except for the transaction. If that has to change over time because there’s pressure on it and there’s direct billing for some of those other ancillary services, that would be the other way to deal with it.

Reilly: When I read that article, though, my only reaction was: “That’s typical from a former Goldman Sachs partner”. (Laughter)

Paschke: Yes, exactly, a former one.

Reilly: Yes.

Scharfenberger: Can I make one last point, which is something I was hoping we were going to get to?

IFR: Absolutely.

Scharfenberger: One thing I always like talking about in these types of forums is when a private equity firm takes a company public, it’s pretty different than when a VC-backed firm or an entrepreneur-owned company goes public.

Jim Cramer did a piece on Ollie’s – I keep coming back to Ollie’s. But he was saying he’s such a huge fan of Ollie’s now and he wasn’t a fan when we took it public, because the private equity firms are just going to dump the stock.

We’re obligated to sell so when we do sell, it is not a bad signal to the market. It doesn’t mean that we don’t believe in the company. It doesn’t mean that we foresee bad things coming down the pike. We have to sell.

We are really bound by strict, forward-looking insider information, material non-public information, both from the time we launch to the deal and then even [right afterwards]. We’re doing bring-down calls before the deal closes that we were not privy to any material non-public information when we did the deal.

I would just like to dispel the myth that when private equity firms are selling that they’re selling because they know about something coming down the pike that is bad for the company.

For our firm, it’s totally the opposite. The only way that we’re going to continue to be able to sell equity into the market, whether it’s on an IPO, a follow-on offering or a block, is to have the reputation of: “Buy that company from CCMP, buy shares from CCMP because we know that that company is a good performer, that the management team is solid. They have great corporate governance and the prospects are good.”

One last point. We’re not in the pennies business. We’re not looking to slice five cents off of every share we sell, which we did do on the last Ollie’s sell down (laughter). It was a billion-dollar gain and we saved like a million or two million bucks. We had to do the block for a specific reason but that’s not the business we’re in. We hope investors are going to make money on our portfolio companies long after we’re gone. It’s an important thing that we try to convey at the time of an IPO market and when we’re doing follow-ons.

IFR: Thank you to our panellists and thank you to everybody that was able to attend.

To see the digital version of this roundtable, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com