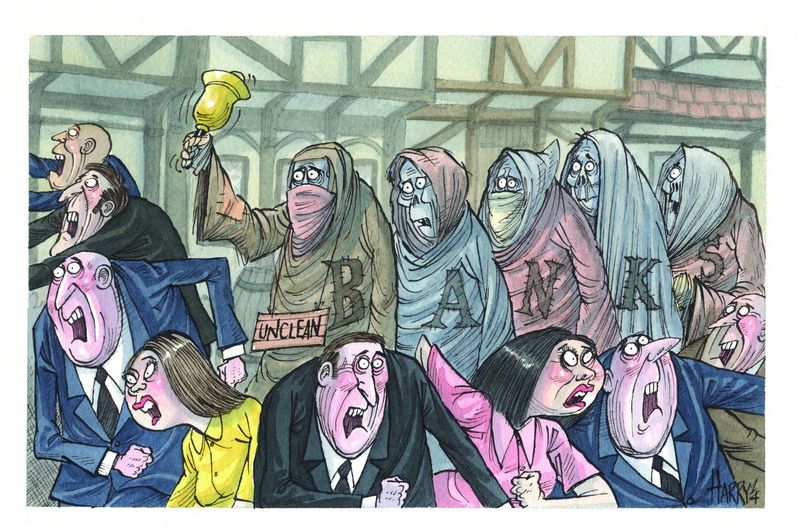

Investors in banks could be forgiven for longing for simpler times. On established metrics banks look incredibly cheap. But a host of new rules around capital requirements and resolving failing banks, not to mention a host of untested debt structures, have left investors attempting to evaluate an unpredictable new world.

On the face of it, many banks represent compelling investments. Certainly, their shares are cheap: price-to-earnings ratios at some of the world’s largest banks remain in the single digits, while on a price-to-book measure many are trading at less than one times book (and some at less than half their claimed book value).

There are – of course – good reasons for that. Reasons that have convinced many equity investors simply to steer clear. Obvious bargains, they are not.

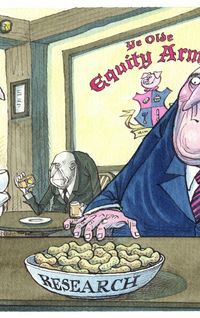

“Do I think they [bank stocks] are bargains?” asked Ed Firth, head of European bank research at Macquarie. “No. They are heavily geared and have risks attached to them. You really have to proceed with caution. Anyone who says they know what will happen within weeks and months after the [European authorities’] asset quality review may not fully understand what is going on. There are lots of reasons why they are trading where they are.”

What are those reasons? There are many. But let’s start with the litigation risks. In the fourth quarter, banks revealed in earnings reports that they have been setting aside billions of dollars in anticipation of fines and regulatory punishment. UBS, in quarterly results announced in October, set aside US$1.78bn for a host of issues, while in November HSBC provisioned US$1.69bn. A September report from Macquarie suggested that European banks had potential litigation liabilities of US$96.17bn, and had only provisioned for about a quarter of that amount.

Dizzying as that estimate may be, it may not be far wrong as regulators are increasingly keen to punish banks, especially repeat offenders. This was most recently displayed with the US$3.4bn penalties imposed by authorities in Switzerland, the UK and US on five banks, including HSBC and UBS, in mid-November for failures to prohibit attempted FX market manipulation. The portion levied by the UK’s FCA was a record £1.1bn and the regulator specifically cited the failure to act despite earlier fines for Libor manipulation.

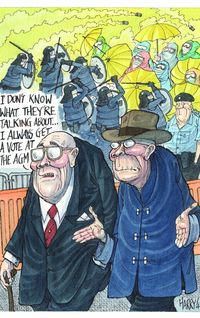

Of course, litigation risk is just one of the many unknowns surrounding global banks. The regulatory picture is still evolving – and may evolve in a way that makes it harder for banks to make money. Investors also struggle to trust what they are told by banks. To take one example, the almost complete opacity of risk-weighted asset calculations – and other measures of risk that are becoming more important inputs into how banks are regulated – is enough to put off many.

Captured

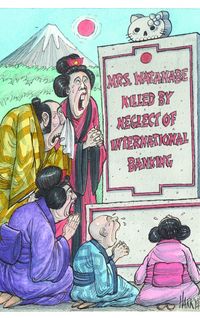

And who would want to invest in an institution that has essentially been captured by its employees and used as a vehicle for their enrichment, rather than a money-making proposition for its actual owners?

That is essentially the accusation made by Bank of England deputy governor Jon Cunliffe. In a speech in October he said that in 2013 global banks’ average return on assets was 0.3% and return on equity in the UK, the shareholders’ return, was also just 0.3%.

He blamed this almost directly on banker pay, citing BoE figures showing that in the 10 years prior to 2007 bank pay bills grew at about the same rate as shareholder profits. But since the crisis, profits attributable to shareholders have fallen from about 60% of the wage bill to just 2% for the large UK banks. In other words, shareholders were getting just 2p for every pound paid to staff.

“It is noticeable that since the crisis, for the industry as a whole, employees have received a larger share of a smaller pie relative to shareholders,” Cunliffe said.

Days gone by

And yet, for some analysts, it is not that banks are uninvestible, it is that investors must recalibrate their expectations. They argue that the days of pre-2007 financial crisis returns are over, but that investors looking for a reasonable return over the long run do have options available.

“Some still want to make 20% returns, but I think those days are gone,” said Matt Spick, a banks analyst at Deutsche Bank. “But the sector is trading at one times price to book and makes a return on equity of 10%.

“So if you are willing to calibrate your expectations and buy solid banks, then some might be OK. You might get 5% or 6% dividend yield plus 5% NAV growth. That falls well short of what some people think is a good return because historically returns have been way bigger. But if I told you you could get near a 10% annual return, that’s pretty good.”

It is also fair to say that if those banks trading at low valuations can follow through on their turnaround plans, they are certain to be re-rated – perhaps aggressively – by equity investors.

A board member of one bank trading at well below one times book said: “We say to investors to stick with us, because as we work through our current problems over the next year, there will be huge upside.”

That might be a compelling pitch, but it is also one equity investors have been taught, through repeated bitter experience, to be wary of. For example, Commerzbank has raised capital four times since the start of 2011 with each trade deemed an opportunity to buy exposure to the German economy at a never to be repeated valuation.

Yet by the time of last year’s rights issue, investors in the previous three deals had all lost money (those that backed the company via the right issue – that is, the fourth, and seemingly, final occasion – are sitting pretty with returns of over 150%).

ECM bankers are confident that equity investors will continue to back recapitalisations of European banks in the hope of making such dramatic returns. However, they run the risk that investors will steer clear if there is any doubt about whether rights issues actually resolve capital issues.

Banca Monte dei Paschi di Siena is a stark warning in this regard. The bank raised €5bn through a rights issue in mid-2014 when it had a market capitalisation of just €2.7bn. The deal was so large that it gave investors confidence it would be a one-off, yet BMPS was actually the worst performer in the European authorities’ stress tests and will return in the new year to raise a further €2.5bn in equity. Investors in the last rights issue lost 40% of their investment in just four months.

The head of ECM at one of the underwriters of that deal said it would be tough to go back to those that had lost so much money to back the bank again, but price would tempt in new investors that see banks as a liquid bet on macroeconomic recovery. BMPS trades at just 0.3 times book value and the rights issue will offer a further discount.

Complicated

On the debt side, meanwhile, the picture is even more complicated, largely due to a number of new regulations that investors need to consider. Additionally, bond prices are not cheap, particularly after a credit rally following the stress test, which (if the results are to be believed) revealed many banks to be in better shape than some had feared.

One major question is around total loss absorbing capital. Global regulator the Financial Stability Board is working to ensure failing banks are easier to resolve and remove the need for taxpayer money to be used in any distressed situation through the use of TLAC.

Consultation began in November on the Financial Stability Board’s TLAC proposals, but rules are not set to be finalised until the G-20 meeting in Turkey in November 2015. In the meantime, investors are uncertain over what will define TLAC-eligible instruments and the required level of TLAC.

The FSB proposes loss absorbing capital of 16% to 20% of group risk-weighted assets. While this is short of the 20%–25% indicated in an earlier consultation paper, the cost could be significant. Bankers said the earlier indication could mean a 25% to 50% increase in annual funding requirements.

It is expected that banks will have until 2019 to comply, but many bankers have complained that, even so, it is difficult to know how to model their businesses.

Regulatory uncertainty

“It’s probably fair to say that regulatory uncertainty and volatility are unhelpful from a market perspective,” said a senior FIG banker at a European investment bank. “The market can operate with bad regulations, but not without any regulations. And we are in the middle of a situation where regulations change frequently. That’s an issue for investors and issuers.”

Another expectation from TLAC rules is that they will result in banks needing to issue anywhere from US$500bn to US$1trn in capital instruments in order to meet the buffer requirements. While some of this might be achieved via raising equity, most will have to come as debt.

That is a risk for bond prices on a simple supply and demand equation and could put bank finances under even more strain as the industry struggles to meet coupon payments on all those new bonds (something that is also bad news for equity investors, who will see cash that could be used to fund growth or spent on dividends going elsewhere).

Of course, another form of capital means yet more new structures in the bank capital market, creating another unknown for investors. New regulations have already led to the creation of new types of convertible debt structures for banks, such as new-style Additional Tier 1 bonds, but these types of assets have had mixed responses from the market.

Investors in these instruments face the primary risk of a bank’s capital falling below a certain level. For most AT1s the minimum trigger level is 5.125% common equity Tier 1. Should a trigger be breached, these bonds could be bailed in or converted to equity, usually at a very low price. Furthermore, banks are not necessarily obliged to pay the coupon and in some cases can be forced by regulators not to.

Initial enthusiasm based on higher coupons has been followed by uncertainty over how to model and price these bonds, leading to many of these AT1 bonds trading below par in the secondary market. There have been exceptions, most recently with SEB’s AT1 bond, but the inherent complexity of these assets has put many investors off, despite the attractive yields.

Tier 2 bank debt is more straightforward, and is effectively standard unsecured debt, but even so there are some complexities. As an example, the National Bank of Australia recently issued a Tier 2 bond offering where loss absorption was not statutory, and bonds would be converted into shares if the firm was declared non-viable by the Australian regulator. However, explicit details on what “non-viable” meant were lacking.

Sam Theodore, managing director for financial institutions at Scope Ratings, is expecting a glut of bank capital issuance, but predominantly in subordinated bonds as there is likely to be more investor interest as they are easier for investors to understand.

“It depends on the investors, but interest [in AT1s] will be restricted,” he said. “Some hedge funds are happy with the risks, but many investors are not and don’t entirely understand the risks they could be taking. Furthermore, many regulators have prohibited banks from selling AT1 to clients, which is odd when you consider that they can buy bank shares. But that’s why I think the main vehicle that will be issued by banks and will get most investor interest will be subordinated debt.”

It is indeed odd to ban investors from buying AT1s, while allowing them to buy even more risky equity. But it’s hard to shake the feeling that conservative investors who like to properly understand what they are buying will be steering clear of the sector entirely.

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.