IPO candidates in Europe are including key-man clauses when awarding mandates in a bid to lock in increasingly stretched senior ECM bankers and prevent them from handing the transaction off to juniors. Punishments for breaching the clause range from the offending bank losing out on a discretionary incentive fee, to being demoted or even thrown off the deal.

Key-man clauses have historically been included in mandates to guard against the departure of a named senior figure from a bank, but savvy clients – those employing IPO advisers and repeat issuers such as private equity firms – have tweaked the clauses to ensure that a particular originator is engaged from pitch to completion.

“At the beauty parade, if there is a really great senior guy who pitches, the issuer will want the person who impressed them to be involved in the work and deliver what they said they would,” said Adam Young, global co-head, equity advisory at Rothschild.

European ECM staffing was cut drastically during the lean years of 2011 and 2012. The shrinkage of teams across all ranks saw additional sector and geographical responsibility handed to those who remained. Even top-tier banks now survive with a handful of managing directors jetting around the region and more junior bankers who specialise in the nuts and bolts of transactions pushing deals through.

“In the good old/bad old days, a senior banker would take a client from soup to nuts and advise on every aspect of every deal for them,” said John St John, managing partner at STJ Advisors. “As ECM becomes more sophisticated but at the same time commoditised and siloed, you get specialists processing deals who the issuer hasn’t met and so issuers start to feel more divorced from having their trusted adviser at the bank. The key-man clause reflects a desire by issuers to ensure they are getting their trusted adviser throughout the execution of the offering.”

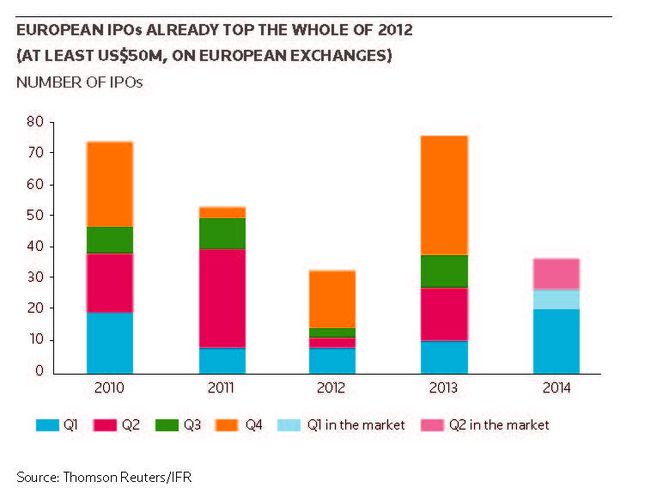

Issuers and advisers are also wary about the potential impact of the sharp increase in deal flow, especially as more major IPOs have launched in 2014 than priced in the whole of 2012 (see chart) and the bulk of these were mandated to a small group of banks.

“When you look at the flow-monsters at the top of the league table, there is a concern about whether you will get the appropriate attention, especially with a smaller deal,” said another IPO adviser.

Turning business away

“We’ve always had key-man clauses, but now they are more pronounced,” said one head of EMEA ECM. “What it does is put pressure on senior ECM bankers – amongst the top five or six banks in the league tables there really aren’t many senior bankers that can pitch. It’s very difficult. It is the reason we’ve had to turn away business.”

One ECM head said his bank had passed on pitching for the £486.6m IPO of UK online goods retailer AO World owing to lack of resources.

“The key-man clause reflects a desire by issuers to ensure they are getting their trusted adviser throughout the execution of the offering”

Others have required near-superhuman efforts from syndicate desks to manage multiple deals without additional staff. In the last week of February, JP Morgan priced the IPO of AO World, the US$952m GDR flotation of Lenta, and the €400m IPO of Lar Espana (as sole bookrunner); and launched bookbuilding for IPOs of Poundland and Gulf Marine Services, while overseeing roadshows for the listing of Circassia. In the same week it handled an accelerated bookbuild in Interserve and convertible bonds for SAS and St. Modwen.

Updated key-man clauses were included in AO and other recent IPOs involving Rothschild, such as Gulf Marine Services and Foxtons. The DKr8.036bn (US$1.48bn) OMX Copenhagen float of ISS, on which Lazard advised and private equity was again the seller, also used the clause.

“When undertaking a deal in a busy market like this, it is essential that the person you are relying on to do the deal is available to do the work,” said Young. “If people are too busy to do deals, they should say so. There is no shame in it.”

Unsurprisingly, bankers are not keen on the restrictions. “It is absolute nonsense,” said the head of European ECM at a US bank. “It is about quality not quantity in terms of the hours you put in. There is really no point in the most senior people turning up to the meetings that are purely process and where there is no value-add.”

Unbelievable

That view won some sympathy with an adviser, who said he was shocked that bulge-bracket firms accepted the key-man clause on one smaller deal he was working on.

“Given the number of deals they are doing, tying someone in is a serious undertaking – it is almost not doable – so to get that accepted is quite unbelievable, frankly,” he said.