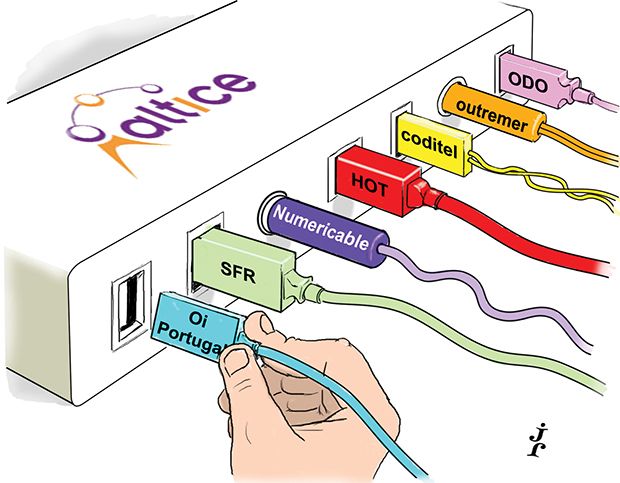

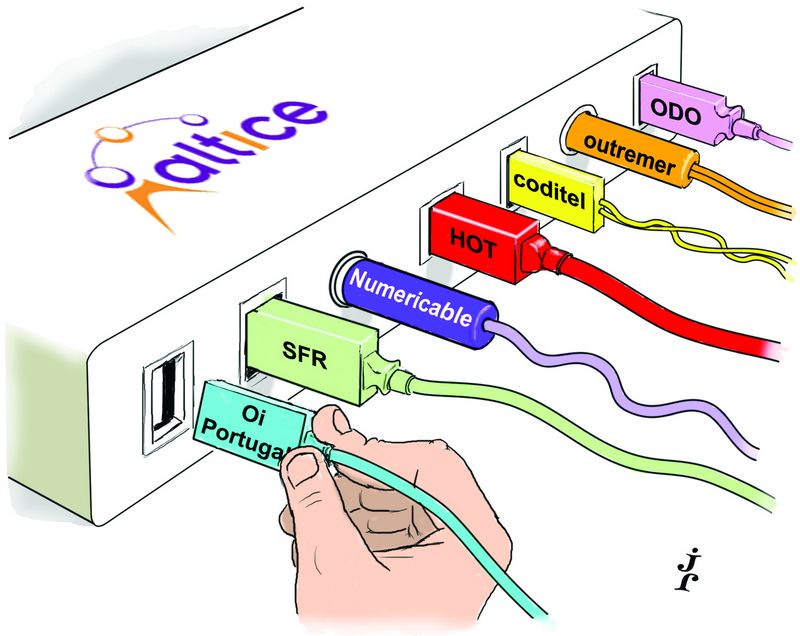

Altice went on an acquisition spree in 2014, which led to the company – and subsidiary Numericable – tapping debt and equity markets in substantial size. For pushing boundaries in every arena, Altice is IFR’s Issuer and Corporate Issuer of the Year.

Patrick Drahi is single-handedly doing his best to boost M&A volumes. The cable mogul’s assets, Altice and Numericable, were involved in numerous transactions in 2014 and have clocked up tens of billions of euros of funding in loans, bonds and equities in the past 12 months.

Yet only a year ago, Drahi was still deciding which assets to include in Altice ahead of listing the holding company. He had successfully floated French cable company Numericable in November 2013 and was set to list Altice as both firms needed funds ready for the next shopping trip. Drahi had used debt to assemble geographically diverse assets and turning to the equity market would ensure that spending could continue without existing covenants becoming an issue.

The steady stream of acquisitions meant there was little time to stop and focus on the IPO: Altice completed a US$1.685bn-equivalent bond issue in December 2013 at the same time as pilot fishing meetings were taking place for its IPO.

On that occasion, the new debt was to finance two acquisitions in the Dominican Republic. The dramatic changes in the business between every issuance were highlighted by the 1,000-page offering document. Yet investors did the credit work required and flooded the book with more than US$15bn of demand, leading to roughly 60% of them receiving nothing.

By the time of the IPO in January, Drahi’s holding in Numericable had been added to Altice in response to investor feedback received during early marketing that all of Drahi’s cable assets should be included. In a sector where companies typically offer exposure to one country, Altice by contrast owned companies in Israel, Western Europe, the French Overseas Territories, and the Dominican Republic.

But it was made clear this list would soon grow.

“We are launching this public offer with a strong M&A angle,” CFO Dennis Okhuijsen told IFR at the time. “Altice plans to diversify in countries we already dominate but we have also identified accretive opportunities in new territories.” There were 17 potential acquisitions under review at that point.

Investors had to get comfortable with an extraordinary lock-up waiver for the company that would allow it to dilute the share capital by up to 50% with new shares for an acquisition just 45 days after the IPO. Such a waiver could have been anathema to equity fund managers used to several years between fundraisings.

The confidence in Drahi – and Okhuijsen, who had previous been treasurer at John Malone’s similarly acquisitive Liberty Global – meant it was a non-issue. Investors did not want to constrain the very deal-making they were counting on for returns.

Despite coming during a period of volatility that saw Liberty Global shares fall 9% and Numericable’s 5%, Altice priced flat to Liberty. The full greenshoe was exercised two weeks after the debut to take total proceeds to €1.5bn.

“The stock behaved like a hero,” said Richard Cormack, co-head of equity capital markets for the EMEA region at Goldman Sachs, a joint global co-ordinator on the IPO with Morgan Stanley. “Altice used all the markets and played those so well, even when markets were down in the week we priced.”

The company’s greatest achievement came in early April when its €17bn bid, with Numericable, for France’s second-biggest telecoms operator SFR triumphed over rival bidder Bouygues to recast the country’s telecoms landscape. Less than three weeks later the two companies then recast the high-yield market.

The US$16.7bn high-yield bonds from the two companies earned IFR’s EMEA High-Yield Bond of the Year and Numericable’s US$5.2bn-equivalent loan is IFR’s EMEA Leveraged Loan of the Year.

The high-yield bonds attracted aggregate demand of more than US$100bn, including a single order of €5.5bn.

In June, Altice exercised the lock-up waiver to raise €911.1m overnight to finance purchases of Numericable shares from other large shareholders, this time through Deutsche Bank and Goldman Sachs. Pricing of €50.90 was 80% up from the IPO and yet still investors flocked to buy, with many orders of more than US$100m.

Financing the €7.4bn acquisition of the Portuguese assets of Oi, agreed in December 2014, should be a breeze.

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.