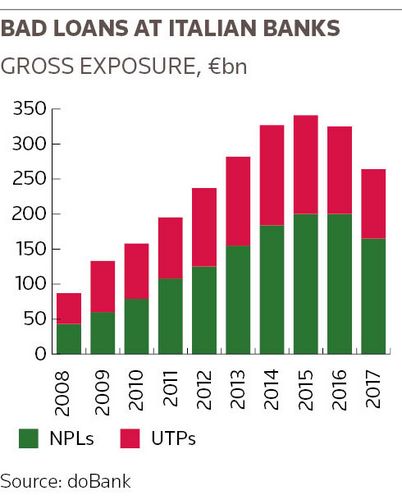

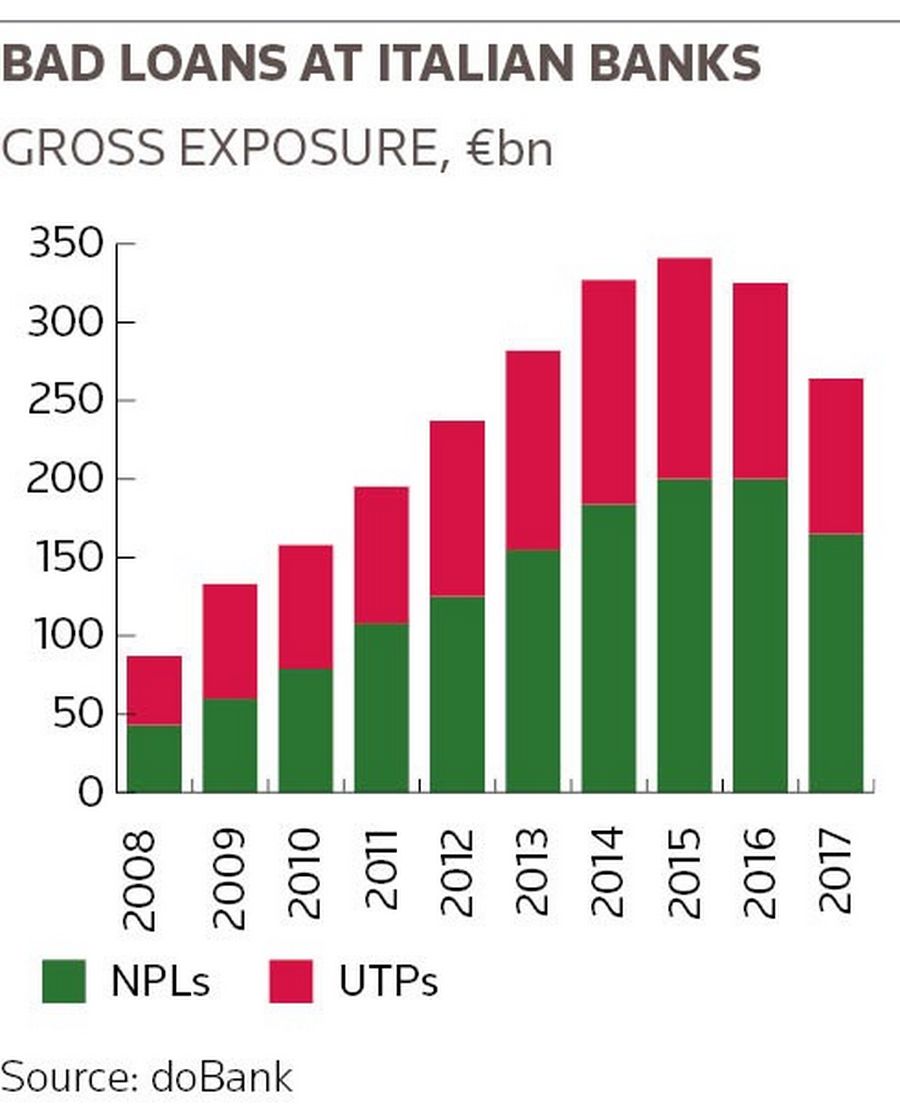

Italy’s largest servicer of bad loans has warned that the market reaction to the government’s ongoing dispute with the European Union over Rome’s plans for public spending could derail efforts to clean up more than €260bn of bad loans currently festering on the balance sheets of the country’s biggest banks.

The stand-off between Rome and Brussels has prompted a sell-off in Italian government debt over recent weeks that has left the country’s banks nursing hefty losses on the €350bn of public debt that they own, which has eaten into the capital buffers they are required to hold.

At the same time, raising fresh funds has become tricky, with Italian banks in effect shut out of bond and equity markets for more than two months now. With just a few weeks to go until the end of the year, Italy’s largest bank UniCredit has only raised about a third of what it planned to this year.

The adverse conditions are making it harder to continue the work of cleaning up banks’ balance sheets, with banks reluctant to progress with sales or writedowns that almost invariably also involve capital hits. UniCredit and Intesa Sanpaolo each still have more than €50bn of non-performing loans on their books.

Bad loans at Italian banks

Bad loans at Italian banks

“Spreads have been increasing, which obviously puts pressure on bank capital and makes it more difficult for them to tackle their bad loans,” said Manuela Franchi, chief financial officer at doBank, the biggest bad loan servicer in Italy with €88bn of non-performing loans under management.

“The problem is that, if they stop selling, the risks to their balance sheets will continue to be high,” she said, adding that the damaging effects of the political stand-off could extend beyond delayed portfolio sales. “If economic growth turns out to be weaker than expected, then you have an additional impact from lower recoveries.”

HALT TO PROGRESS

The recent paralysis comes after two years of frantic activity cleaning up the system. Three banks were bailed out by the government after they were unable to raise capital privately, while several bad loan sales took place, including an €18bn portfolio unloaded by UniCredit – the largest to date.

Other sales are in the works, including a bad loan sale from Banco BPM. The Verona-based lender has said the deal is on course to proceed next month, but bankers have become concerned about what concessions investors might demand given the current backdrop and the impact on the capital levels of BPM.

Still, doBank sees huge potential for growth. The company manages bad loan portfolios day-to-day on behalf of banks and investors – it counts Fortress and King Street Capital Management*, which bought the €18bn UniCredit deal, among its clients – and seeks to recoup money through agreements with borrowers or court action.

But it is looking outside of the Italian NPL market for that growth. It recently set up an office in Greece, and sees potential in winning mandates related to the €100bn of bad loans that banks have there. It is overhauling its structure to allow it to take on more leverage and potentially buy some of its rivals.

PITCH TO BANKS

doBank’s pitch to banks is that it can extract far more value from such portfolios than the banks can do themselves: it saw collections increase by 44% in the first two years of managing a UniCredit portfolio, for instance.

The company relies on a bespoke software system that helped generate €1.8bn of collections last year.

“Some banks were initially reluctant to use servicers to manage their bad loans,” said Franchi, who said that some initially focused on managing NPLs themselves. “But, over time, even the doubters have changed their minds. A strategic servicing partner can improve the portfolio management.”

doBank is also targeting unlikely-to-pay – or UTP – loans that are not yet classified as in default, and recently signed a deal to manage a €2bn portfolio of such loans. It estimates that Italian banks have more than €90bn of UTPs, with regulators expected to clamp down on such exposures.

“It’s a huge market: today the net book value of UTPs is higher than the net book value of NPLs,” said Franchi. “At the same time, the ECB has started to focus on banks’ non-performing exposures – NPLs plus UTPs – which should drive banks to become more aggressive in tackling these assets.”

*Corrects name of client