IFR: So Doug investors are driving pricing at the moment. Can they continue to demand that you price in their favour? To what extent will the balance shift the other way or when?

DH: Well as Otsuka-san mentioned, it’s pretty much standard for all Japanese deals right now that you go out on a 3% to 5% discount and the vast majority of deals are tending to price around the 3% discount. It is certainly true that all investors would try to get the most attractive terms for themselves. So, but the most professional and fair way to ensure that you price at the tight end within the 3% to 5% range is to generate the maximum amount of demand.

Obviously if coverage of the book is not too high, or the number of investors is not loo large, it’s much easier for investors to negotiate a higher discount. The one thing that always surprises the foreign firms is some very large Japanese deals are sometimes done as domestic deals. It always surprises us a little bit because most of these companies sell 50% to 80% of their products overseas and there’s so much money sitting in London and Boston. When you make a product and sell it overseas, you provide an English language instruction manual to work the car or the stereo system.

Why would you not also provide an English language prospectus when you’re doing an equity offering, particularly when your current shareholders are Fidelity, Capital or Putnam? And back to your question, clearly the more demand you get, the better the pricing is for the issuer. So certainly I think as foreign firms we tend to try to argue let’s be inclusive of everyone. We understand sometimes for expediency or whatever it may be, it’s quicker to do just a domestic offering, but when it comes to getting maximum demand and best pricing, we obviously try to push for global offerings.

IFR: So Shinohara-san, more instruction manuals in English.

MS: I think there are several needs here. Of course there are many needs for a global offering and there are many needs for a domestic offering. There were two large domestic convertibles last year [Y100bn each from Aeon and Hitachi]. These represent very high quality names. Aeon is a domestic retailer so wanted to focus on its customers. There was a meaning to that. Each deal has a meaning to it and it’s true that there is a huge source of demand in Japan so some issuers want to tap that.

On price movements, sometimes international offerings might have volatile price movements. I think the important thing is variety here. And satisfying issuers’ needs is going to be important. Coming back to this pricing matter, I think one trend which is very important is that last year there were five times as many straight share offerings against 2008 and 95% of those were capital increases. There were many arguments in the past about dilution, but I think the meaning of capital increase is very much directly focused now.

Corporates are taking risk money and they don’t have anywhere to hide. They have to focus on their story, they have to sell that story and they have to prove that they were right. So to directly look into this very important but basic theory was recognised quite widely in the market. Before there was some fear about dilution but now it’s about focus on the truth. That was a very positive trend, that’s the first thing.

Second thing is pricing. There aren’t so many differences in pricing straight share offerings. But management are much more concerned now about performance after issuance, because they are taking risk capital from the market. They are selling the equity story and they have to prove it. So they are very much concerned about performance. It’s not an easy market so they are facing that difficult fact and are more concerned with the performance of their shares. From a pricing point of view, they are very much not only focusing on the pricing target but the aftermarket performance, which is quite positive. So I think these two trends in the market are positive trends in the Japanese capital market.

IFR: So how have issues performed generally in the aftermarket if you look back, three, six months?

MS: It has been quite good, It’s true the market itself has been quite positive, in 2009; this year, it’s a little bit shaky. But the performance of these large offerings has been basically quite positive, so I think they should be happy, the market is happy and the investors are … there is a good result.

IFR: We talked about this issue of dilution and it’s come up a couple of times already so perhaps it’s a good point to talk about the new third party allotment rules that the TSE brought in recently. Ito, could you talk a little bit about the rules themselves and so on just to summarise, I think we all know, just for the sake of conservation, just summarise what they are and talk about them perhaps and we’ll talk about the market impacts afterwards. But the rules were brought in quite recently. Could you just summarise them for us would you please?

MI: Recently, many Japanese listed companies have been financed by third-party allotments of shares. A third-party allotment could be made by a board resolution under the Companies Act of Japan so Japanese listed companies could issue new shares up to three times the number of outstanding shares without shareholder approval. So from a shareholder’s point of view, this means that shareholder rights could be diluted by 75% due to the third party allotment. As a result, there are many cases that third-party allotments have been made in volume and at a price that is severely damaging to shareholder’s rights and shareholder value. Therefore we received a very large number of requests from domestic or foreign investors to improve this situation.

When it comes to the US market, the New York Stock Exchange requires a listed company to seek shareholder approval for third -party allotments that result in an increase of outstanding shares by 20% or more. In the UK market, the general principal established by the market players restricts the issue of new shares without pre-emptive rights resulting in an increase of outstanding shares by 5% or more. So that’s why we established a new TSE rule on third-party allotments. The purpose of the new rules is to prevent listed companies from undermining shareholders rights.

The new listing rules introduced last August impose some new restrictions on third-party allotments. For third-party allotments that result in an increase of new shares by 25% or more or which result in change of control, the Tokyo Stock Exchange will seek the opinion of an independent committee of the company about the need and rationality of the allotment. Or it will seek shareholder approval. These methods are supposed to protect shareholder’s rights from infringement and they are a means to prevent a situation where the company’s management can water down oversight by shareholders through dilution of voting rights or equity value.

IFR: Kusunose-san, has there been much reaction since the rules were introduced? Has there been any notable market impact?

TK: The three times of outstanding number of shareholders that could be issued by board resolution was outrageous so everybody felt that there should be some requirement or regulation or restriction to monitor management of the company. So I really respect the decision by the TSE. It’s not necessarily in line with New York and London because Japan is a different market. But generally speaking I pretty much support the TSE.

MS: There is a balance here and the course of it is very much right, but in terms of the what kind of measurement, there can be argument there. But it’s a balance of flexibility and governance; quite an important matter.

DH: Certainly, during the last several years, we’ve seen the TSE trying to push the Japanese capital markets forward. Obviously, there’s been quite a bit of work done on creating a structure under which rights offerings can potentially be done; there hasn’t really been a meaningful rights offering in Japan yet. It’s far more do-able today than it was say three years ago. So it seems that the Japanese capital market regulators, TSE, the FSA etc are all trying to help move the capital market systems here forward which is beneficial given that markets continue to be fairly challenging.

IFR: We did see an unusual rights offering recently for Takara Leben, which among other things didn’t have any brokers or underwriters. Was it a one-off?

TK: I think it’s still too early to judge because this was the first one. The company’s market cap at the time of the offering was less than Y10bn and the fundraising was around Y5bn, so more than half. I’m not saying the reason for the capital increase was right or wrong but there were questions. To achieve this size of capital increase would be difficult in a public offering because of its relative size.IFR: I’d like to talk a bit about the prospects in Japan for IPOs and whether that market is going to come back and grow in the next 12 to 18 months. Doug, why don’t you kick off on this one? What are your thoughts about the prospects for IPOs and provenance of IPOs?

DH: The market always welcomes IPOs around the world, IPOs are the crème de la crème of the offering calendar. Having said that, there are a few relatively large names that everyone expects to come in the next year or two. But I think relative to many other markets, the Japanese IPO market still remains relatively quiet. I think it’s partly a function of the fact that Japan is such an established economy that you would naturally expect fewer IPOs than you would in emerging market economies where many companies have only been established in the last 10 or 20 years, so they’ve only now just came to the point where they have critical mass to go public.

So I think we will see a somewhat sporadic lumpy flow of large IPOs with a reasonable supply of smaller ones. The smaller ones are a little bit interesting because back to my comments about international, I mean I think one area where it is sometimes is hard to argue for a global offering is if it’s a relatively small IPO given the time, the paperwork involved etc, and ultimate size, maybe it doesn’t always make as much sense, even though there would be interest from overseas markets. I think when it comes to the medium and small cap IPO market, I’d defer my peers at the Nomura and Daiwa for their comments.

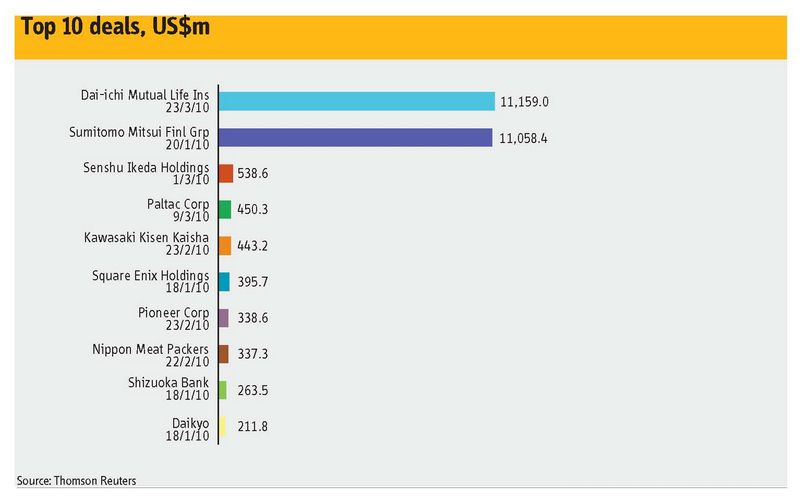

MS: IPOs like Dai-Ichi Life, with US$10bn size, many new investors, have a huge impact. The performance has been very good; the quality of the companies is there, the performance is good, so that has a really positive impact, so we do want to see quite a lot of these. But in reality, as Doug said, there aren’t so many. There are a few, but we would like to see more. We would like to see new names coming in to stimulate the market. And your point, Doug, was …?

DH: What I’m basically saying is when it comes to small, medium-sized corporates that are doing IPOs –which tends to be the majority by number in Japan – they often end up as purely domestic transactions, so I think that Nomura and Daiwa will probably have a better insight into that.

IFR: Indeed. Otsuka-san, do you have a comment then? Mid/small cap IPOs?

YO: I think we’ll see more transactions this fiscal year, compared to the last fiscal year. But most of them will be small to medium sized. I think because of their economic situation, many companies are not good enough to clear the high standards set by the Tokyo Stock Exchange, but that’s a good thing, to maintain a good quality market. So I think it may take time to see a big increase in the number of issues.

IFR: In terms of private equity-backed offerings, do you think there will be exits through IPOs? Is that a potential channel?

TK: Well we saw some slight pick-up in activity in the States with financial sponsor exits. But there is not a long list of companies held by private equity firms in Japan but to the extent there is, IPO exits are definitely an option. Historically speaking, Japan has brought something like 100 to 150 IPOs per year, but the average size is probably US$30m-$40m so they’re really small and not really on our radar screen. For the big ones, I don’t think financial sponsors offer a very big opportunity in the Japan context.

IFR: In terms of issues in the market now, I guess the one that everyone is talking about is the Mizuho offering which three of you [Nomura, Bank of America Merrill Lynch and JP Morgan, as well as Mizuho Securities] are involved in.

DH: Well there’s been a shelf registration filing. But no deal has been announced. All the shelf registration says is that they have announced the possibility of doing up to US$8bn or Y800bn some time in the next 12 months. That’s not even an option per se because basically they don’t have to do something, but they’ve said that they are seriously considering it and they just want to let the market know that that might happen.

Click here for Part three of the Roundtable.