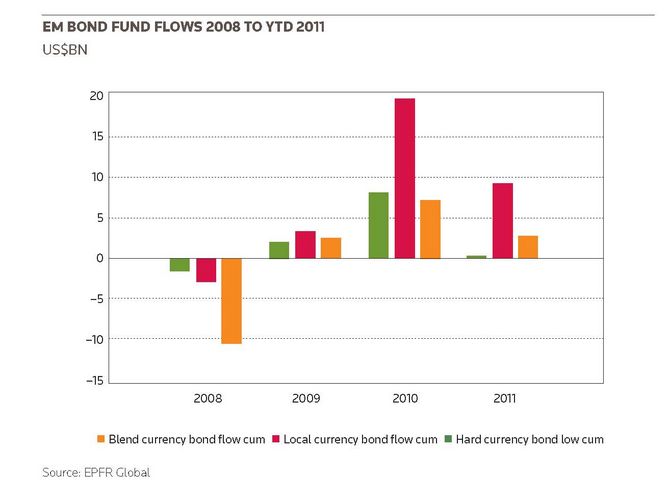

Inflows into EM local currency bond funds have far outpaced the amount moved into hard currency and blended funds and, with the US downgrade and eurozone difficulties the shift has accelerated.

To view the digital version of this report, please click here.

The structural weakening of the dollar and the strengthening of emerging market currencies have set the stage for strong performance by local currency bond funds. Indeed, a look at recent reports from data analysis group EPFR show that in the past twelve months inflows into EM local currency bond funds have far outpaced the amount moved into hard currency and blended funds. The downgrade of the US to AA+ by S&P and the continuing problems of the eurozone have accelerated the shift.

What is more interesting is the asset class held up even amid the intense volatility of August. When equity funds lost US$26bn in the week ended August 10 – with EM stock funds accounting for US$7bn of that – US bond funds saw US$1.5bn go out the door and high-yield bond funds lost US$6.2bn. Meanwhile, EM local currency funds saw inflows of US$108m. The week ending August 17 repeated the pattern as local currency EM bond funds took in a net US$273.1m even as hard currency EM bond funds and blended currency bond funds lost US$562.3m and US$83.8m, respectively.

“In the current environment, investors have realised they want to invest in the creditors rather than in the debtors,” which includes being exposed to their currency, said Brad Durham, managing director at EPFR. “Most emerging market countries run current account surpluses and exhibit more healthy macroeconomic fundamentals than developed economies.”

Setting the stage

Robert O. Abad, senior emerging markets analyst at Western Asset Management Company, furthered Durham’s theory. He said the extreme volatility had prompted a flight from risky equity markets into developed world bonds which has pushed yields even lower and made EM local currency bonds more attractive. He added that institutional investors were thinking: “Wait, I need to pare down my traditional holdings in favour of asset classes such as emerging markets, reaffirming the stronger credit metrics and growth prospects of those countries.”

Furthermore, the structural weakening of the dollar, and the strengthening of emerging market currencies have set the stage for strong performance by local currency bond funds. “If you feel the dollar or euro will weaken, you know there has to be an appreciation side of the equation, and that side is emerging market [currencies],” said Abad.

Most of the money being parked in these funds is being invested directly into the local markets. For instance, at the end of August foreigners held 40% of all Mbonos issued by Mexico, the highest level ever. But there is increased demand for Reg S/144a local currency instruments.

“Most emerging market countries run current account surpluses and exhibit more healthy macroeconomic fundamentals than developed economies”

So much so that bankers have been building up a significant pipeline of local currency deals in Latin America. They recently reported several mandates for global bonds denominated in Brazilian Reais. Colombian companies have also been interested in issuing and Chilean corporates may return with more peso inflation-linked transactions. Not to mention sovereigns as Peru and Uruguay which have stated their plans of issuing more debt in local currency.

There should be no shortage of interest, not only because the pocketbooks of local currency funds are bulging but because these bonds provide such an attractive investment now. “This is not just an FX play, but a rates play,” explained Abad. “You look at the yield curve in the US and Europe and it is very flat and low based on historicals. Then you look at Brazilian local markets and see you can get 5% or 7% [real return].”

As for the risk of a reversal, Abad notes that: “If global growth slows, as many expect, the cycle will just keep perpetuating itself because you are getting compensated not only from the currency side, but from the carry and yield compression on the rates side.”

Indeed, some investors have been talking about a secular change that has emerging markets becoming increasingly important in the global stage. One portfolio manager in London calculates that within 10 years, the so-called emerging market countries could account for half the gross production of the world.

“The long-term fundamental story is that the world is indeed upside down”

From that standpoint the EM local currency is compelling. However, it remains subject to short-term fluctuations. But even these might be mitigated by a lack of political co-ordination in developed economies. “The political risk here is if Congress [in the US] does not take the measures needed to maintain the Triple A rating with Fitch and Moody’s”, and if there is no clear solution to the European debt problems, then there will be no catalysts to undermine the strength of EM bonds and currencies, said an EM strategist in New York.

To be sure, additional problems in Europe would affect all markets, including EM. “If there is a double-dip recession and systemic issues, as we saw last time, then everyone will be hurt,” said the strategist. But barring that Armageddon scenario, EM seems to be the best bet at this point, both in the currency and the securities fronts. And that is being reflected in the continued inflows into local currency EM bond funds.

“If you are looking for some place to put your money, and you need some kind of return and cannot have everything in cash, you think, ’where can I put my money where I will not lose it’?” said a fund manager in New York. “The long-term fundamental story is that the world is indeed upside down,” said Abad.

Brazil sidelined

Curiously, though, Brazilian issuers, which would stand to benefit the most from this search for EM currency bonds, may be sidelined. Recent regulatory changes are making it harder for them to issue in their home currency, even though they were at the forefront of the movement of issuing local currency debt with several corporates having successfully printed global Real-denominated paper in the past twelve months.

It all started because of a decision by the Brazilian government to tax currency derivatives in an attempt to curtail the Real’s appreciation. The move to impose a 1% financial transaction tax on real futures increased the price of the swap, made the real non-deliverable forwards market less liquid and inflated the all-in cost of issuing global Real-denominated bonds.

One banker in Brazil said that costs to swap a 10-year bond had increased significantly. He said that a back of the envelope calculation, debt that before would swap into 100% of local benchmark rate CDI would now swap into 120% of CDI, as the 1% financial transactions tax is applied twice. “The derivatives guys are taking their bite now,” said another local banker.

Another local banker said that the swap was not that expensive in the end. Factoring in discounts and other calculations it may come down to 70bp–80bp. Still, that means that a bond that before would swap into 100% of CDI now would swap into 107% of CDI.

The problem is that this already comes on top of a 15% withholding tax applied last year. So, if before the company’s all-in costs usually represented roughly 117% of the coupon it was paying on the dollar debt, it now has to add roughly one percentage point on top of that, at least.

In other words, now, if a Brazilian blue chip raises 10-year money in dollars in the US market at 4.65%, its all-in costs are actually closer to 5.5%, without including bank and lawyer fees and other expenses of issuing.

“We got a lot of requests for quotes on potential global Real deals and the indications we sent were a lot more expensive than two weeks ago,” said a local banker of an international shop in mid-August. He said that, for instance, a theoretical five-year global Real-denominated bond that priced with a 10.625% coupon would swap originally at 100% of local interbank rate DI. Now, it swaps roughly into 107%.

Some banks are also considering increasing the fees for underwriting Real-denominated issues. Brazilian shops such as Itau BBA and Bradesco BBI, for instance, will have higher costs to do global Real-denominated bonds. Leads on these transactions commonly hold a reserve of the bonds they underwrote to provide liquidity to the market. Brazilian banks often hedge that currency exposure through derivatives. That means that, now, to make a market in a global Real bond, these banks will have to factor in their IOF costs of 2%.

Beyond this, as Brazilian banks shun global Real bonds, this asset-class, which was already illiquid, has become even more so. That has been reflected in the bid-ask spread of the few corporate global Real-denominated bonds outstanding. For instance, that spread for the 2015 Real-denominated bonds of utility CESP used to be 50 cent on average – it now stands at US$3.

The reduced liquidity could make investors even more hesitant to buy new Real-denominated bonds, since the ability to quickly and cheaply liquidate a position has been their biggest complaint. Still, an investment officer for a large US asset manager said he remained interested in buying Real-denominated global bonds, especially after the recent depreciation of the Brazilian Real.

But, the potential upside of the currency that attracts investors may be another reason for issuers to flee the structure. After all, they will have to hedge their cashflow at a higher exchange rate.

The result of this, say some bankers, is that the local market has become even more attractive. And with the local rates curve tightening and corporate spreads remaining unchanged, nominal yields are being compressed. It is no wonder that as giant utility Cemig circulates a R$1bn request for proposal in August it did not even consider the global Real market.