The M&A market in the Middle East, like other regions around the globe, has been directly affected by the global financial crisis and the instability that has continued in its wake. By Darren Davis, managing director, head of resources and energy group MENA, HSBC.

Within the Middle East region, the instability caused by the global financial crisis has been compounded by a number of ongoing fundamental political, economic and technical shifts specific to the region that are driving changes in the energy sector in particular. These changes have an impact on the supply of energy, both primary (oil and gas) and secondary (power), and just as importantly, the demand for energy again at both the primary and secondary level.

The changes are still being absorbed but the impact that they are having is beginning to become clearer and we are now able to see some clear trends in regional energy sector M&A activity. Our expectation is that these fundamental shifts in the regional energy balance will continue to drive an increase in regional M&A activity within the energy sector ahead of other sectors.

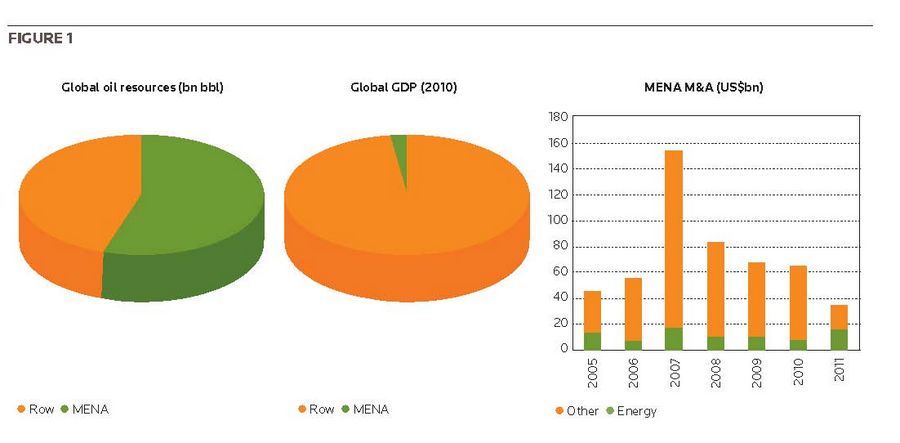

First, to put the regional market in context, the Middle East, while a major player in the energy industry, remains relatively small in economic terms, with the entire Middle East and North Africa (MENA) region from Morocco across to Egypt and down to the Gulf accounting for barely 3% of global GDP in 2010. Inevitably, this means that economic activity, and M&A activity, is on a much smaller scale than other regions of the world.

So, even in the last of the boom years, 2007, the Middle East represented only 3% of the global M&A activity, according to Dealogic, with deals closed of about US$150bn in that year. Given the importance of energy to the region it might be expected that it would represent a large portion of the activity but in fact, for reasons noted later, the energy business has typically accounted for less than 20% of all M&A activity in the region.

Diagrams

The MENA region has, in line with the global slowdown, seen M&A activity drop precipitously and although M&A activity picked up last year, 2011 has again been a slow year – with just US$34bn of deals closed by the end of September, less than 25% of the total for 2007.

Of course, on top of the effects of the global economic situation, the Middle East has also had to deal with the impact of the Arab Spring. While the political changes have certainly had very direct effects on markets such as Egypt and Libya, we have seen little impact on M&A activity outside of those specific areas.

Certainly, the Gulf region has come through the unrest without any obvious impact on M&A activity and even in Bahrain (where we are currently running two sell-side mandates on energy assets) the interest of investors seems to be undimmed. It does appear that international investors have taken the view that the Gulf at least will continue to be an attractive region in which to invest for the foreseeable future, driven particularly by the strong growth expectations in energy spending in the region and the view that political stability can be maintained.

But aside from the general economic and political environment, what factors are influencing activity in the energy sector specifically? Perhaps the biggest single factor within the sector that differentiates it from many other geographies is the dominant operational role played by national governments through the national oil companies.

Within the oil and gas sector, governments continue to own and, more importantly, directly manage, the vast majority of the region’s hydrocarbon resources. While there is significant private sector involvement in the upstream business, particularly of oil majors, these are typically under long-term contractual arrangements with very limited, if any, ability for those companies to transfer these interests via a sale to third parties.

There are exceptions in the region, of course, notably Egypt, Oman and Kurdistan in Iraq, where foreign investors have more flexibility in managing their portfolios and we continue to see activity growing in these markets. One factor driving activity in the smaller markets is that many of the oil and gas “juniors” that have gained access to upstream opportunities are now facing challenges, due to global financial market conditions, in gaining access to capital either for exploration activity or development capex. This constraint is leading to more consolidation activity among these players, and also the acquisition of such players by larger players with better access to capital.

As noted later, the need to increase oil and gas production within the region is becoming acute. This will, over the medium term, lead to greater involvement of the private sector in the oil and gas production of the region. Even in the more traditionally government-dominated states, national oil companies will increasingly seek to access technological expertise, either through partnership or by acquisition, and in some cases seek to reduce the level of investment capital they need to find from their own sources by partnering with foreign investors.

Within the power industry, again, government involvement is the norm but the industry is considerably more open to private sector involvement than that of the hydrocarbon sector. Private developers are able to participate in all of the major markets, in some instances with full ownership of assets, and more importantly have a relatively free hand in selling or acquiring interests in the plants they develop.

The sale of the Middle East portfolio of AES Oasis, on which HSBC advised the seller, was the largest sale seen to date but there have been a number of smaller trades in Oman and Jordan and other sales are currently under way in the region. We are still seeing very strong investor interest in this asset class, which again shows that potential investors still have a very strong interest in the Gulf region and that M&A activity is limited more by the nature of the market rather than lack of investor interest.

Investment by regional power players, particularly governmental ones, in the power sector outside the region is also picking up, at least in part, as the region seeks to redeploy the capital accumulated from recent high prices into tangible, long-term investment assets.

Government involvement in the energy sector also impacts in another indirect but very important way. Governments in the region continue to manage the price of energy to domestic consumers of both refined oil products (gasoline, diesel) and electricity. Prices vary across the region but are consistently below international prices and in many cases below the actual cost of production. While this is becoming an increasingly expensive undertaking for governments, it is reasonable to expect that the recent political unrest means that a change to the subsidisation of energy prices is unlikely.

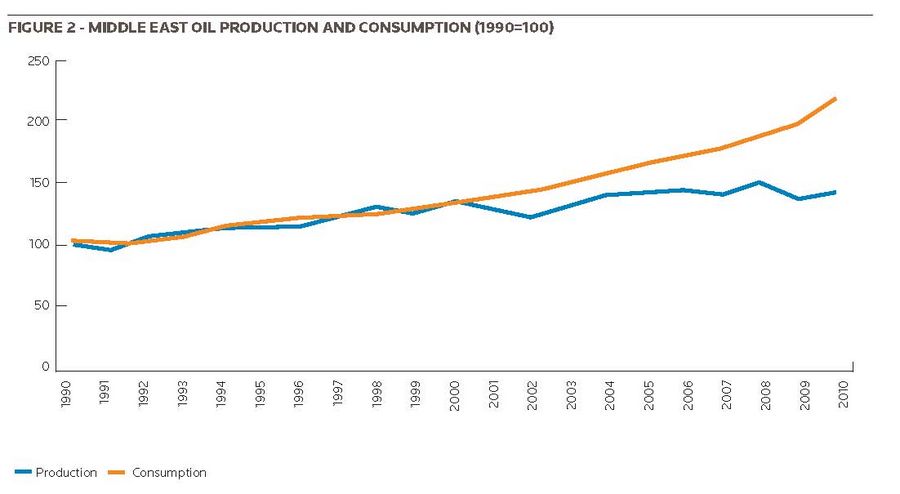

This means that the strong growth in demand for energy in the region will persist and the Middle East will continue its transition from being not only a significant producer of oil and gas to being a significant consumer as well. This transition is well under way (Saudi Arabia already consumes more oil per head than any other nation) and has both a direct effect through the rising demand for refined products eating into the potential exports of crude oil, and indirectly through the rising demand for electricity.

This is in turn constraining gas supplies and in some countries leading to the consumption of oil that would otherwise be exported. This of course will, if unchecked, lead to falling government revenues at a time when government spending is rising rapidly to deal with the infrastructure investment needed in much of the region.

Diagram

This pressure on supply caused by sharply increasing growth in domestic demand will, in our view, increase the drive to bring in the private sector, particularly in the oil and gas industry, both upstream and in downstream refining capacity. This probably won’t lead to significant M&A activity in the major producing states such as Saudi Arabia but will continue to grow activity in those countries with more open upstream markets such as Oman and Egypt.

Concurrently we will see the new governments in Libya and Tunisia being keen to attract more foreign investment in their hydrocarbon industries, and this will again give rise to more M&A activity around the companies owning upstream assets in those countries.

However, this does not mean that M&A activity will be irrelevant to the big producing countries. What we will see from some of the larger national oil companies is more outbound M&A activity as they seek to secure outlets for their crude production, control more of the crude oil value chain, and in some cases access refined products.

In upstream investments some of the major national oil companies will also seek to offset depleting reserves with acquisitions of reserves in other regions and to access operating expertise and technology that can then be redeployed in their domestic operations.

Within the power sector, the dynamics are different but the effect of subsidised prices is no less significant. The rapid rise in demand for power is something that has been under way for some time and has driven a massive expansion of power generation capacity in the region over the past 10 years or so. The power sector has a well established model for participation of the private sector and with the growth we’ve seen in the last decade, there is now a stock of power generation facilities in the region in which the private sector has a significant stake.

This private sector investment is diverse and includes strategic investors from within and outside the region, as well as financial investors, although this is on a much smaller scale. Because of this maturity in the asset base we have already seen a number of transactions in the region in which privately held stakes in the sector have been traded – the aforementioned AES transaction being the largest to date – and we expect this to continue as new players enter the market and existing players seek to manage their portfolios.

The constraints on gas supply and the need to reduce the use of crude oil in power generation is also leading to a more active interest in alternative power generation sources. Nuclear has been the most high-profile of these but we expect the solar sector to become important also over time, particularly as some of the expected challenges with solar in the region appear to be less of a problem than first believed. The onshoring of the technology in solar power generation and in the manufacturing process will drive the acquisition by MENA players of foreign owners of technology and manufacturing expertise.

So in summary, we see growing activity both within the MENA region itself, although in this case more so in the power sector, but also cross-border transaction flow will certainly increase over the medium term across all parts of the energy industry. Current global uncertainty will in our view lead to opportunistic buys from the region, both due to depressed asset pricing but also the desire for diversification from US dollar exposure, and we are therefore confident in predicting a steady rise in activity over the coming five years, although the heady levels seen in 2007 are unlikely to be reached again.