MarketAxess has granted Pimco a special arrangement that allows the bond giant to limit the information it shares on the electronic trading platform and take advantage of any off-market prices, three sources with knowledge of the matter told IFR.

The arrangement, which has been in place for at least three years but is largely unknown outside the close-knit dealer community, allows Pimco to block the transmission of the so-called covers for trades it executes on the platform.

A cover is the second-best price at which an investor could have executed a particular trade after soliciting simultaneous bids from competing dealers.

The concession granted to Pimco isn’t prohibited, but it has raised eyebrows among some market participants, as it gives the firm a prerogative that is not readily available to the platform’s more than 1,000 other institutional investor clients.

MarketAxess declined to respond to detailed questions about its relationship with Pimco and the platform’s set-up. A spokeswoman for Pimco similarly declined to comment.

The Securities and Exchange Commission, which oversees alternative trading systems, did not respond to requests for comment. A representative for the Financial Industry Regulatory Authority, which regulates broker-dealers, declined to comment.

Some critics see the agreement as another example of the considerable sway that the largest institutional investors hold in the US$8trn US corporate bond market - from commanding larger allocations on new bond sales to calling the shots in debt restructurings.

NEW PLATFORMS

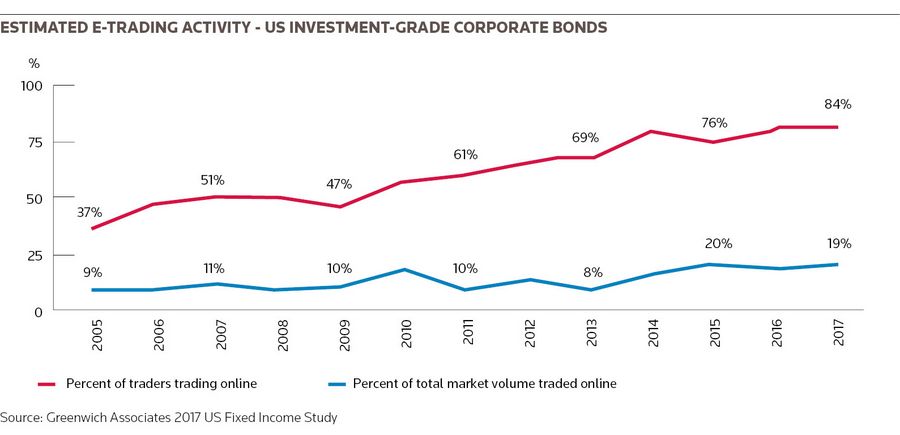

Despite their growth, electronic platforms only absorb around 17% of the total trading volume in US corporate bonds, according to consulting firm Greenwich Associates. Most transactions are still negotiated over the phone, email or instant messenger.

Electronic trading providers have sought to establish themselves as the disruptors of what they see as an antiquated and inefficient market structure, promising market participants increased liquidity and a level playing field.

Such platforms typically earn commissions on each trade executed on their systems as well as membership fees from some of their members.

MarketAxess is by far the largest player in e-trading of US corporate bonds, with a market share of 86% last year, according to data from Greenwich.

Tradeweb - which is majority owned by IFR’s parent company Thomson Reuters - and Bloomberg trail with shares of 6% and 5% respectively.

Tough post-financial-crisis rules have made it more costly for banks to hold bond inventory and the resulting reduction in market liquidity has accelerated an investor shift to electronic trading in recent years.

MarketAxess saw nearly US$1trn of US corporate bonds change hands on its platform in 2017, up 77% from 2014, while its stock has roughly quadrupled in value over the past four years.

PLEASING PIMCO

While other large asset managers initially sought to develop their own platforms, Pimco traditionally resisted the move to electronic trading in corporate bonds.

“Pimco didn’t really do any electronic trading. They were voice traders,” one of the sources, who is a former trader, told IFR.

Pimco has a long-standing practice of declining to disclose the cover bid, regardless of whether a deal is negotiated over the phone or through other means, according to traders who have done business with the firm.

That practice stands in contrast with what the traders described as the standard market practice of providing the winning dealer with information about the cover.

By declining to provide that information, they say, Pimco makes it harder for dealers to get a sense of how their levels compare with the rest of the market. That allows the firm potentially to exploit any gaps by seeking to trade more with the same off-market dealer.

Pimco’s unwillingness to provide cover levels posed an issue for MarketAxess, whose platform had been programmed to automatically display covers under its popular request-for-quotes RFQ trading protocol, two of the sources said.

As a condition for trading on the platform, Pimco requested - and obtained - that MarketAxess block the transmission of cover information for all its trades under the RFQ protocol, according to the two sources.

“Pimco demanded that MarketAxess - for all of their inquiries - removed a function that disseminated to the dealer with the winning bid what the cover was,” one of the two sources told IFR.

“I was told that they were doing this specifically for Pimco and not for everybody else.”

MarketAxess’s decision to accommodate Pimco’s request did not sit well with some market participants, who argue the special treatment is at odds with the platform’s objective of becoming the marketplace of choice for electronic credit trading.

“You are violating the trust that everybody has the same rules in the sandbox,” the same source said.

A third source noted that the fact that MarketAxess provided covers automatically for all its clients was one of the key incentives for many dealers to join the platform in the first place.

IFR was unable to determine whether any other firms have requested - or obtained - the same treatment from MarketAxess following the deal with Pimco.

The decision to accede to Pimco’s request to hide cover bids was never publicised and there is no option on the platform that allows any user to decide whether to provide covers on trades, the three sources said.

A spokesman for Tradeweb declined to confirm whether his company similarly allows certain clients to decline to display covers, while a representative from Bloomberg was not available to comment.

UNDER COVER

Because firms responding to an RFQ don’t see each other’s levels in the process, the cover information is viewed by some as precious because it offers the winner a glimpse into where the closest competitor stood.

“It gives you a sense of your chance of exit, an idea of your potential margin and how far you were from the second-best dealer,” a trader at a major investment bank told IFR. “The difference between the winner and everybody else is just that cover.”

While investors have always had the possibility to decide whether to provide covers over the phone, the majority choose to do so as that helps dealers calibrate their responses and, ultimately, make markets.

“Most accounts who transact with regularity in the corporate bond market are trying to be decent partners and are happy to allow that information to go back to the dealer,” a trader at another major institution said.

“We use cover information to try to improve our performance on subsequent inquiries.”

Many investors who discussed the matter with IFR said they believe covers are so important for market liquidity that they would continue to display them even if they had the option not to do so.

“I love the cover,” one buyside trader told IFR. “That type of transparency is good. That is how the platform should work.”