IFR: So that’ll bring more capital into that sector, interesting. And Jonathan, there was mention made earlier of project bonds, but there aren’t that many. Do you sense that there’s appetite for project bonds out there?

Jonathan Segal: Yes. A lot of people are expressing surprise at why there haven’t been more project bonds. The truth is, these projects take a very long time to structure. There’s a long lead time, often 18 months to two years, even more in some cases. And the bank market was strongly supporting these projects, right through up until the end of 2007 and then in some cases 2008. The reduction of bank interest for these infrastructure projects only kicked in about two years ago, so any decision by issuers to look more to the bond markets would not necessarily have kicked in yet.

My other observation is Dubai World clearly triggered a return to focusing on credit quality rather than implied sovereign support. And implicit in that is that investors are feeling obliged to do more credit work or are prepared to do more credit work. And that’s the dynamic that will work strongly in favour of project bonds as and when there is a flow of those coming to market. We think they will be well received and investors will go back to basics, looking for strong well structured projects in infrastructure and essential projects, rather than the more ambitious ones that don’t have a clear reason for being there. And they will be prepared to do credit work, as a flipside of the weakening in certain credits which were not supported by strong stand-alone fundamentals.

IFR: Talking of in-house credit work, I guess a deal that everyone’s talking about is the US$1bn five-year Sukuk for Dubai in the third quarter, around which there has been a lot of speculation?

Robert Mohamed: I thought it was a non-deal road show. Are you in on that Jonathan?

Jonathan Segal: No additional information over here in London.

Robert Mohamed: That means he’s in.

IFR: Robert, were this deal to happen, would it be seen as a bellwether of sentiment towards the Gulf?

Robert Mohamed: Well, the DEWA transaction was probably the key litmus test for what’s actually going on in the region. There are people who say that transaction was mispriced, I disagree with them. I think given what happened on the 25th November 2009 [the date Dubai World announced it was delaying repayment of its debt], it was critical that the transaction was priced correctly and that was the price the market dictated.

It never went anywhere near the indicative levels that were being sounded out in North America, which obviously were going to be much wider than in the region. I think to come out barely three months after the events of last year with a US$10bn-$11bn book, is a huge success story. That shows you that when we met the accounts across the board, they all bought into the story and all understood the inextricable link between water and electricity. And without that utility entity Dubai almost ceases to exist.

I know that Dubai is on the road at the moment with a series of heavy duty investor meetings. Whether a deal actually comes out of that I don’t know but if it does I think it will be another positive sentiment for the region as a whole.

IFR: If we go back two or three years, Islamic debt was priced wide to conventional debt. That differential eroded to nothing before the global financial crisis and now people are talking about Islamic debt coming at a premium to conventional debt. Is Islamic debt a durable form of debt financing or is it a product gimmick for international banks? Does anyone have any thoughts about Islamic debt and where it sits in the product spectrum?

Robert Mohamed: Clearly, if you asked that question three or four years ago the answer you’d have got is very different from the one you’ll probably hear today. I think that side of the market has been slightly disappointing. I think there could have been a lot more activity, but against the backdrop of that you’ve got to look at the lack of standardisation, the lack of precedents. Every single transaction has to be looked at in a unique way, which incurs exorbitant costs.

If you compare those costs on a straight-line basis to what it would cost you to do a conventional deal, it’s a no brainer because you’re restricted in terms of the Sukuk investor base with that particular account. Also with a conventional product you’ve got a much larger investor base and that’s the way the market’s going. You can see the success of the recent Malaysian Sukuk transaction: there was a huge scarcity element there and the transaction just blew out of the window. I think there are more opportunities for GCC counties to look at the similar product but I think they have to tread very carefully.

Jonathan Segal: The commentators who are making out that the Sukuk market is a different market are missing the point. I think Sukuk offer a different documentation format, and many Sukuk are sold to investors who also invest in conventional bonds. So they’re not two different markets; it’s a slight tweak on an existing international bond market, which depending on the issuer and the size and tenor involved may bias it more or less towards that niche investor base which only invests in Sukuk.

But to talk about the Sukuk market as a different market or to talk about some credit failures or credit problems with Sukuk issues as if it were a distinct market is inaccurate. Credit issues can affect any transaction irrespective of whether it’s a Sukuk or a straight bond. It just depends on the issuer’s fundamentals, not the structure.

So I think Sukuk market will continue. I don’t think there’s any reason for it to grow exponentially faster than the overall financing volumes out of the region, but I think it’ll broadly track those. And it does add some additional investors who don’t invest in the conventional bond market.

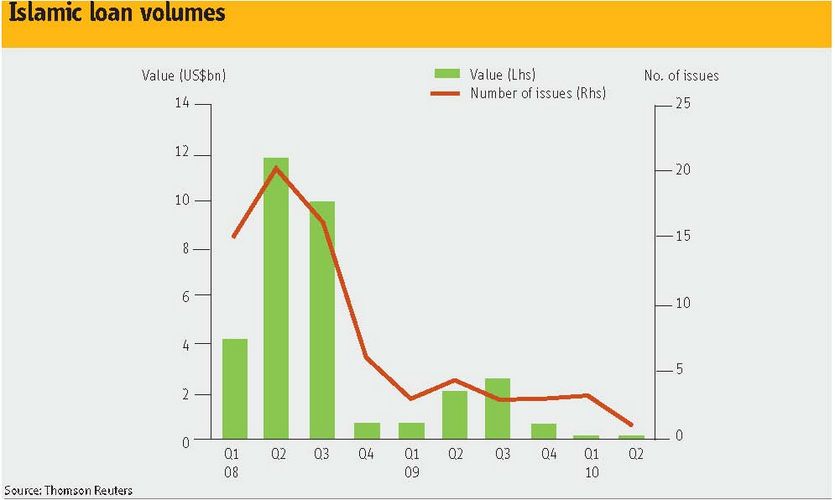

Steve Perry: The Sukuk market is obviously limited in maturity as well, which is why the conventional bonds are normally more attractive. On the loan side, it tends to be a left hand/right hand scenario. You bring an Islamic deal to the table if it makes sense and if you think you can get more liquidity out of the market. If you think you can get it out of the conventional, you won’t touch an Islamic tranche because the borrower doesn’t want to do it because it’s more costly. And as Robert said, it’s very much more time consuming with your Sharia boards being different in certain cases so it can open up a bit of a can of worms. But generally we’ve used them fairly frequently on the loan side and find them a good source of liquidity if you need it.

IFR: So this is additional bank liquidity that wouldn’t necessarily fund the conventional tranche?

Steve Perry: Exactly. Islamic banks only.

Simon Williams: I think many investors are comfortable with the terms that are being used. There’s also real appetite for a standardised terms for Sukuk, so that what is Sharia compliant is understood to be Sharia compliant universally. There were certainly some concerns a while ago that there were inconsistencies and the potential for some Sukuk being ruled non-Sharia compliant, which could have then affected the value. I think when those terms are standardised, the Sukuk market will grow along with that broader Islamic finance world.

IFR: I did just want to talk very briefly about M&A trends. Volumes aren’t particularly impressive here in the region, looking at inbound or outbound deals. Bearing in mind the recovery story, though, would now be a good time for international or regional buyers to engage in M&A on the basis that as the recovery takes hold asset prices go up as well and it becomes more expensive to finance?

Farouk Soussa: I won’t speak to the M&A market specifically but just from a general point of view of consolidation and therefore prospects for M&A. I think on paper it’s a very good time in the sense that as the economies have all taken a bit of a knock, I think consolidation of costs has been key. Companies that have high operational and financial leverage are most exposed to a slowdown in economic activity.

I think that there is a clear argument for further consolidation, both in the corporate sector and in the banking industry and there’s a lot of duplication, not just within the UAE but across the GCC. There’s only so much of any particular industry that the region can sustain so I think on paper there’s a good chance of it. But of course the volatility has put people off. I think the Dubai Holding/Emaar merger was going to be a litmus test of that, in that respect, and it didn’t come off; I think politics and personalities come into play. The fact that a lot of the companies are not listed companies but are big family companies and conglomerates makes it that much more difficult to try and, to achieve what on paper should be happening, which is consolidation.

Robert Mohamed: I think that’s part of the process as well. Some of those family companies are as large as many European listed companies and span the entire GCC region and beyond. If you can get those private families along the listed route and then look at potential IPOs going forward, that in itself will be a key driver of potential M&A activity. What we learned from the prolific growth of the equity market between 2002 and 2007 was that the foundations were less than robust, as we can see now.

Farouk Soussa: We were talking about diversifying funding earlier and we didn’t really talk about equity funding. And that really could be one of the catalysts for us to go forward.

Simon Williams: That requires two sets of reforms: reforms to the equity markets themselves and reforms to those corporates too. I just sense an appetite amongst the capital market authorities and among the large family businesses. They’ve recognised the potential and are ready for change.

I think it needs some policy issues to make it happen. You mentioned the kind of duplication that we have in the region. There are six economies in the Gulf and we have eight equity markets. A single region-wide equity market, as a proposition for international investors, would be very attractive.

Robert Mohamed: And that in itself will engage international investors to stay in the region rather than coming in for a quick exit. Because the transparency element is key; the legal framework and the enforceability are other critical components as well and these are key attractions to keep international investors in the region. These aspects have certainly been part and parcel of the thought process as to whether the dollar you put on the table in the GCC stays for the duration, or whether it’s taken away and returned to its mother country.

IFR: By way of closing our conversation, I wanted to go around the table very quickly to capture general sentiment. If we created a Thomson Reuters IFR Confidence Index today for the Gulf region, where would you all come out in terms of your one-year to 18-month view?

Simon Williams: Give me a two year/three-year time horizon and I’m still convinced by the case for the Gulf economies. I think last year’s downturn was harsh and I think the recovery has taken longer than perhaps most of us round the table might have anticipated. I don’t think we are through it; it’s going to take time.

Farouk Soussa: I think that there are significant opportunities for growth coming from the government expenditure side. I do think credit is starting to pick up in certain of the markets but it has been disappointing in most of the region.

Credit has picked up in Saudi Arabia and Qatar, which will give a good tailwind to growth.

But overall it’s going to come down to government expenditure. Now ultimately that’s a policy decision. If we see a softening in global oil prices it’s a policy decision how long governments are willing to carry on spending. They have the funds but quite clearly don’t want to deplete those funds.

My view is that the strong government expenditure will stay in place. I’m very bullish on growth but probably less bullish on the quality of growth given the fact that there’s very little co-ordination and therefore the risk of duplication. But if you’re asking me will we see growth in the region, I’m probably an eight out of 10.

Steve Perry: I’m always an optimist. In the last three or four months, we’ve seen two corporates come out with five-year transactions. That would have been unheard of about 12 months ago; they’d be doing one-year deals and that was it. And this in the middle of the Greece crisis as well. So I think in 18 months I’ll be a seven or eight.

Robert Mohamed: I’d probably echo that. I’m extremely bullish, and the ability of prime government related entities and corporates to access the market speaks for itself. I think I’m probably coming out at seven or eight.

Jonathan Segal: I agree with all of that. I’d probably be seven or eight, maybe eight for choice. I think the only thing that may hold back the progress and growth in the region is the banking sector, which outside a few safe havens, will take a while to come through the phase of write-downs etc. We think it could take as long as one to two years for there to be forward momentum. Barring that, I think that there’s a lot of reasons to be positive about the region.

IFR: On that note gentlemen I think we’ll bring it to a close. Thank you for your comments.

Click here to view the Online magazine version.

| Top 5 Global Loan rankings | |||||

| 2010 H1 | |||||

| Financial adviser | YoY rank change (%) | Value (US$m) | Market share | No of deals | |

| 1 | JP Morgan | — | 36,705.90 | 9.1 | 106 |

| 2 | Bank of America Merrill Lynch | — | 33,404.50 | 8.3 | 176 |

| 3 | Mizuho Financial Group | ?2 | 33,244.60 | 8.3 | 223 |

| 4 | Mitsubishi UFJ Financial Group | ?1 | 26,919.20 | 6.7 | 229 |

| 5 | Sumitomo Mitsui Finl Grp | ?1 | 23,930.90 | 6 | 186 |

| YoY change is H1 2010 compared to H1 2009 | |||||

| Source: Thomson Reuters | |||||

| Top 5 MENA Loan rankings | |||||

| 2010 H1 | |||||

| Financial adviser | YoY rank change (%) | Value (US$m) | Market share | No of deals | |

| 1 | WestLB | ?6 | 2,243.00 | 18.1 | 6 |

| 2 | HSBC | ?1 | 1,229.80 | 9.9 | 4 |

| 3 | Mitsubishi UFJ Financial Group | — | 959 | 7.7 | 2 |

| 4 | National Bank of Abu Dhabi | ?4 | 895.9 | 7.2 | 1 |

| 4 | Santander | — | 895.9 | 7.2 | 1 |

| Note YoY change is H1 2010 compared to H1 2009 | |||||

| Source: Thomson Reuters | |||||

| MENA Syndicated Loan Fees | |||

| 2010 H1 | |||

| Manager | Fees (US$m) | Market share (%) | |

| 1 | Standard Chartered | 7.5 | 6 |

| 2 | Mitsubishi UFJ Financial Group | 5.8 | 4.6 |

| 3 | Sumitomo Mitsui Finl Group | 5.2 | 4.1 |

| 4 | Mizuho Financial Group | 4.8 | 3.8 |

| 5 | HSBC | 4.8 | 3.8 |

| 6 | Credit Agricole CIB | 4.3 | 3.4 |

| 7 | Banque Saudi Fransi | 4.1 | 3.3 |

| 8 | Alinma Bank | 4.1 | 3.3 |

| 9 | National Commerical Bank | 4.1 | 3.3 |

| 10 | Societe Generale | 3.7 | 2.9 |

| Total | 125.6 | ||

| Source: Thomson Reuters/Freeman Consulting | |||

| MENA Syndicated Loan Fees | |||

| 2009 H1 | |||

| Manager | Fees (US$m) | Market share (%) | |

| 1 | Credit Agricole CIB | 10.4 | 9.4 |

| 2 | Standard Chartered | 8 | 7.2 |

| 3 | HSBC | 6.7 | 6 |

| 4 | Mashreq Bank | 4.3 | 3.9 |

| 5 | National Bank of Abu Dhabi | 4.2 | 3.8 |

| 6 | BNP Paribas | 4 | 3.6 |

| 7 | State Bank of India | 3.9 | 3.5 |

| 8 | Mitsubishi UFJ Financial Group | 3.8 | 3.4 |

| 9 | RBS | 3.5 | 3.2 |

| 10 | Sumitomo Mitsui Finl Group | 3.4 | 3.1 |

| Total | 110.9 | ||

| Source: Thomson Reuters/Freeman Consulting | |||

| Top 10 MENA loan issues | ||||||||

| 2010 H1 | ||||||||

| Loan package amount (US$m) | Date | Borrower | Nation | Sector | Maturity date | Use of proceeds | Bookrunners | |

| 3,584 | 24/03/2010 | IPIC | Utd Arab Em | Other finance | 24/03/2013 | Refin/Ret Bank Debt, General Corp Purp | Banco Santander de Negocios, Bank of Tokyo-Mitsubishi UFJ, HSBC, National Bank of Abu Dhabi | |

| 2,500 | 24/02/2010 | Orascom Telecom Holding SAE | Egypt | Telephone Commun | 14/04/2013 | Refin/Ret Bank Debt | BNP Paribas, Banque Misr, Barclays, Caisse Nationale de Credit Agricole, HSBC, ING, JP Morgan, Mashreq Bank, National Bank of Egypt, Standard Bank, Standard Chartered Bank, WestLB | |

| 2,000 | 14/05/2010 | Qtel | Qatar | Telephone Commun | 14/05/2013 | Refin/Ret Bank Debt, General Corp Purp | BNP Paribas, DBS Bank, Qatar National Bank, Societe Generale, RBS | |

| 1,709 | 14/01/2010 | Global Investment House KSCC | Kuwait | Investment Bank | 14/01/2013 | Refin/Ret Bank Debt | WestLB | |

| 650 | 25/03/2010 | Qatar Aviation Leasing | Qatar | Insurance | 25/03/2013 | General Corp Purp, Aircraft Financing | Deutsche Bank, Standard Chartered Bank | |

| 505 | 17/05/2010 | African Export-Import Bank | Egypt | Commercial Bank | 17/05/2011 | Refin/Ret Bank Debt, General Corp Purp, Finance Linked-Trade | Arab Banking Corporation (ABC) Capital Markets Group, Bank of Tokyo-Mitsubishi UFJ, HSBC, ICBC Bank, Raiffeisen Zentralbank Oesterreich, Standard Bank, Standard Chartered Bank, WestLB | |

| 320 | 11/05/2010 | Saudi Oger | Saudi Arabia | Construction | 01/07/2012 | Refin/Ret Bank Debt | Caisse Nationale de Credit Agricole, ING, Fortis, Arab Bank, RBS | |

| 278 | 19/03/2010 | Bonyan Dev and Trade | Egypt | Real estate | 18/01/2017 | General Corp Purp | Commercial International Bank (Egypt) SAE | |

| 250 | 14/01/2010 | Egyptian Drilling Co | Egypt | Natural Resource | 13/01/2017 | General Corp Purp | Cairo Aman Bank (Eqypt), Commercial International Bank (Egypt) SAE | |

| 250 | 09/06/2010 | Allana International Ltd | Utd Arab Em | Retail | 09/06/2013 | Refin/Ret Bank Debt General Corp Purp | BNP Paribas, HSBC, State Bank of India, WestLB | |

| Source: Thomson Reuters | ||||||||