Are G-SIBs doing enough to promote and support gender diversity in their senior executive ranks? On the evidence of the EBA’s recent survey and my own analysis of the most senior management bodies of US and European G-SIBs, clearly not.

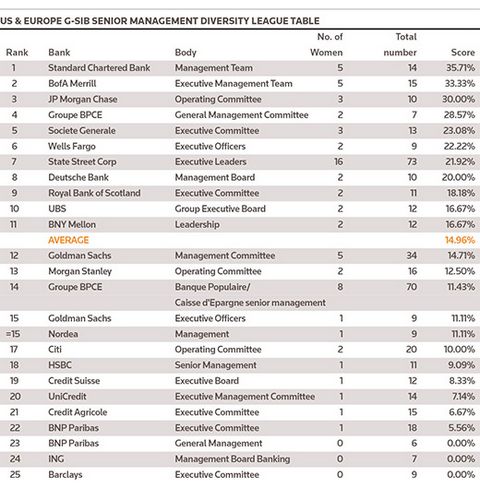

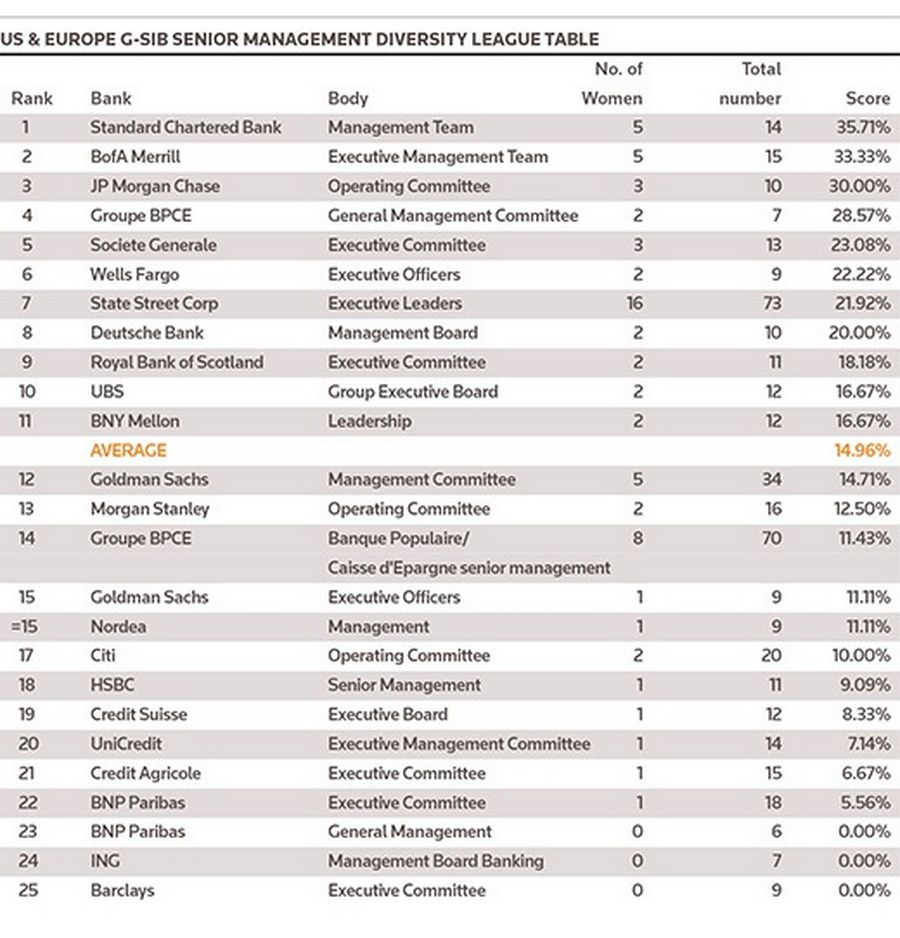

Check out my diversity league table below. As you will see, there are some big discrepancies in achievements here. The EBA’s recent Report on Benchmarking of Diversity Practices found that only 15% of UK firms surveyed had a policy on promoting diversity on their management bodies. Diversity is a question the industry has been pondering for some considerable time. But there needs to be less pondering and more doing.

In the UK, the issue was pushed front-of-mind following the open letter penned a couple of weeks ago by James Proudman, executive director, deposit takers supervision; and Sarah Breeden executive director of international banks supervision at the UK’s Prudential Regulation Authority. The letter reminded all firms covered by the Capital Requirements Regulation of their obligations in this regard.

My analysis of the 23 US and European G-SIBs’ most senior management bodies found that of the 420+ executives running many of the world’s biggest banks, there were just 67 women. The numbers are massively skewed by State Street, which accounts for almost a quarter (16) of the cadre of senior women working at those G-SIBs by dint of its huge executive board (73 people).

I counted just 12 women running business lines at European and US G-SIBs, almost all in retail/consumer banking and asset and wealth management. Of the rest, around a dozen run HR; another dozen are in finance, legal, and risk roles; just three run regions and the rest are in a variety of central C-suite support roles.

Only Isabelle Ealet, co-head of securities at Goldman Sachs, and Kim Newell, head of EMEA global markets at State Street, feature in investment banking roles.

I say (with some hesitation) that I’m not sure I understand why corporate governance issues should have permeated the CRR/CRD IV or whether capital adequacy and related ‘quantifiable hard-risk’ issues sit comfortably alongside rather unquantifiable ‘soft-risk’ issues such as diversity and compensation.

But far from being seen as a soft issue – and skating over the potentially challenging regulatory steer towards positive discrimination that I’m not going to comment on here – EU agencies do seem deeply troubled by the rather sinister-sounding notion of groupthink with regard to corporate governance. Groupthink came in the CRD, it came up in the EBA benchmarking report, and it made it into the PRA letter. (I think they’ve all been entranced by groupthink.)

“There is a risk that groupthink undermines good governance in firms,” Proudman and Breeden wrote in their letter, “leading to decisions which impact the safety and soundness of firms being arrived at without sufficient consideration of a broader range of viewpoints and perspectives.”

In its recent benchmarking survey (which collected data from 873 banks in 29 European countries), the European Banking Authority said more diverse management bodies “can help improve decision-making regarding strategies and risk-taking by facilitating a broader range of views, opinions, experience, perception, values and backgrounds. A more diverse management body reduces the phenomena of ‘groupthink’ and ‘herd behaviour’.”

The survey found that despite the legal requirements (see Appendix below), only a limited number of institutions had adopted diversity policies. And gender diversity targets differ significantly between EU/EEA member states as does the actual level of diversity in the composition of banks’ management bodies. The EBA found a 13.63% representation of women in management functions and 18.90% in supervisory functions, which it considers very low. Diversity at smaller institutions is even lower.

Banks can no longer brush this issue under the executive carpet. In Europe, certainly, time is running out: the European Commission is due to review and report on the results of what is enshrined in the CRR/CRD IV on this key topic by the end of this year. The clock is ticking …

APPENDIX

Here are the relevant bits of the Capital Requirements rulebook that I’ve produced here for reference.

Article 60:

“The lack of monitoring by management bodies of management decisions is partly due to the phenomenon of ‘groupthink’. This phenomenon is, inter alia, caused by a lack of diversity in the composition of management bodies. To facilitate independent opinions and critical challenge, management bodies of institutions should therefore be sufficiently diverse as regards age, gender, geographical provenance and educational and professional background to present a variety of views and experiences.

“Gender balance is of particular importance to ensure adequate representation of population. In particular, institutions not meeting a threshold for representation of the under-represented gender should take appropriate action as a matter of priority.

[…]

More diverse management bodies should more effectively monitor management and therefore contribute to improved risk oversight and resilience of institutions. Therefore, diversity should be one of the criteria for the composition of management bodies. Diversity should also be addressed in institutions’ recruitment policy more generally. Such a policy should, for instance, encourage institutions to select candidates from shortlists including both genders.”

Article 88 Section 2:

“Member States shall ensure that institutions which are significant in terms of their size, internal organisation and the nature, scope and complexity of their activities establish a nomination committee composed of members of the management body who do not perform any executive function in the institution concerned. The nomination committee shall: (a) identify and recommend, for the approval of the management body or for approval of the general meeting, candidates to fill management body vacancies, evaluate the balance of knowledge, skills, diversity and experience of the management body and prepare a description of the roles and capabilities for a particular appointment, and assess the time commitment expected.

Furthermore, the nomination committee shall decide on a target for the representation of the under-represented gender in the management body and prepare a policy on how to increase the number of the under-represented gender in the management body in order to meet that target.”

Article 91 Sections 10 and 11:

“Member States or competent authorities shall require institutions and their respective nomination committees to engage a broad set of qualities and competences when recruiting members to the management body and for that purpose to put in place a policy promoting diversity on the management body.

“Competent authorities shall collect the information disclosed in accordance with Article 435(2)(c) of Regulation (EU) No 575/2013 and shall use it to benchmark diversity practices. The competent authorities shall provide EBA with that information. EBA shall use that information to benchmark diversity practices at Union level.”

And finally, Article 435 requires institutions to disclose their governance arrangements with at least annual updates. Section 2(c) demands transparency on the policy on diversity “with regard to selection of members of the management body, its objectives and any relevant targets set out in that policy, and the extent to which these objectives and targets have been achieved”.