India’s bank capital gap is coming down, but for the wrong reasons. Banks are putting the brakes on lending instead of raising equity and holding onto unrealistic price expectations in the offshore bond market.

India’s banks have made some progress in addressing their capital shortfall over the last year, but it’s not yet reason to celebrate. While the past two months have seen a flurry of bank capital issuance in the local bond markets, the sector will need to do more in the far deeper offshore capital markets, where investors and issuers remain far apart on pricing.

At an estimated US$90bn, according to Fitch Ratings, the funding gap to meet Basel III capital requirements from 2019 remains sizable. On the surface, the hole has narrowed a lot from estimates of US$140bn a year ago, but market participants say the shrinkage reflects a slowdown of lending growth into single digits, rather than resolute efforts to raise capital. With the economy set to grow at around 7.5% this year, roughly the same pace as last year, tamping down on lending is also not realistic in the long term, analysts warn.

“On an optical basis [banks] may be able to manage their capital ratios, but I don’t think this is a sustainable solution,” said Saswata Guha, a director at Fitch Ratings. “And it’s not without its ripple effects. Hybrid securities will have to start shouldering a significant share of the capital burden if banks have to consider lending in a meaningful way.”

With the Indian government planning to inject only US$10bn over the next four years into the state-owned banks, bankers and analysts say that Indian banks will have no choice but to look to the global capital markets to raise the amounts needed.

Today, even quality projects struggle to get access to funding, and bankers say they are struggling to meet demand for credit.

Capital buffers are also under pressure from the rise in bad loans, which jumped 15% in the first half of this year to US$138bn in June, according to central bank figures, despite the slowdown in lending.

Furthermore, by April 2017, domestic banks will begin migrating to the Indian Accounting Standards, which is close to IFRS. This will force them to make provisions based on expected credit losses, something that could add further pressure on their capital strength.

As such, Indian bank analysts explain that capital remains as important a problem as ever, and that the drop in the funding gap is misleading. Even a very modest increase in the pace of bank lending could easily push the figure back over the US$100bn mark.

With the Indian government planning to inject only US$10bn over the next four years into the state-owned banks, which account for 80% of the capital shortfall, bankers and analysts say that Indian banks will have no choice but to look to the global capital markets to raise the amounts needed.

Indian banks have been busier lately raising capital onshore. September was particularly active, as many issuers sought to take advantage of tighter spreads. State Bank of India printed two Additional Tier 1 offerings which raised a total of Rs46bn (US$687m) and Union Bank of India and Oriental Bank of Commerce each raised Rs10bn via AT1s. Prior to these deals, onshore AT1 issuance had only totalled Rs100.3bn in the first eight months of the year, according to Fitch.

While initially reticent, domestic investors have become fonder of hybrid securities as falling government bond yields have reached a point where new AT1s are offering investors as much as 300bp more yield.

Yet many analysts maintain that the onshore subordinated debt market is not deep enough to match the sheer amount that will need to be raised. There are also questions around the strength of state support for bank capital bonds – one of the main selling points for investors. The Indian government has put forward a new draft bill that will create a bank resolution plan and includes an option to bail-in creditors.

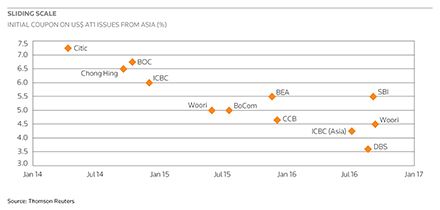

The offshore market offers the potential to raise substantially more capital, but the pricing mismatch between issuers and investors has left the market in limbo. A case in point was State Bank of India’s September issue of Additional Tier 1 capital, the country’s first in the offshore market under Basel III.

When news emerged that SBI was marketing the B1/B+ (Moody’s/S&P) rated bonds at an aggressive mid-5% area, investors roundly criticised the transaction as absurdly tight. At the time, higher-rated AT1s from Standard Chartered and Barclays were yielding over 7.75%.

A weak investor response pushed SBI to cut the size of the perpetual non-call five offering to US$300m from initial indications of a benchmark US$500m. Details of the order book were not disclosed, and the bonds launched at 5.5%. They fell close to a full point from par upon hitting secondary markets.

Bankers defended the deal as reasonable, given the rates Asian banks were paying for their AT1s, and also highlighted that there was significantly more state support behind most of these banks, unlike those in Europe. Some denied that SBI had ever wanted to raise as much as US$500m, saying instead the lender was only interested in locking in as low a price as possible.

Since their unhappy beginning, SBI’s bonds have quietly recovered and were bid at 99.750 in late October, according to Tradeweb. Following the deal, two new Chinese AT1s priced well inside of SBI, prompting some investors to joke that maybe SBI looked like a decent yield after all.

The buyside may have pursed its lips, but FIG bankers argue that SBI has done an important service to the rest of the country’s banks by setting a benchmark that can be referenced for future bank capital transactions. The pricing SBI was able to achieve will encourage other Indian banks to venture into the offshore market at the start of next year, they say.

“Investors may not have liked it, but the secondary market is telling us what the value of the SBI bonds is, and they are doing ok,” said a Hong Kong-based head of Asia-Pacific FIG at a large European investment bank who worked on the SBI AT1. “The SBI trade was challenging, but we still got it done. It has established a template and a precedent, and other banks will look to that.”

Some investors, on the other hand, question whether a US$300m offering is really large and liquid enough to provide a benchmark for the entire Indian banking industry.

The next Indian lender to explore the offshore AT1 market will have to offer more of a concession and pay substantially more to achieve a meaningful size, investors say. They also point out that SBI, even with some problematic fundamentals around its profitability and loan book, is actually in better shape than its state-owned peers.

In effect, future issuance of offshore capital relies on a calculation that the opportunity cost for Indian banks will outweigh the cost of issuing capital at market-clearing rates. If demand for credit rises a notch as the economy rebounds, issuers may have to change their mindset.

For now, however, questions over the fair value of Indian bank capital securities remain unanswered.

“They won’t get away with that again and will certainly have to pay more than SBI, and you can’t say that a deal that was that hard to do will lead to more,” said a Hong Kong-based head of fixed income at a large asset management firm. “If they want to do anything in size, they will have to pay more than this. I can’t see SBI as a real benchmark for any of them.”

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@tr.com