Betting on markets remaining calm has long been a popular, though risky, trade in finance. Now, a growing number of banks is looking to bring such strategies to corporate credit markets, the last major asset class where so-called short volatility trades are rare.

JP Morgan updated its credit volatility index earlier this year with an eye on bringing systematic credit volatility strategies to a wider audience, spawning an exchange-traded fund launch in late March.

Goldman Sachs has been trading a revamped version of its own index since late last year, according to people familiar with the matter. Other banks including Barclays, BNP Paribas, Citigroup, Deutsche Bank and Societe Generale are working on their own offerings, according to people familiar with the matter.

Trades that profit from markets staying subdued - or shorting volatility in trader speak - entered the mainstream in other asset classes several years ago, most notably in equities with products referencing CBOE’s famous S&P 500 “fear gauge” - the VIX.

They have a chequered history. Last year, a surge in equity volatility upended some of those products in spectacular fashion, underlining the risks of such trades.

Adding credit derivatives into the mix may sound ominous. But bankers believe the market is ripe for development, offering investors potentially meatier returns at lower levels of volatility than in markets like equities.

“People are now looking at credit volatility in its own right,” said Danny White, head of credit index structuring at JP Morgan. “That’s a big shift.”

A TOUGH SELL

Traders short volatility by selling options contracts. There is money to be made doing that for the simple reason that other investors are willing to pay for the certainty of having the right to buy or sell an asset at a given level in the future.

These strategies are profitable so long as the market doesn’t gyrate too much over the course of an option’s life, but can rack up hefty losses if it does. Credit Suisse shuttered its short VIX product after it lost over 80% of its value early last February following an explosion in equity volatility, which analysts dubbed “Vol-mageddon”.

One draw for the pension funds and asset managers that engage in systematic volatility selling is that returns are far less reliant on the direction of broader markets than simply buying a stock or bond.

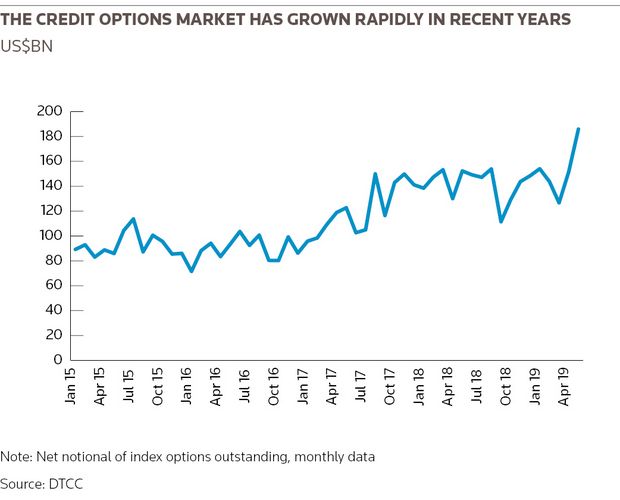

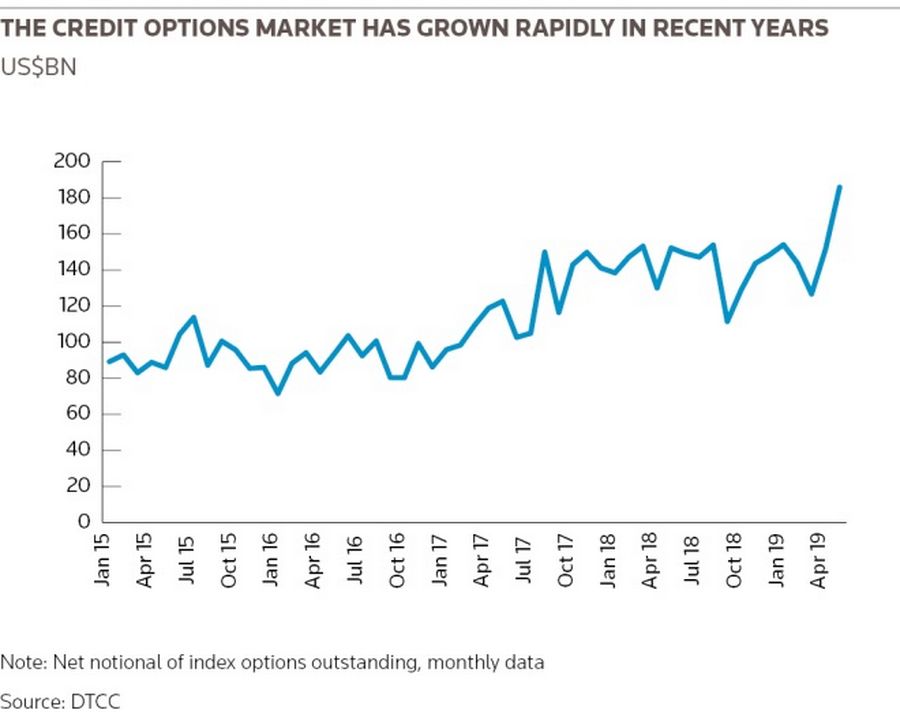

Bankers hope that the rapid growth in credit options will open up the market to such activity. Daily trading volumes in credit options now clock in between US$20bn and US$25bn, analysts say. That compares to average daily volumes of roughly US$22bn in US high-grade corporate bonds, according to MarketAxess.

But the credit volatility market has proven a tough nut to crack until now. One problem is that the market is far more lopsided than in equities. Buyers, such as insurance companies hedging their bond portfolios, far outweigh the small number of funds willing to sell credit options.

As a result, the implied volatility - effectively the cost of buying those options - tends to trade at a 30% premium to realised volatility, or how much the market actually moves over the contract’s life, according to JP Morgan. In the equity market, that premium is closer to 5%.

“One of the reasons the premium exists is because people psychologically don’t like selling volatility on credit,” said White.

Ease of trading presents another problem. Trading credit options is complicated and operationally burdensome.

“We don’t have easy access for now for systematic volatility positions,” said Michael Hattab, a senior portfolio manager at LFIS, a Paris-based investment manager. Currently “you need to have the perfect execution” to make money.

BROADER AUDIENCE

Bankers hope they can drum up more interest in this area by creating indexes that systematically short volatility, and then selling them to clients through certificates, funds or swaps.

Take the recent launch by ETF provider Tabula Investment Management of a fund that tracks the JP Morgan Global Credit Volatility Premium Index. The strategy sells options on credit-default swap indexes linked to European and US high-yield debt. It also hedges moves in credit spreads daily with the aim of providing investors exposure purely to the difference between implied and realised credit volatility.

That differentiates it from some of the short VIX products that blew up last year. Those were exposed to market moves - and were far more levered. Another selling point: credit spreads tend to be less volatile than stock prices during market sell-offs.

“The way volatility moves and also returns to previous levels is different in these two markets,” said MJ Lytle, chief executive of Tabula.

Since its launch, assets in the Tabula ETF have grown from around €10m to €53m. The ETF returned about 1% in April and is down around 1.4% in May following the recent pick-up in volatility. The JP Morgan index has on average returned roughly 8% a year since June 2008, the bank said. The biggest drawdown over that period - or decline from a recent peak - was 9.7%, in 2010.

Other banks are looking at updating their own indexes with the aim of selling them to a wider range of clients. Though one banker said he was not sure about launching a related ETF because of the potential for retail investors getting involved.

An important turning point was data provider IHS Markit bolstering its offering on credit options late last year. That allowed banks to use third-party data rather than their internal marks for options positions, giving clients greater comfort.

“In terms of the market depth, there’s more banks that really made a commitment to providing liquidity compared to a couple of years ago,” said Gavan Nolan, director, fixed income pricing and research at IHS Markit.