Five contract months will initially be listed, beginning March 2015. The contracts will be traded in units of ¥100, similar to Nikkei 225 mini contracts in an attempt to attract a broad range of investors.

The index is a departure from typical price or market-cap weighted benchmarks as it employs smart-beta methodology to skew exposure towards firms with more shareholder-friendly policies.

Created as part of the third pillar of Prime Minister Shinzo Abe’s package of economic reforms aimed at strengthening corporate governance and kick-starting the economy, the index selects constituents based on operating profit and return on equity metrics.

Having already enjoyed a significant boost after GPIF, the country’s largest pension fund with US$1.3trn of assets under management, confirmed its intention to shift its benchmark from Topix to the new Nikkei 400, the listed derivatives instruments are expected to garner significant support, particularly if the experience of Topix 1,000 futures is anything to go by.

Launched last March, investors flocked to the OSE for Topix contracts, which now rival the more established Nikkei 225 contracts. According to OSE data, open interest on Topix futures stood at 520,513 at the end of October, compared to 412,741 for Nikkei 225 futures. However, the lesser-known index has struggled to gain traction with smaller investors as mini futures linked to the benchmark garnered open interest of just 62,827 compared to 632,933 for similar instruments linked to the Nikkei 225.

Quick take-up of the newer contract reflects increasing investor frustration with the price-weighted methodology of the Nikkei 225, which sees Japan’s most high profile equity index heavily skewed to a handful of firms. For example, just three companies account for almost 20% of the Nikkei 225, with Fast Retailing Co representing over 10% of the index.

Topix employs a market cap weighting that has delivered a broader distribution with higher weight towards financials and yen-sensitive exporters – the first to reap the benefits of monetary easing. However, with corporate governance at the centre of the next wave of Abe’s economic reforms, much of that interest is expected to flow to the newest addition to Japan’s listed equity derivatives market.

Interest in the Nikkei 400 has grown rapidly since launch. More than 15 exchange traded funds already track the index, including five JPX-listed funds with total assets of more than ¥200bn, according to exchange data.

In addition, the index has already spurred an active over-the-counter derivatives market including breakable total return swaps and call options for direct exposure as well as relative value trades.

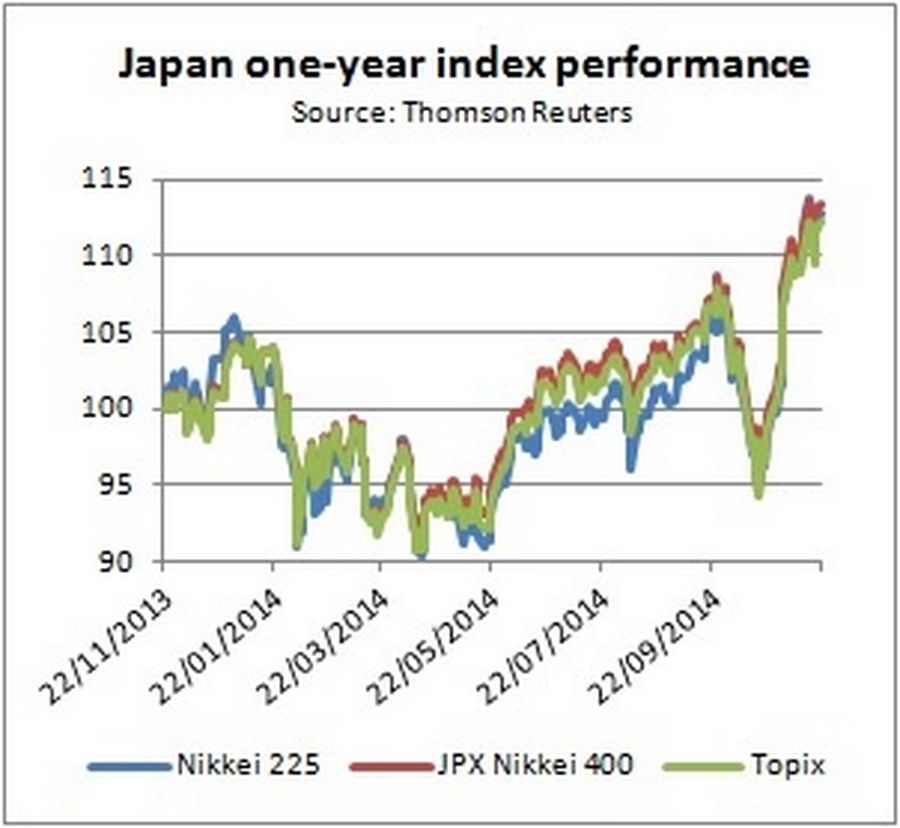

Given the high correlation between the three indices – around 95% – investors are typically playing relative value through conditional outperformance options that pay out only if the index closes up at expiry, delta one swaps overwritten with options to pay out after the first few percentage points of performance, or timer outperformance options to reduce the cost of exposure.

A total of seven dealers have already signed up to be part of the market-making programme for the new futures, including Mitsubishi UFJ Morgan Stanley Securities, BNP Paribas Securities and Newedge Japan, owned by Societe Generale.

Japan one-year index performance

Source: Thomson Reuters