Lauded for the success of its original covered bond purchase programme in 2009–10, the European Central Bank is, however, receiving far less praise for its second effort.

To view the digital version of this report, please click here.

Now more than halfway through the 12 months it set aside for the programme, the ECB has only spent a third of its €40bn kitty and there appears little it can do to claw open Spain and other markets locked shut by the crisis.

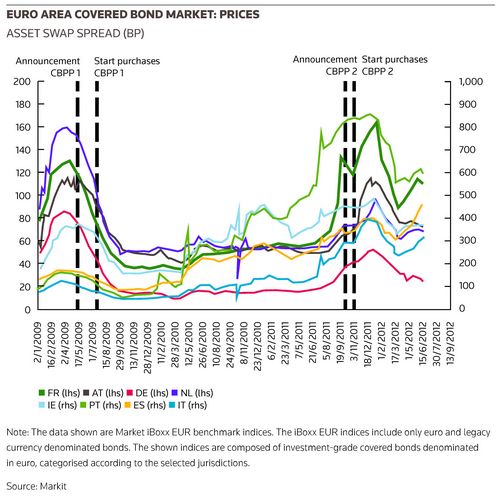

ECB analysis shows that in contrast to the first programme, which slashed covered bond yields before a single euro was even spent, the launch of the second one had little immediate impact.

In fact, swap spreads continued to climb well into its second month and only reversed once the first of the ECB’s twin LTROs was unleashed at the end of December.

Apart from the headline figure – the first covered bond programme was worth €60bn – differences between the two programmes are mainly cosmetic.

As in 2009–10, the current programme buys in both primary and secondary markets with the aim of easing general funding conditions and improving market liquidity.

The maturity of bonds eligible for purchase has been pushed up to 10.5 years from about seven years and minimum issuance volume has been cut to €300m from €500m.

When it started the new purchases in November it wanted to spend more of its money in the primary market than the first time around when almost three-quarters of its purchases were in the primary market.

Experts suspect it was to try and help banks with less than guaranteed market access get bonds away.

Correct tactics

But its plans have been scuppered by the intensification of the crisis. The split between primary and secondary market purchases currently stands at 65%/35% in favour of the secondary market, having been 56% in the primary market in February when markets were still basking in the afterglow of the LTROs.

With little fundamental difference between the two programmes, many blame the impotence of the current one on a mix of the paralysing power of the debt crisis and a belief that the ECB simply did not get its tactics right.

“Sometimes the solutions fit the problem and sometimes they don’t,” said one senior covered bond analyst at a large European bank.

“Back in 2009 we were in a banking crisis and the spreads between the resident sovereigns and the covered bonds were tremendously wide. When the second programme started it was no longer a banking crisis; it was a sovereign crisis so it was a totally different situation.”

“Many covered bonds were already trading almost flat to the sovereign so what can you expect a purchase programme in this situation to do. The answer is nothing, there is zero impact,” he added.

Analysis shows that there was only a drop in spreads once the ECB buried banks neck deep in ultra-cheap LTRO cash.

Side effects

The side effect of the monster injections, however, has been a major reduction of new covered bonds issuance in many major markets. There is little sense for a bank in Spain to pay 5% or 10% to issue a covered bond when it can just knock on the ECB’s door and get 1% money no questions asked.

In fact, there has only been about €45bn worth of eurozone covered bonds issued so far in 2012, nowhere near where it was this time a year ago.

Analysts also added that issuance from outside the eurozone could even top that from inside the bloc this year, something which would be unprecedented.

Benjamin Sahel, head of the ECB’s market operations analysis department said that it was not really a problem that the LTROs appear to be cannibalising the covered bond market because overall banks are benefiting from both.

Cavalry and the Big Bertha

While banks may have used the LTROs to get their one to three-year funding, CBPP2, as it is known, helps out if they are looking for anything longer.

“The cavalry and the Big Bertha are complementary,” Sahel said at an IFR conference in Frankfurt in May. No prizes for guessing which one was the LTRO.

ECB experts do admit, however, that CBPP2 does not have the power to reopen markets that have been slammed shut by the problems of their sovereigns. Risk aversion to troubled parts of the eurozone is just too strong.

There has been no covered bond issued by Greek, Portuguese, Italian, Cypriot or Irish bank since CBPP2 started in November and none are expected any time soon. After enjoying a brief lush spell at the start of the year, Spain’s banks are also on the market’s blacklist again.

Uncertain future

With the ECB’s purchases continuing at a snail’s pace and highly unlikely to pick up enough speed to hit the €40bn target by the programme’s November end date, questions are now centring on whether the bank will cut short its spending or give itself more time to finish the job.

In April when the bank’s LTROs were still warming sentiment, Mario Draghi suggested the ECB could cut and run.

“After the LTROs the market conditions have improved considerably. That is one of the reasons why we will monitor the programme to judge whether it is appropriate in the present market conditions,” he said at a news conference.

But things have changed dramatically since then and there has been no more news out of the euro tower.

If the ECB did shut the programme down prematurely it would be the first time in its history it had not completed one of its plans.

And although questions remain over its usefulness in the current environment, analysts argue the ECB should trudge on regardless.

“I think they will just let it keep on going. There is no need to kill a dead man,” said one.

Despite the criticisms, those inside the ECB are certain the programme has provided some support to the market.

They point not only to how it is helping banks with three-year plus funding, but also how it was welcomed by Spanish issuers during their two-month issuance blast at the start of the year which raised them almost €7bn.

And if markets do show any signs of opening back up, most would be more than happy if the ECB was still there to lend a helping hand.