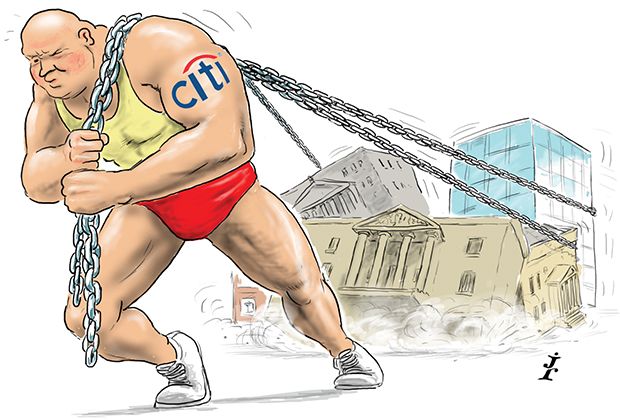

Issuance of capital by banks around the world was one of the big themes of 2014 in the US market, and Citigroup grabbed the lion’s share of the business, while at the same time expanding its client base among US financials. Citigroup is IFR’s North America Financial Bond House of the Year.

The past year has seen a surge of bank issuance in the US market, not only by US financials but also Yankee banks, as jurisdictions around the world finalise regulations dictating capital, leverage and liquidity ratios.

Bond as well as preferred issuance in US dollars by financials (excluding self-led deals and issuing entities of corporates) had surged to more than US$415bn by November 15 2014, eclipsing what was a record US$311bn in 2013, according to Thomson Reuters data.

Citigroup was at the front of the highly competitive pack of underwriters fighting for the business. Having spent years forging new relationships with banks in every corner of the world, Citigroup brought a greater diversity of bank names to US investors than anyone else.

“Our FIG business is a perfect manifestation of being a global organisation,” said Peter Aherne, head of North America capital markets, syndicate and new products at Citigroup. “And the keystone of that business is our strength in corporate bond underwriting.”

Societe Generale and Credit Agricole chose Citigroup for the second consecutive year for capital securities issuance, while Nordea awarded the bank with a joint lead manager role on its inaugural two-part AT1 offering of US$1bn of perpetual non-call fives and US$500m of perpetual non-call 10-year securities – the first by a Swedish bank.

Citigroup was chosen by Abu Dhabi’s Al Hilal Bank to underwrite its inaugural US$500m AT1, the first for that country, as well as to bring Emirates NBD to US investors for the first time with its own US$500m AT1 – also a first for the UAE.

One of Citigroup’s greatest strengths is the repeat business it receives from Australian, Japanese and Canadian banks.

Highlights out of Asia included SMFG’s debut US$1.75bn Tier 2 trade, ANZ’s US$800m 4.5% 10-year subordinated Tier 2, a first for an Australian bank in the Yankee market, and a US$1bn debut by Hong Kong-based AIA.

Citigroup was also active bookrunner on what became the US’s biggest REIT deal to-date – a US$3.5bn offering of three, five, 10 and 30-year fixed-rate notes by Australia’s Westfield Corp.

Its close relationship with all of the Canadian and Australian majors enabled Citigroup to revive the US covered bond market as soon as basis swap changes made the US competitive with Europe.

After underwriting the first US dollar covered issue for the year, a US$1.75bn five-year from Westpac, it was on every one of the five deals that followed.

Citigroup also didn’t miss a step in the US market. It was used so often as an underwriter of FIG deals that few days went by when the bank was not leading a FIG trade, and sometimes several on the same day.

In January, for instance, it brought Legg Mason, SunTrust Bank, Ally, PNC Bank, M&T Bank Corp and Bank of NY Mellon to the market in six consecutive trading days.

The highest profile deal from a US financial was Synchrony’s US$3.6bn debut, and Citigroup was among the active bookrunners on the transaction.

The BBB– rated deal came at a tricky time, but Citigroup and the other bookrunners had built such a strong shadow book ahead of the announcement that the transaction gathered orders of US$17.2bn from 250 accounts, tightened in spreads by 15bp–20bp from initial price thoughts and saw its three, five, seven and 10-year tranches tighten by 6bp–9bp on the break.

Citigroup was also active bookrunner on American Express’s first-ever Tier 1 issue, of US$750m of perpetual non-call fives.

The bank is also a popular port of call for alternative asset managers and PE companies. It was chosen, for example, by Apollo to be active bookrunner on its debut in the senior unsecured bond market in May with a US$500m 10-year note issue.

Despite a total of US$6.6bn of issuance from four financial issuers in the market on the same day, the book grew steadily, peaked at US$22bn from more than 100 accounts and was priced at 152bp, or 10bp tighter than initial price thoughts.

To see the digital version of the IFR Review of the Year, please click here.

To purchase printed copies or a PDF of this report, please email gloria.balbastro@thomsonreuters.com.