Seven eurozone countries have 2yr yields that are in negative territory. Italy, Spain and Ireland all have 10y yields that are lower than in the US or UK. The German curve has negative yields out to 2018.

These are just some of the statistics that are grabbing the headlines especially after Thursday’s ECB meeting. It would seem that, in trying to escape negative rates, the market has lost all connection to risk in pursuit of yield.

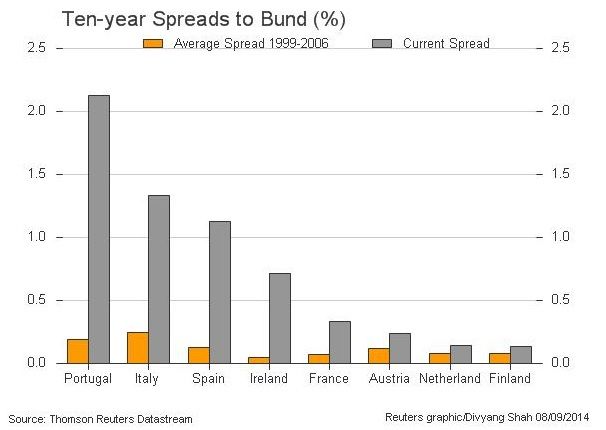

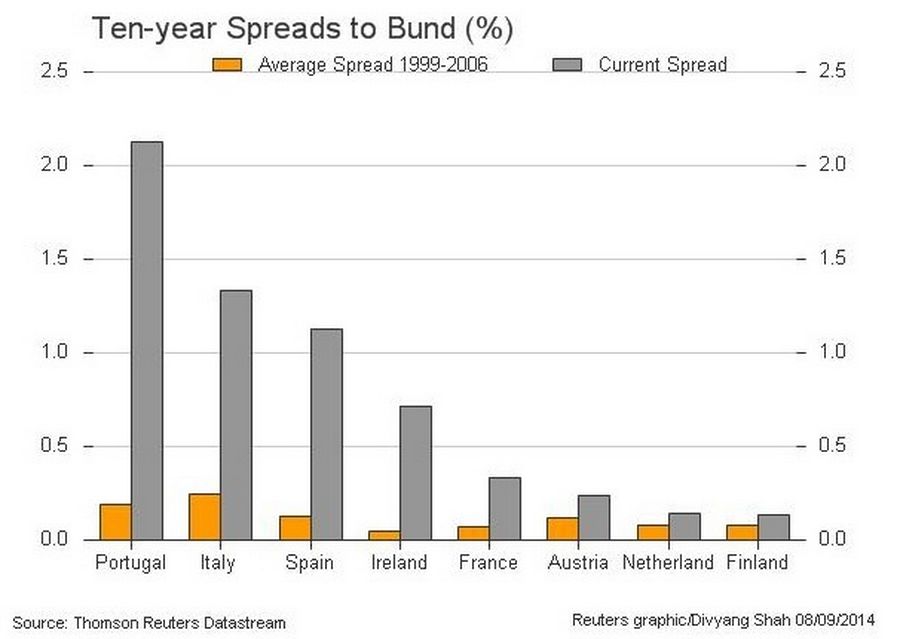

But this story is only partially true. The connection to risk can be seen if one looks at 10y spreads vs Bunds where the periphery and the core have spreads that are wider than the pre-crisis 1999-2006 average.

The story for periphery spreads is based on divergence and as bund yields move lower, peripheral yields become more attractive.

Over the next few months there is an additional factor that will help peripheral spreads in the form of credit easing from the ECB.

As the ECB lifts ABS/covered bonds/RMBS this will free up room to either take more risk as well as reinvest in sovereign debt.

But the refi rate cut has also reduced the cost of any TLTRO sovereign carry trade by a further 10bp.