Over the weekend, I saw a note on one of the newswires that client deposits held by Greek banks are now at their lowest level in 10 years. To me that says that if the Greeks don’t trust the Greeks, how the hell do they expect the rest of us to do so?

Meanwhile, the rhetoric has gone from the sublime to the ridiculous with Prime Minister Tsipras declaring that a failure to reach an agreement would not occur because of Greek intransigence but “because of the obsession of some representatives of creditor institutions”.

The “institutions” in question, so said Tsipras, were run by unelected representatives and it should not be they but political leaders who should find a solution. Sorry mate, it now has to be the lenders who decide whether to offer an extension of further credit and on what terms. The politicians intervened in the past and you and your lot have done nothing but to laugh at the hapless providers of cash who have gone out of their way to keep your country afloat.

Please don’t get me wrong; I love Greece and its people and I would be amongst the last wish upon them what I suspect is coming ever closer to befalling them. There is an old English proverb which states that one must cut one’s suit to match one’s cloth – not, as is commonly suggested, that one must “cut one’s cloth…” – but Tsipras and his merry men, above all Minister of Finance Yanis Varoufakis, have spent their time trying to blame the rest of the Eurogroup for providing the wrong cloth rather than measuring and re-measuring the piece they had.

The only good news is that the rest of the continent has had plenty of time to get its head around the probability of Greece’s ignominious departure from the fold and thus become used to the idea. The fears that the sky would fall in are now, surely, largely dispelled and although some markets will suffer some wobbles, I don’t see another Lehman-like event on the horizon.

La dolce vita? Not yet

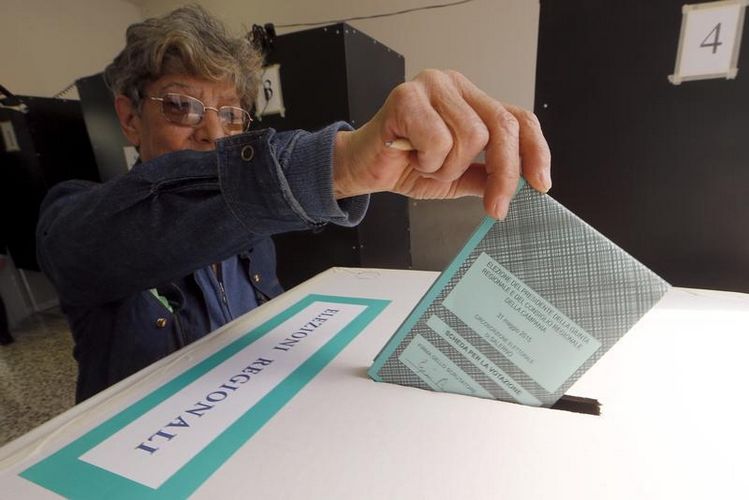

Meanwhile, a bit further to the West, Italy has been through regional elections in seven of its 20 regions. Prime Minister Matteo Renzi’s Democratic Party was expected to do really well, thus supporting his drive to drag the ossified socio-political set-up which has so severely hampered structural reform into the 21st century. In the event, it looks as though the outcome is only marginally above becoming a fiasco for the young Prime Minister. Exit polls have the PD (Partito Democratico) with 22.6% of the popular vote, only marginally ahead of the 19.6% of Beppo Grillo’s anti-establishment 5-Star Movement and 12.9% for the xenophobic Northern League. The PD had been slated to sweep five of the seven regions but so far it has clearly taken only three and will, in all likelihood, at best limp home in a further one with still unclear.

There is no doubt that Italians, on the sharp end of the Mediterranean refugee crisis, have had enough of proposed solutions and that they want to see decisive action. Too much dancing around the handbags. Renzi isn’t of the old school but he is still suffering from the desire of many voters to plump for the non-conventional protest parties. What was slated as being the anointment of Renzi as the “new man for a new Italy” is turning into a wet squib.

That said, several years ago I observed that Spain is a country with a capable political class but no economy to speak of and Italy as a country with a capable economy but a political class, best not spoken of. Renzi has surely moved the country forwards and his assurances that the economy is turning and that Italy is emerging from the darkest recesses – or some of them at least – surely have some validity. GDP is positive again for Q1, albeit not in a huge way.

The corner might have been turned and I would suggest that the election results of this weekend might prove to be either the last or perhaps only the second last hurrah for the Grillo-style protest movements.

Which way to jump?

Finally, it’s Non-Farm Payroll week again. I was taken by a piece put out by Citi’s research team which says, amongst other “In the current expansion, quarterly swings in GDP have been bigger, but contained less useful information, than in past cycles. Many of the gyrations in quarterly growth seem to have been false signals.” False in which way they don’t explain. They go on to conclude “(this) week’s data, especially the employment report, will provide additional clues about the underlying pace of growth. Employment growth presents a sharp contrast with GDP.” The first part of that sentence is so self-evident it hurts, but the second bit nails the problem facing investors.

This is proving somehow to the very opposite of a jobless recovery. It is stumbling recovery which is somehow creating jobs but only inconsistent growth. And then we’re surprised that the FOMC isn’t sure which way to jump? It’s busy week across the board on the statistical front but all will be aware that it won’t be until Friday that we have anything truly important on the table.

A big miss or a big beat on the labour front will confuse markets but a consensus meet will do little to add fresh impetus. This is not the week to put on any new long-term bets. Mind you, was last week any better or will next week be? Best just hold your nose and jump….