Geopolitical risk related to Russia/Ukraine, dreadful German factory orders data and Italy back in recession have been some of the headlines the market has been trading off the last 24 hours.

It has been enough to send 10-year Bund yields to record lows while the two-year Schatz yield is close to breaking into negative territory. But it has also encouraged some mild profit taking on peripheral debt where 10-year spreads are wider by 8bp–12bp (Italy, Spain and Portugal).

These moves look impressive, but we have to remember that both yields and spreads have moved up only marginally from their lows and investors are still sitting on comfortable positions when it comes to the P&L.

However, being comfortable on a profitable position is no excuse for complacency on liquidity/positioning risk. The cumulative events over the last 24 hours are sufficient to make it attractive to trim exposure in an environment that still allows the conversion of paper profits.

“Crisis” warning from Finland on Russia sanctions

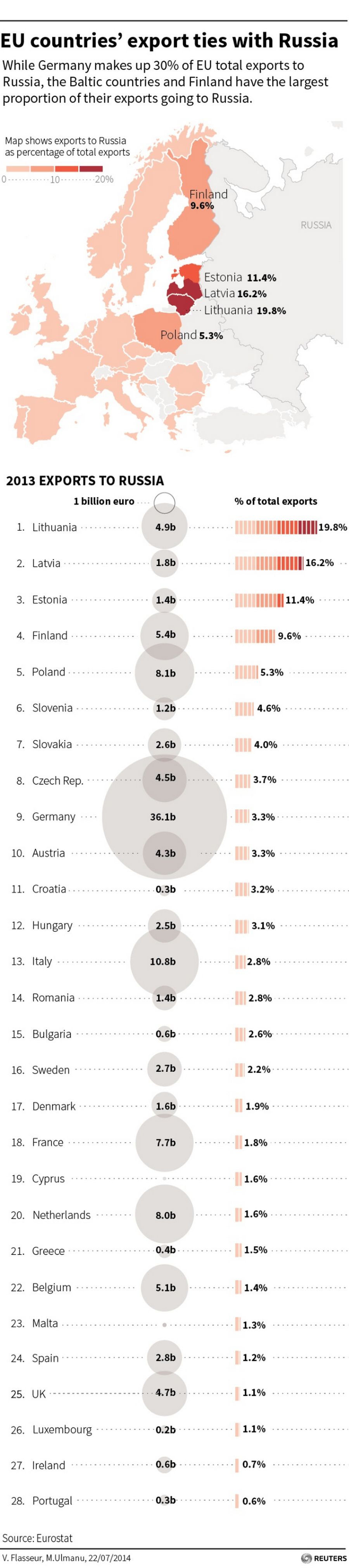

When it comes to trade, Finland is in the top three of EU members to be affected. Its exports to Russia make up 11.4% of total exports which is less than Lithuania (19.8%) and Latvia (16.2%) using data from 2013. (see http://link.reuters.com/ked52w).

The PM of Finland Alexander Stubb has warned of the indirect impact of Russia sanctions saying they could “potentially cause economic crisis” in Finland. Stubb says that if sanctions hit the Finnish economy disproportionately then it will seek aid from EU partners.

Given the tail risks involved it might be attractive to take a look at shorting five-year Finland, which trades almost 3bp through five-year German OBLs, against a long on five-year Holland. There is a small positive carry of 6bp.

EU exports and Russia

Source: Reuters