Divyang Shah, IFR Senior Strategist

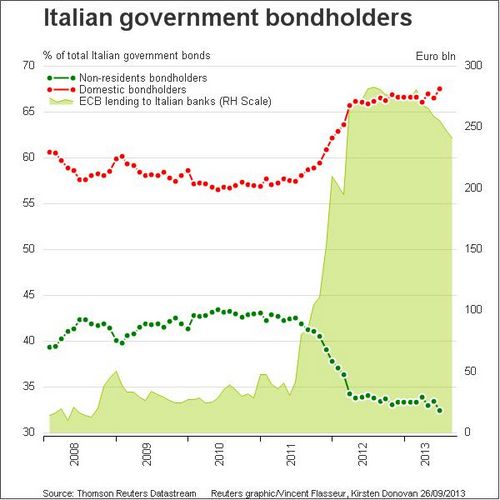

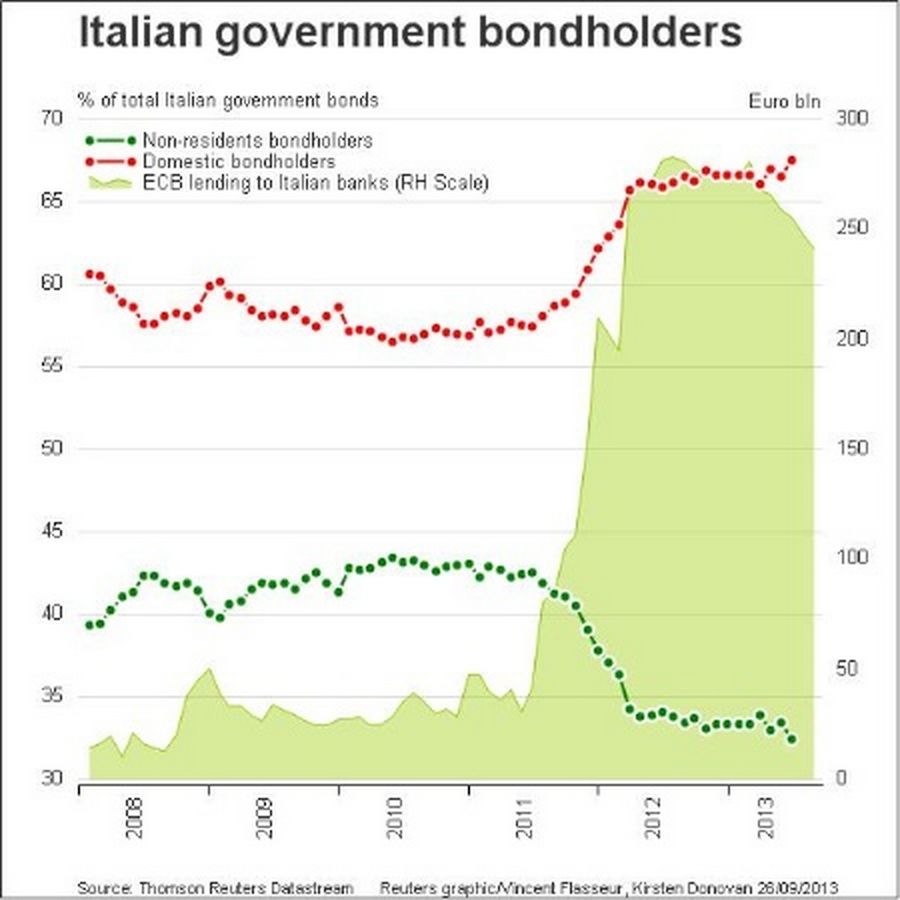

ECB Board member Joerg Asmussen is reported (by MNSI) as saying that global investors are returning to the eurozone and that US investors are buying eurozone peripheral bonds. Some evidence for this can be found in ECB data on eurozone bank holdings of sovereign bonds.

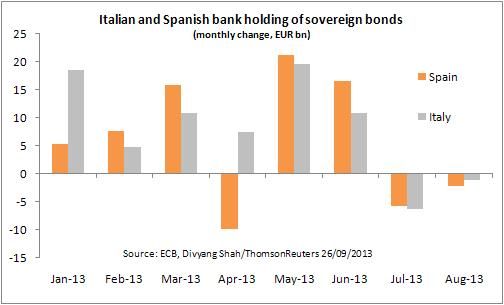

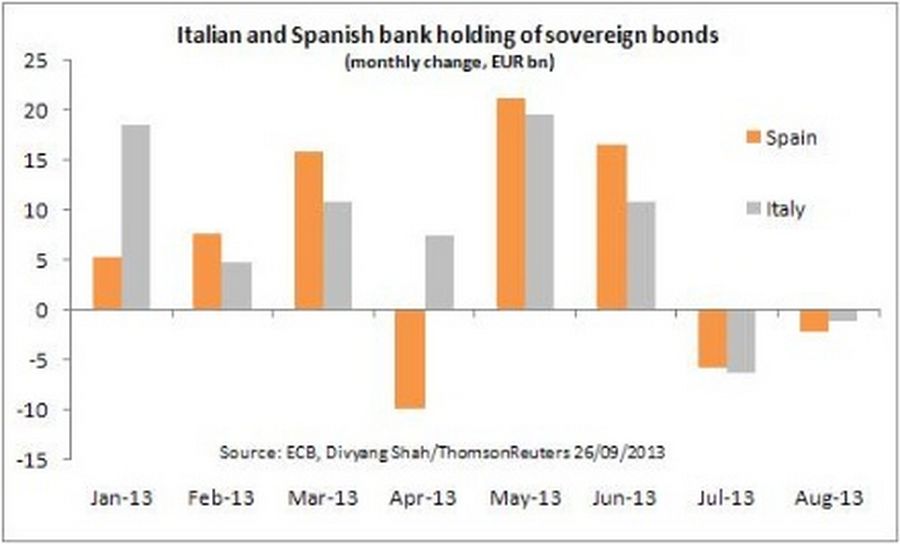

ECB data released today shows the reduction in sovereign bond holdings by Italian and Spanish banks extended into August. Spanish banks reduced holdings by €2.2bn in August (after a reduction of €5.8bn in July) while Italian banks reduced their holding of sovereign bonds by €1.1bn (reduction of EUR6.3bn in July).

Our view is that the data for July and August reflects Italian and Spanish banks parting with their inventory in order to meet demand from foreign or domestic (non-bank) demand. The reduced holdings by banks in Italy and Spain came at a time when 10-year spreads for Italy and Spain were largely moving sideways.

The heavy domestic purchases before July and August likely reflect Spanish and Italian banks supporting their respective domestic sovereign bond markets.

The fact is that non-resident holdings of Italian debt (and Spain) has been on a sharply declining trend since 2011.

The recent return of confidence might simply reflect covering of underweight positions by global investors as opposed to a willingness to take a more positive view on the outlook for peripheral debt.