UniCredit will escape the embarrassment of potentially being in breach of new capital rules after Pimco agreed to buy a US$3bn five-year bond issued by the Italian bank - albeit only after demanding a princely ransom, with the fund manager set to rake in more than US$1bn in interest payments over the bond’s life.

The private placement senior non-preferred deal comes just weeks before the new total loss-absorbing capital requirements come into effect in the new year and ends a difficult 10 months for UniCredit, which has effectively been shut out of wholesale capital markets since January.

Jean Pierre Mustier, the bank’s chief executive, told IFR that previous attempts to come to market had been continually thwarted. Financial turmoil at home in Italy as well as in Turkey, where UniCredit owns a large bank, was a major obstacle. But the threat of a fine from the US over Iran sanctions breaches also complicated matters.

“In April this year I had potentially insider information about the sanction issue,” he said. “I could not issue in public markets because we had information which could not basically be communicated. I had to wait until I had better confirmation on what I thought could be the appropriate level of fine.”

A window finally opened after the bank released third-quarter numbers and updated the market on the Iran fine on November 8. After a roadshow, Mustier said the bank received a reverse enquiry from a large bond investor – he declined to name which, but insiders have confirmed it was Pimco.

“We wanted to make up the time lost, and that’s why we decided to do a transaction that could be as large as possible,” he said. “After a roadshow, it was clear that there was a specific reverse enquiry from one investor and it would be more efficient to do a private placement.”

EYE-WATERING COUPON

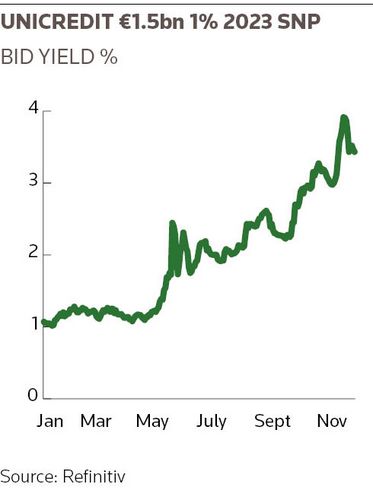

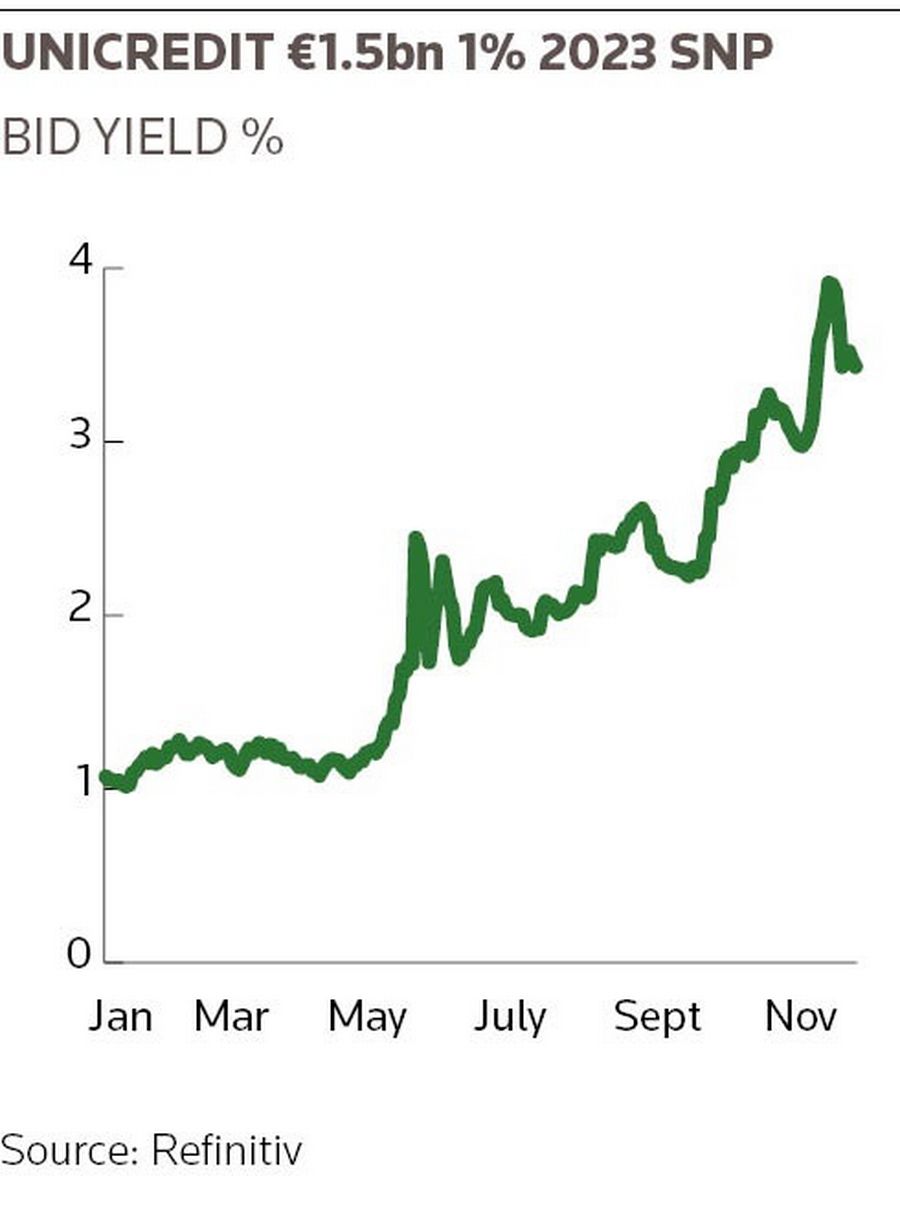

But the terms of the five-year bond have raised eyebrows. The coupon of 7.83% compares with a coupon of just 1% when UniCredit sold €1.5bn of five-year senior non-preferred paper in euros at the start of the year. The yield has gapped out since, but it was still only at 3.5% before the dollar trade came.

“Doing the deal has given us some certainty,” said Mustier, who added that the buyer had not dictated terms. “We negotiated the terms with them … we had a proper discussion about the level, whether they were comfortable and whether we were comfortable. It was a mutually agreed price.”

It is not the first time that UniCredit has done a private placement that took the market by surprise. Almost two years ago, just days before Christmas, it printed a €500m Additional Tier 1 deal with an eye-watering coupon of 9.25%. The deal immediately traded in by more than 100bp in the secondary market.

The bank has never confirmed which investor bought that deal. However, Pimco is widely believed to have been the buyer. The fund manager was also one of two investors that bought €17bn of bad loans for just a few cents in the euro in a flagship clean-up of the bank a few months after Mustier took the helm in 2016.

Still, the Frenchman defended the deal as the best way to meet its TLAC obligations.

“I didn’t want to go down the public route in the current environment,” he said. “We are really only a tweet away from having a problem or something new-ish popping up, and I cannot take the risk … And so for us, security and the ability to close the deal in the size I wanted to do [meant] the private placement made a lot of sense.”

DIVIDED OPINION

Bankers and traders are divided as to how to read the US$3bn private placement. Some are of the opinion that paying up was worthwhile, given that the trade got UniCredit out of a potentially difficult hole. But others were more dismissive.

“I think this is nonsense,” said one banker not on the deal. “I’m not sure they needed to demonstrate this kind of market access. There’s only one guy on the planet who has this amount of money and there’s no room for negotiation. Had they done US$1bn, it would have been a better signal.”

Mustier and chief financial officer Mirko Bianchi were on the road again last week, holding meetings with fixed income investors in Europe, the US and Asia. However, another deal before the end of the year is unlikely: TLAC requirements are now covered, and the bank has sufficient funding from deposits.

How the situation evolves in 2019 is anyone’s guess: though there are signs that the political standoff between Rome and Brussels that triggered risk-off for Italian assets is abating, the coalition government is unpredictable. Italian banks may need to weather high funding costs for some time to come.

“The spread itself is unfortunately the spread where we have to issue these days,” said Mustier. “The overall level of spread today for Italian banks is high … and we have to take that into account in our projections. This does not reflect what should be our funding cost in a normal environment, but there are events we do not control.”

GOVERNMENT SUPPORT

Still, he said the bank would not rethink its exposure to Italian government debt. At just over €53bn, it accounts for more than 6% of all assets, and compares with about €35bn seven years ago. Like many other banks, it has used cheap European Central Bank loans to load up on sovereign debt for extra yield.

“I am comfortable to keep the portfolio at more or less the same level,” said Mustier. “We have €12bn of redemptions next year and we will re-invest them back into BTPs.”