(Reuters) - Portugal’s government debt market is likely to benefit more than any other in the euro zone from the European Central Bank’s bond-buying programme that starts next month.

While Portugal’s total debt is one of the highest in the bloc, having been bailed out by the International Monetary Fund and the European Union during the debt crisis, its stock of marketable bonds is relatively small.

Analysts say the trillion euro programme will scoop up between a fifth and a quarter of the Portuguese bond market - the largest or the second largest portion in the euro zone.

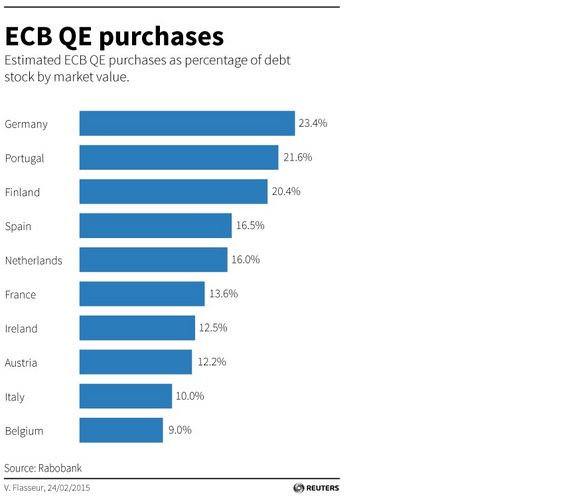

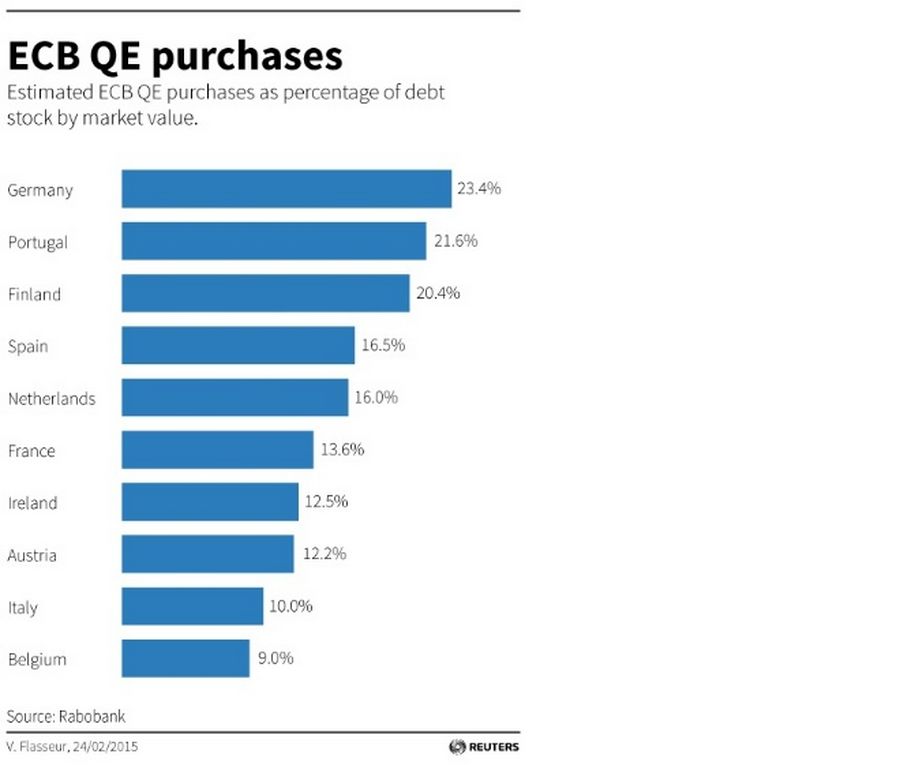

UBS strategists expect the ECB to buy about 23.2 percent of the Portuguese market, the largest share. Rabobank expects the ECB to purchase about 21.6 percent – or 20.7 billion euros based on recent market values – second only to Germany’s 23.4 percent.

Either way, Portugal’s 2.1 percent 10-year bond yield has more room to fall than Germany’s 0.4 percent equivalent. Rabobank sees the gap between the two narrowing to at least 125 basis points.

“Portugal stands significantly better, in proportional terms, than its peripheral peers,” said Richard McGuire, head of rates strategy at Rabobank.

Portugal will also benefit from investors’ diminished concern about Greece, which is on the verge of signing a bailout extension with its international lenders.

Failing to secure the funding would have put Athens’ future in the euro zone in doubt and turned investors’ focus on the currency union’s next weakest link, Lisbon.

For Portugal, this means borrowing from the market will be cheaper and more readily available, allowing it to meet its goal of repaying IMF loans ahead of time.

Those loans carry a 3.5 percent interest rate, while the highest yielding bond, a 30-year, offers 3.1 percent. IMF loans have a 7.25 years average maturity, according to UniCredit.

Early repayment would boost investor confidence and fuel speculation that rating agencies will restore Portugal to investment grade. Portugal is rated BB by Standard & Poor’s, Ba1 by Moody’s and BB+ by Fitch.

S&P reviews Portugal’s rating on March 20, Fitch a week later and Moody’s on May 8. Two upgrades to investment grade would see Portugal regain its place in the main bond indexes, triggering automatic buying by the funds that track them.