Even before it has begun, the European Central Bank’s looming bond purchase programme has already distorted prices to such an extent that a variety of public sector issuers are being forced to rethink their borrowing strategies.

For peripheral borrowers, the market distortions are unambiguously good news; for others higher up the credit curve, life is likely to become considerably trickier.

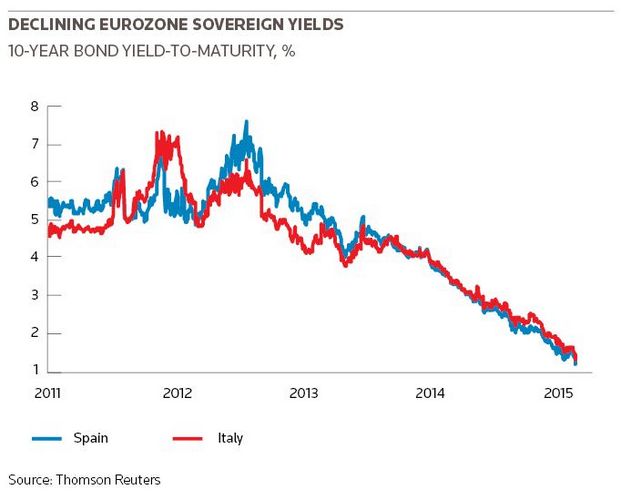

The ECB’s quantitative easing programme through which it will purchase at least €1trn of assets will only roll out this week, but European bond yields have already tightened sharply in anticipation, pushing investors further up the curve and further out towards the eurozone periphery.

This has given some of those peripheral countries the opportunity to term out debt piles that have spiked in recent times after a succession of crises within the single currency bloc – and to do so at compelling yields.

Spain, for example, last week issued a €7bn 15-year bond paying a coupon of only 1.95%.

“Seven or eight years ago, we were a smaller issuer with a very small amount of debt outstanding. This has changed rapidly and our gross issuance programme is now €240bn for this year,” said Pablo de Ramon-Laca Clausen, senior adviser for funding and debt management at the Spanish treasury. “As a result, there is a concentration of redemptions in certain points of the curve, and so we are comfortable gradually extending duration.”

The Kingdom’s debt-to-GDP ratio spiked from 39.4% in 2008 to 92.1% in 2013 as it assumed Spanish bank debt through an EU bailout programme. Similarly, Portugal’s debt-to-GDP ratio went from 71.7% to 128.0% and Italy’s from 102.3% to 127.9% over the same period, according to European Commission data.

“The rhetoric of QE has already done half the job in terms of lowering funding costs for peripheral issuers”

Analysts believe that one of the aims of the QE programme was to redirect investor flows from the European core to the periphery to allow these countries to better manage their debt piles at lower funding costs.

In that regard, the job is arguably already done: both Portugal and Italy have been flooded with demand when issuing 30-year bonds this year at record low coupons, even though the rating of the former is firmly in junk territory while that of the latter is at the lower end of the investment-grade spectrum.

“The rhetoric of QE has already done half the job in terms of lowering funding costs for peripheral issuers, be it SSA, FIG or corporates, without the ECB having bought anything,” said Conrad Baker, head of SSA syndicate at Nomura.

Programme rethink

While a boon for some, the advent of QE is proving to be a major headache for other public sectors issuers which are in the crosshairs of the €60bn-a-month purchase programme.

Spreads have tightened to such an extent that the best-rated sovereigns and agencies are now trading at negative yields at the short end, creating uncertainty about whether they have access to the market at this part of the curve.

“Our bonds are trading very, very tight to swaps and French Treasuries, which is not very helpful for new issuance, especially in terms of new bonds with maturities less than 10 years,” said Philippe Noel, head of capital markets at French agency Cades (Caisse d’Amortissement de la Dette Sociale).

And those uncertainties are forcing the likes of Cades to consider moving issuance into other currencies. “We will wait and see if we would need to switch a bit of our planned euro issuance to US dollars,” Noel said.

Cades believes that the ECB may buy €500m–€600m of its bonds as part of QE.

The European Investment Bank did price one of the first syndicated bond deals with a negative yield last week, a €400m tap of its 1.375% November 2019 ECoop note at –0.026%.

Because it was a reopening, there was still a coupon on offer. But it remains to be seen how many investors will be willing to pay for the privilege of lending to other top-rated issuers.

Germany’s KfW, one of the best rated and most liquid agency names in Europe, is grappling with the same problem.

“It is hard to predict what the effect of the ECB purchases will be. I can anticipate, though, that one challenge will be to issue in short maturities in euros – but that is not a problem in US dollars,” said Horst Seissinger, head of capital markets at KfW.

The German agency does not have any definite plan to issue a benchmark bond at the moment, though it will continue to look for opportunities.

Two other issuers last week circumvented the negative yield problem by using other currencies to price short-dated bonds.

Belgium priced a US$2bn 1.125% three-year note, a deal that offered a 1.204% yield but still represented a saving when swapped back into euros because of the deeply negative basis swap.

Finland followed soon after, this time pricing a three-year bond in the sterling market, a £250m 1% December 2018 note that offered a 1.099% yield.

“The [Belgium] deal was more about the arbitrage on offer,” said Alex Barnes, head of SSA fixed-income syndicate at Citigroup, a bookrunner on the trade. “I’m not sure if these issuers are necessarily locked out of short-dated euro issuance, as some thought when QE was first announced, but I agree there is still some uncertainty around how syndicated new issuance will work in practice at negative yields.”