The pick-up in European corporate defaults continues to weigh on bank trading desks this quarter, with JP Morgan and HSBC on the hook for sizeable losses after French holding company Rallye entered bankruptcy protection last month.

JP Morgan lost around US$25m on bonds and credit default swap positions related to Rallye, according to people familiar with the matter. HSBC lost about US$5m on its exposure to Rallye, one of those people said. Spokespeople for JP Morgan and HSBC declined to comment on the losses.

The struggles at some of the finance industry’s largest bond trading units show how the recent increase in credit market volatility is creating winners and losers among the banks and funds that trade this market.

IFR reported last week that JP Morgan had struggled this quarter in European high-yield trading. JP Morgan’s European high-yield credit trading desk, headed by Bhavit Sawjani, is known for not being averse to taking risk, having made tens of millions of dollars in revenues for the bank last year, according to people familiar with the matter.

Elsewhere, one of Citigroup’s credit traders left its London office last month after racking up about US$10m in paper losses on CDS positions related to UK travel company Thomas Cook.

By contrast, Goldman Sachs and Credit Suisse have had particularly strong quarters in European high-yield after getting on the right side of some big moves in bonds and derivatives markets.

Rallye, the holding company for French retailer Casino, has been one of the most high-profile companies to run into trouble this year in Europe.

Investors had been scrutinising its finances for some time. Scott Goodwin, co-founder of New York-based hedge fund Diameter Capital Partners, recommended buying CDS protection on Rallye at the Sohn Investment Conference last year. Goodwin said the company was “burning a material amount of cash” and had a large amount of debt maturing in the next year.

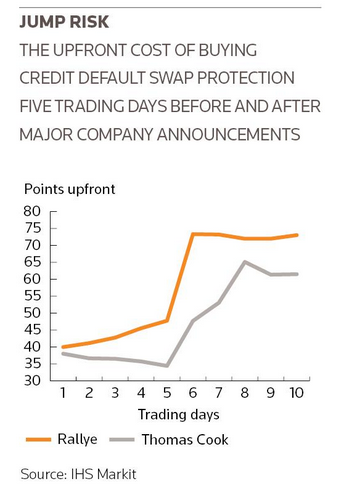

But the speed and scale of the slump in Rallye’s debt prices show how difficult it is for traders caught on the wrong side to cover their positions. The upfront cost of buying five-year CDS protection on Rallye leapt from 48 to 73 points overnight after the company entered creditor protection, according to data provider IHS Markit. That means the upfront fee a buyer of default protection would have paid to insure US$1m of Rallye debt rose from US$480,000 to US$730,000.

The Credit Derivatives Determinations Committee, an industry body of banks and investors that rules on whether CDS contracts should pay out protection holders, voted last month that Rallye entering bankruptcy protection had triggered CDS. An auction to determine the size of those CDS payouts is scheduled to be held on June 27.