International lenders’ confidence in syndicated loan opportunities throughout Turkey’s telecoms, financial and infrastructure sectors is clearly reflected in the US$6.5bn-plus worth of volume circulating the market.

To view the digial version of this report, please click here.

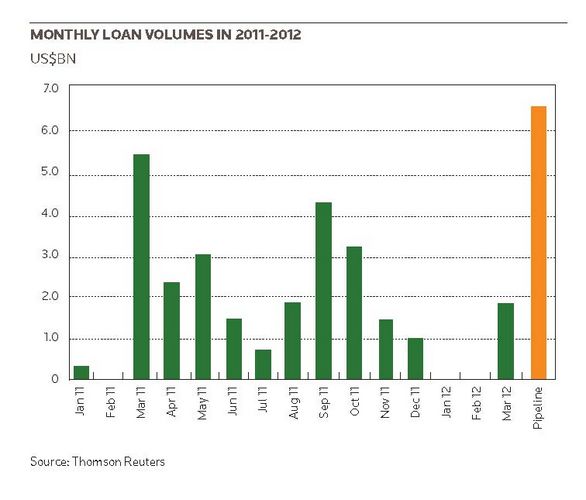

Although signed deal volume for 2012 only stands at just under US$1.8bn – versus US$5.8bn during the same period in 2011 – Turkey’s loan activity will pick up, said international lenders.

Comparatively, loan volumes across the wider Central and Eastern European region – notably Russia – have been extremely slow this year, so the G20 member’s multi-billion worth of pending deal flow is taking centre stage.

“Turkey’s economy is doing well, the country is in a good political position and it’s one of the growth markets of the region. That can’t be said about many places, so I think people are positive about the right transactions,” Simon Meldrum, director of Central and Eastern European, Middle East and Africa loan syndications for the Royal Bank of Scotland, said.

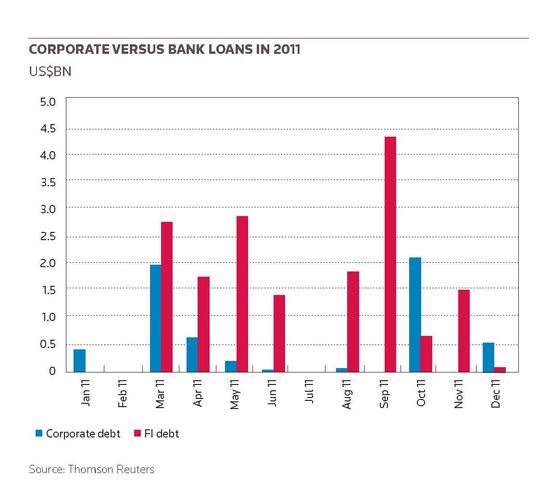

Total syndicated loan volume in Turkey reached US$25.6bn in 2011, with activity peaking in March with eight deals totalling US$5.45bn. A similar volume pattern is expected in 2012, with a pick-up in issuances starting between March and May.

Rising volumes are already evident, with the signing of Akbank’s US$1.2bn deal and telecoms group Turk Telekom’s US$600m loan in March, respectively.

Pricing pressure

International lenders watched closely the progress of loans for Akbank and Turk Telekom which not only represented the opening of the Turkish borrowing market in 2012, but also set crucial pricing benchmarks.

Intensifying calls for prices hikes have been heard across the CEE markets since the eurozone crisis triggered a rapid reappraisal of international lenders’ balance sheets, and many European lenders grappling for US dollar funding.

Turkish bank borrowers’ bi-annual refinancing round historically demands extremely competitive pricing, which lenders have long argued is not sustainable. Akbank, which always kicks off the country’s bank refinancing wave and sets the trend for subsequent deals, paid an all-in cost of 145bp on its March deal, up from 100bp for its previous deal agreed in August 2011.

Lenders were heartened by the increase in pricing, but further price hikes are inevitable as many lenders – especially European banks – continue to negotiate financial mine fields.

“Turkey’s economy is doing well, the country is in a good political position and it’s one of the growth markets of the region. That can’t be said about many places, so I think people are positive about the right transactions”

As expected, Garanti Bank has matched Akbank’s 145bp all-in pricing as it kicks off its search for a new US$1.3bn refinancing deal.

Meanwhile, Turk Telekom’s US$600m refinancing – split between a US$285.2m tranche and a €239.4m tranche – set an important benchmark for corporate borrowers’ pricing expectations in the ever-changing lending landscape.

“It is not as easy pricing these deals as it was in the past,” a second banker said.

Pricing of the three-year deal settled at 350bp all-in and was well received by many lenders, though the company’s national prominence and the inclusion of a euro tranche – currency flexibility was key in garnering European lenders’ support – were both considered essential in getting the deal successfully signed.

Islamic interest

Up to US$350m-equivalent worth of syndicated Islamic financings are circulating the Turkish market, with Turkiye Finans Katilim Bankasi’s search for a US$150m loan and Bank Asya’s US$200m deal.

Turkiye Finans Katilim Bankasi’s loan is being done with initial mandated lead arrangers and bookrunners ABC Islamic Bank, HSBC Amanah Finance, Noor Islamic Bank and Standard Chartered.

Meanwhile, initial mandated lead arrangers and bookrunners ABC Islamic Bank, Emirates NBD, National Bank of Abu Dhabi, Noor Islamic Bank and Standard Chartered are working on Bank Asya’s refinancing.

The one-year Murabaha financings, which are scheduled to close in early April, include US dollars and euros and carry a 200bp margin.

The need to diversify debt funding as banks battle with unpredictable balance sheets mean Turkey’s Islamic FI activity – currently a rarity in the international loan market – could rise, bankers said.

“Islamic deals are the sort of thing we could start seeing more often,” a third banker said.

Such financing could also form a crucial part of a broader debt financing puzzle that Turkey will need to fund its huge infrastructure ambitions.

“Given the sheer size of debt quantum that will be required to support new projects going forward, it is of key importance that all liquidity sources are fully maximised,” said Mark Waters, head of EMEA energy and commodities, asset and project finance syndicated loans and head of African loan origination for BNP Paribas.

“This will include balance sheet support from both local and international banks, whilst also working closely with the development finance institutions and export-credit agencies. A further source of liquidity could be Islamic banks and so advisers and arrangers should also look to carve out specific Islamic tranches where relevant in order to focus on the main Islamic banks across both the Middle East and Asia.”

Project ambition

Turkey’s ambitious plans to relieve long-time stresses on its beleaguered road network means that well over US$5bn worth of syndicated loans will be completed, or near completion, during the coming year.

“There are so many things that Turkey wants to do. There is no lack of ambition on the part of the Turks in commerce and energy to get things done,” a project finance banker said.

The first project loan financing that is scheduled to close first is the US$900m deal for the Eurasia Tunnel Project in mid-2012, which includes the construction of a 5.4km tunnel between the European and Asian shores of Istanbul.

Istanbul’s rapid population growth and economic development over the last decade has boosted car ownership to over 1.3m vehicles, putting growing pressure on the region’s economy and tourism development.

UniCredit is acting as adviser, with up to 10 other lenders on the deal, which will also widen up to 9.2km of existing roads to develop approaches on both sides of the tunnel.

International lenders are also eyeing a syndicated loan for up to US$4bn to back Turkish Privatisation Administration’s plans to privatise 2,000km of state-owned toll roads. The massive deal size means local banks will have to play a key role.

“For the right sponsors, the Turkish banks can put enormous tickets on the table, but even with them you still need the international banks’ support,” a second project finance banker said.

The privatisation package includes two bridges, connection roads, motorway service areas, maintenance operations and toll collection units, with the total project cost estimated between US$5bn and US$6bn. The Industrial Development Bank of Turkey, part of the Isbank Group, has been mandated as financial adviser.

Another mammoth financing is the looming US$10bn Gebze-Ismir toll road project, with the seven-year construction project – which started in October 2010 – including a new 421km motorway that will connect Gebze, a city near Istanbul, to Izmir on the Aegean coast.

The financing has been split into two phases, with the first consisting of roughly US$4bn and the second stage beginning in 2014. The loan portion of the financing will not be clear until late this year, and the deal is facing several challenges aside from sheer size, also the complexity of the infrastructure, foreign exchange and tenor.

“We are still at the stage of thinking how to make the deal work financially with all the risk factors,” the first project finance banker said.