This article was originally published by the Official Monetary and Financial Institutions Forum (OMFIF) in the The OMFIF Briefing.

As an American politician said, ‘It’s déjà vu all over again.’ Exactly four years ago, on 28 June 2011, I published an article urging George Papandreou, then prime minister, to hold a referendum to ask the Greek people if they wanted to remain in the euro. ‘Not every creditor deserves a break,’ I wrote. ‘They should have known it was risky to lend to Greece. Let them bear the cost.’

At end-October 2011, Papandreou announced his intention to hold a referendum on 4 December, but was talked out of it by German Chancellor Angela Merkel and French President Nicolas Sarkozy. He lost the subsequent election. His party, Pasok, never recovered. Four months ago, I recounted this story in an OMFIF Briefing, when I urged the new party in power, Syriza, to hold a referendum. ‘Like Papandreou, but with still greater urgency, Syriza can go back to the citizens,’ I stated. ’The government has to say, “We thought it would be easy to defy austerity. But we have found out that is not so. If we are to fulfil our promise to you, we have to carry out Grexit.”’

Alexis Tsipras, prime minister, called Merkel and François Hollande at the weekend and told them he was planning a referendum rather than accepting the latest creditors’ offer. They tried to talk him out of it. He went ahead anyway.

Now the creditors have withdrawn their offer. The European Central Bank is freezing credit to Greek banks. The crunch point is here. Greek depositors are withdrawing money at alarming rates. Tsipras announced late on Sunday that the banks will be closed for an indefinite period and capital controls imposed.

Technically nothing has changed. In real life, everything has.

Greece is still in the euro area. On Tuesday it’s supposed to repay €1.5bn to the IMF. On Sunday 5 July, the referendum will decide whether the Greek people accept the offer (whatever is still on the table). But whether they say Yes or No, it’s too late. Between the still-existent troika withdrawing the last offer and the ECB completely shutting the window for emergency liquidity supply, Greece may face no choice but to default on Tuesday or soon afterwards.

We’re in new territory. Or maybe we are back in the old territory inhabited by all the euro economies 17 years ago, in the good old days before the euro was born.

The situation is changing by the hour. We can only speculate about the exact date and manner of default. But some things are certain. Since the ECB has shut the liquidity window, Greece has to find money to replace the euro. As the ECB will not provide any new money, it will have to be created. It won’t matter whether, technically, Greece is in the euro bloc or not. Barring a last-minute change of mind by the creditors and another offer, Greece will have to print its own currency (or, rather, for the time being, stamp a new designation on existing banknotes.)

By introducing its own money – call it the eurodrachma or the new drachma (ED or ND) – Greece will embark on a path to freedom from the euro area. This is not as novel as people may think. We saw in 1993 the velvet divorce between the Czech and the Slovak Republics. Previous monetary unions have broken up. The British Labour Party had the problem of administering austerity in 1931. It refused and split. Soon after, the new coalition went off the Gold Standard. Sydney Webb, the founder of the Fabian Society, ruefully observed, ‘They never told us we could do this.’ The British economy threw off the burden of linking sterling to gold and went on to enjoy a quicker recovery from the Great Depression than the Americans.

When the Americans in 1971 reneged on their obligations to buy gold at $35 an ounce, the Bretton Woods system of fixed exchange rates broke down and countries were able to depreciate their currencies without having to ask the IMF. The key to having your own currency is the freedom to devalue.

The Greek government has to decide the value of the ND/ED in terms of the euro. The Greeks could begin at par and then let it float. There is no reason why the euro and the new currency should not circulate together.

The government has to pay salaries and pensions in ND/ED. It should use all the euros it has to settle international trade obligations until the new currency stabilises. Of course, people who still have euros stashed away in cash will keep them saved under mattresses or wherever else. Indeed all the old euros may disappear, as under Gresham’s Law.

People will use ND/EDs for daily non-durable purchases. For higher value transactions, the euro may continue to be in use. The government will have to renege on all international debts and debt service charges. Since it has been managing a primary budget surplus, it should have some spare capacity to ease conditions.

Since the government outside the euro area has fiscal freedom, it can choose if it wishes to run a deficit to alleviate the misery of the last five years. It will not have access to the international capital markets for the time being. But it’s possible that some private equity funds or sovereign funds may view Greece as a good long-run proposition.

Of course, the ND will depreciate. Inflation will erode some of the relief. There is no reason however to fear hyperinflation or a total breakdown of fiscal discipline. As the citizens have been used to austerity, the government can run the economy fairly, combining a tight fiscal policy and a relatively easy monetary policy.

Outside monetary union, Greece regains the use of normal macroeconomic policy instruments. It can determine its own timetable for making structural reforms.

On Monday morning, after a tumultuous weekend, this may not look like a good news story. But before too long it could turn out to be one.

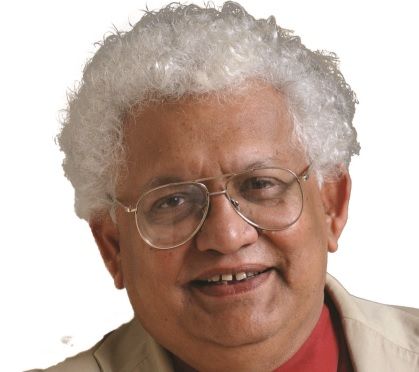

Prof. Lord (Meghnad) Desai is emeritus professor at the London School of Economics and Political Science and chairman of the OMFIF Advisory Board. This article was originally published by the Official Monetary and Financial Institutions Forum (OMFIF) in the The OMFIF Briefing.