A monetary cycle that was supposed to have seen the Federal Reserve and European Central Bank back quickly away from their stimulative policies and move into full-blown tightening has been replaced by a rapidly hatched Plan B. Markets are struggling to figure it all out.

A monetary cycle that was supposed to have seen the Federal Reserve and European Central Bank back quickly away from their stimulative policies and move into full-blown tightening has been replaced by a rapidly hatched Plan B. Markets are struggling to figure it all out.

Under the umbrella of a much gloomier growth outlook, Plan B is dovish. It is a stance induced by poor economic data, lower growth forecasts, US-China trade tensions and political strife, including the vexed question of Brexit. All factors that have on occasions led to disorderly and volatile markets.

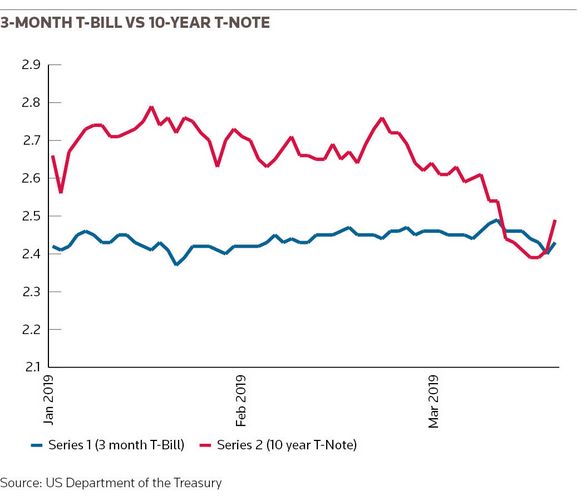

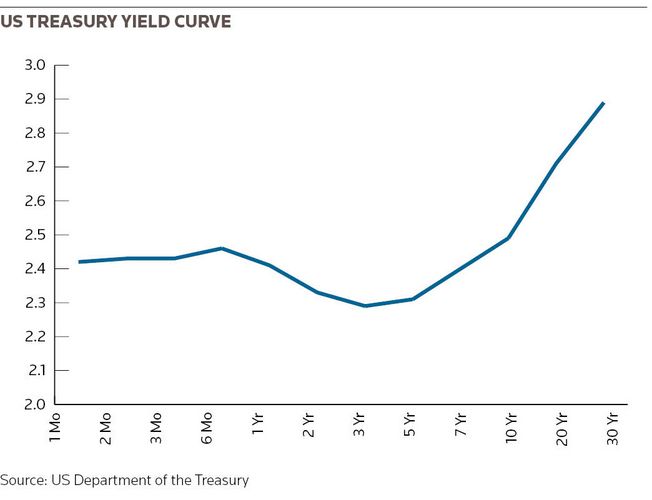

Spooked by economic, political and geopolitical headwinds, and by subsidiary fears that monetary authorities would fail to change direction and potentially make things worse, US stocks led global markets into a tailspin in December. Bouts of volatility built on unpredictability followed the March FOMC meeting, short-lived three-month T-bill to 10-year T-note inversion (signalling a recession to some) and the poor March Germany manufacturing PMI, which pushed 10-year Bunds into negative yield territory.

The bottom line of the new monetary reality is the continuation of elements of stimulus fronted by lower rates for longer. The ECB’s summer 2019 rate hike was pushed to 2020. The hikes the Fed had been signalling and the market had been duly pricing in have been replaced by stasis, with a growing proportion of participants believing the next step could be a rate cut; a view supported by overnight index swaps.

“The most dramatic development of the year to-date has not been on either trade policy or politics. Rather, it is the Fed’s full-throated embrace of a monetary stance more dovish than many market participants had been expecting,” head of macro research Ajay Rajadhyaksha and global macro strategist Michael Gavin co-wrote in Barclays’ Global Outlook published on March 28, right below a heading which read ‘Fed capitulation rocks markets’.

The revised monetary policy stance has up-ended the much-vaunted process of asset price normalisation in the capital markets that was supposed to have accompanied expected policy normalisation. Years of central bank stimulus has demolished any vestige of proper price discovery. A risk-reward profile that has been heavily skewed to borrowers throughout the QE phase was supposed to have shifted towards investors as spreads found a new equilibrium. The shoe was decidedly on the borrower’s foot in the first quarter of 2019.

Having the central bank as buyer of first resort in the bond market had led to artificially tight spreads and the formation of asset price bubbles. Anxiety around how the market would be weaned off central bank support without incurring some abrupt repricing disorder or cliff effect had started to replace anxiety around why stimulus was there in the first place (to boost growth via the extension of low-cost bank credit into the real economy).

Turning point

A key turning point in Europe was the September 2018 ECB meeting, which called an end to monthly net purchases under the Asset Purchase Programme by year-end, leaving only the reinvestment of principal from maturing securities (although, with securities holdings from the APP still above €2.5trn at the end of February 2019, the ECB’s presence will continue for some time).

A key component of expected normalisation, parallel with the end of asset purchases and the beginning of rate tightening, was the run-off of TLTRO II borrowings, which had reached €740bn at their height and provided much-needed cover for banks, principally in Spain and Italy.

In the way of best laid plans, the ECB’s March 1.1% projection for 2019 euro area growth, 60bp lower than its December forecast, was a reality check. The ECB pointed to unexpectedly sluggish real GDP growth in Q4 2018 and substantially weaker than previously expected activity in H1 2019.

“The broad-based worsening of economic sentiment indicators across countries and sectors in recent months suggests that more persistent adverse factors have also been at play and that the underlying cyclical momentum is somewhat weaker than previously assessed,” the ECB starkly noted.

With policy rates left unchanged in March, a sign in and of itself, the unveiling of TLTRO III cemented the gloomy outlook. “These new operations will help to preserve favourable bank lending conditions and the smooth transmission of monetary policy,” the ECB noted, no doubt masking sweaty hand-wringing expectation.

Room for manoeuvre

“The ECB is preparing the ground for further policy easing if the low-growth and low-inflation trajectory persists,” said Rainer Guntermann, interest rate strategist at Commerzbank. “The conditions for the new LTROs could be crafted with similarly attractive conditions as last time, which would benefit banks in peripheral countries, while the forward guidance on rates remains very relevant as the pledge to keep rates at current levels could be extended.

“The ECB is mulling over the adverse side effects of negative rates and potential counter measures,” Guntermann continued. “A tiered deposit rate would alleviate the penalty on excess reserves, which should be good news for banks in core countries. While a tiered deposit rate would shift the economic lower bound for interest rates and could open the door for rate cuts, this remains unlikely unless recession and deflation fears resume.”

Daniele Antonucci, chief euro area economist at Morgan Stanley, agrees that in a scenario of low growth and, importantly, low inflation, the ECB’s first line of defence will likely be an extension of forward rates guidance to push out the date of the first hike.

“Coupled with a tiered deposit system, this will mitigate the impact on banks’ margins. Tweaks to the ECB reinvestment policy could also result in extra monetary support. If the growth and the inflation undershoot is more meaningful, the ECB may have to look for ways to restart the QE programme, which has contributed greatly to easing financial conditions,” Antonucci said.

Xavier Chapard, global macro strategist at Credit Agricole CIB, is clear: central banks are done with the normalisation of their monetary policies. “We don’t expect any rate hikes or new tapering in 2019-2020 from the Fed, ECB or BoJ. The ECB and the BoJ are in any case at the limit of their monetary tools, so they won’t be able to ease monetary policy any further via lower rates or larger QE,” he said.

“They can only commit to maintain their current policies unchanged for longer and guarantee the transmission of easy monetary policy to the real economy.” The ECB can do this, he said, via the new TLTRO, a two-tier deposit scheme, or restarting the CSPP; the BoJ via more equity purchases. “The Fed has more ammunition because it can cut rates to zero and introduce more QE.”

In the US, the Fed’s March 2019 growth forecast of 2.1% was 40bp lower than its September forecast had been. From the beginning of May, the Fed will slow the pace of tapering from US$30bn per month in US Treasuries to US$15bn. From September, it will cease cutting its securities holdings.

Gloomy

The IHS Markit Flash PMIs for March did nothing to dispel the sense of unease. The US Manufacturing print was a 21-month low; survey respondents indicating another dip in optimism regarding the year-ahead business outlook.

That would appear to support the Fed’s U-turn, although Barclays’ Rajadhyaksha and Gavin caution against exaggerating the signal the Fed has been sending about the health of the US economy. “We believe the US central bank is simply being cautious, in part because it can afford to be so, given how well behaved inflation data remain,” they noted.

On a three to six-month horizon, Barclays believes the Fed’s stance is a major support factor for financial assets, among other things “[providing] reassurance to more precariously positioned sovereign and corporate borrowers that US dollar financial conditions are unlikely to be tightened in the near future, bolstering the fundamental investment case for assets that might suffer from such a tightening. … The market response to the Fed’s new stance has driven safe-haven bonds to levels that are unattractive in anything but recession or crisis scenarios”, the analysts wrote.

The March IHS Markit Flash Germany Manufacturing PMI registered its lowest reading in over six and a half years. The shock print sent the 10-year Bund yield into negative territory. Commerbank’s Guntermann, though, is relatively sanguine.

“While global growth risks from slower-than-expected expansion in China linger, we are not expecting lasting recession either in the euro area or the US. Buoyant oil prices will help prevent inflation expectations edging towards deflation risks (like in the run-up to ECB QE in the second half of 2014). We expect 10-year Bund yields in a broad -0.2% to +0.3%% range through 2019, and around 0.25% at year-end,” he said.

Credit Agricole CIB’s Chapard believes risks remain tilted to the downside as long as the global industrial cycle continues to slow. But despite the risks and disappointing activity data in Q1, he expects eurozone growth to improve slightly in coming months, towards 1.5% versus 0.8% in the second half of 2018.

“This is based firstly on expectations that the global cycle will stabilise thanks to the stimulative measures adopted by China in the last few months. Second, financial conditions will be supportive for growth thanks to central bank cautiousness. Third, the impact of political uncertainties (trade wars, Brexit) will fade, while the one-offs that weighed on eurozone growth in H218 (disruptions in the auto sector, social unrest in France, financial tensions in Italy et cetera) won’t be repeated,” Chapard said.

Backing up his case, he says, are solid domestic fundamentals: resilient employment growth and corporate margins, wages accelerating slightly, and a fiscal stance that is supportive for 2019 growth. He believes recent data support his scenario, in particular the rebound of March Chinese PMIs, the March Italian PMI above 50 for the first time since September, and the strong rebound of risky asset prices in Q1. “This should all be sufficient for eurozone growth to be slightly above potential,” he said.

Morgan Stanley’s Antonucci also believes the euro area was mainly affected by the China-led trade shock. Its impact was compounded, he says, by a number of more domestic factors, such as cutbacks to German car production following new emission standards. “As the trade shock peters out and these temporary drags on growth reverse, the cycle should bounce back for some time, also helped by a fiscal boost. Growth should reach its trend pace again at the turn of the year but, then, as the cycle matures and there’s less pent-up demand, and as stimulus diminishes, should slow again later on,” Antonucci said.

Sovereign debt stampede

Amid the uncertainties, perhaps the most remarkable capital markets phenomenon of the first quarter was the amount of sovereign primary debt that flew off the shelves. Over two dozen EMEA sovereigns across the eurozone core and periphery (including the former bombed-out outer-periphery economies of Greece and Cyprus), the Brexit-tinged UK, Nordics, Eastern Europe, Turkey/Middle East and Africa tapped the syndicated bond market for almost US$144bn-equivalent.

What was more arresting than the volume of debt raised was the extraordinary investor reception: aggregate levels of demand ran to around US$640bn, and almost all issues were multiple times oversubscribed, allowing borrowers to hit good levels amid investor stampedes. So much for governments struggling to meet challenging funding requirements.

“With the inflation pathway looking fairly flat ahead, together with some uncertainty as to how risk markets will perform from here on, investors have been keen to buy into fixed-rate sovereign assets and maintain a core of quality holdings,” said Lee Cumbes, head of EMEA public sector DCM at Barclays.

Investors piling into core supply led to yield compression which unleashed an ungainly lurch for yield along and down the curve. Huge levels of demand for EZ periphery and EM sovereign new issuance gave the impression that the buyside had lost touch with economic reality and had become immune to risk. The reality is more prosaic.

Since the market had been expecting three Fed hikes in 2019 and the ECB to tighten after the summer, investors had held off buying in the gloomy and volatile fourth quarter of last year on the assumption that issuers would be offering better terms, particularly in euros following the end of QE. Hence they came into this year very cash-rich. Bank treasuries in particular were more flush than usual because they had seen a huge wave of redemptions in their LCR portfolios.

“What was striking was how quickly the signals from the economic data and from central banks pointed to a U-turn from prior expectations,” said Pierre Blandin, head of SSA DCM at Credit Agricole CIB. Ten-year Bunds yielding 15bp at the start of the year and going negative at the end of March was much lower than investors had been expecting.

No concessions

“The combination of high cash levels and a growing perception that yields were going to stay extremely low, at the same time as staying in cash at punitive yields was not an option, prompted investors to put cash to work quickly. At the start of the year, wider spreads had to some extent offset low yields, but clear signals that yields were going to stay low and were actually rallying forced investors to chase the market,” Blandin said.

This led to the exceptional first quarter for sovereign primary issuance. “Spreads adjusted to the overwhelming demand through Q1. New issue premiums were around 4bp–5bp at the beginning of the year for governments funding in size. That had been sufficient to pull in demand. NIPs now are almost zero, and some SSA issuers are pricing through fair value but demand has remained strong in a very active market,” Blandin said.

In reality, the primary market is the only place where large investors can buy in size, which only added to the urgency to buy. Investors can’t buy big blocks in secondary because lifting the offer in size moves the price.

The market is almost back to the yield lows it reached in 2016 when sovereigns sold a slew of 50-year deals as investors went out the curve to generate yield pick-up. While sovereigns didn’t go ultra long in 1Q 19, there was a stream of 30-year trades. “Seeing Land NRW raise a significant amount through its Century bond was a clear illustration that the investor community is desperate for convexity and duration,” Blandin noted.

Investors also went down the credit curve and generated huge demand for EM and frontier sovereign names. EM issuance had slowed towards the end of 2018 over concerns about the impact of higher US dollar yields. Since that scenario moved off the table, investors have piled in. Belgium, Italy and France tapped the 30-year point in Q1, but perhaps more strikingly so did 10 sovereign issuers from Latin America, Eastern Europe, the Middle East and Africa.

To see the digital version of this report, please click here

To purchase printed copies or a PDF of this report, please email gloria.balbastro@refinitiv.com